I was recently speaking with the Commercial Director of a small chain of holiday hotels in Benidorm. When we came to discuss basic online marketing issues, he confessed that they were not doing anything because the owner didn’t want to invest. I couldn’t believe it. I asked him: “Don’t you protect your brand on Google? Aren’t you on metasearch engines?”. No. The owner sees it as risky because he has to pay money out in advance with no clear or guaranteed return.

NB: This is an article from mirai, one of our Expert Partners

Subscribe to our weekly newsletter and stay up to date

Nevertheless, they happily pay 20% commission for reservations from intermediaries such as Booking.com, Expedia, Hotelbeds, etc. Obviously their direct sales are quite low (5% of total sales) and they will stay that way as long as they remain unaware of the opportunities they are missing.

What do the leading OTAs (Booking.com and Expedia) do?

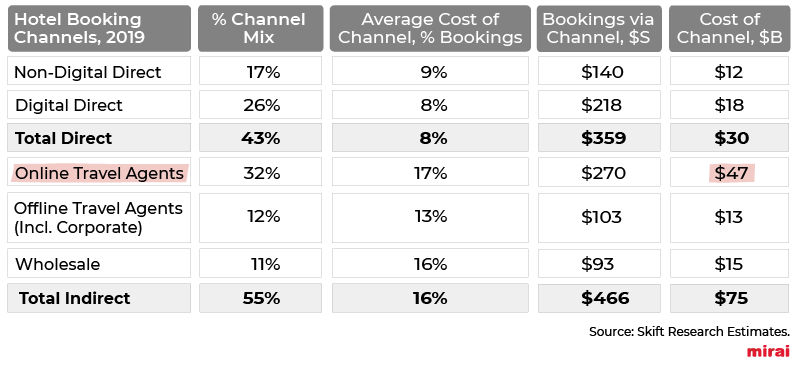

To understand it better, let’s analyze the subject step by step. Let’s start by taking a look at the companies that know the most about hotel marketing, the OTAs. The hotel industry pays OTAs around $47,000M per year in commissions, an average of almost $2,685 per room per year*.

*based on hotel statistics https://hoteltechreport.com/news/hospitality-statistics

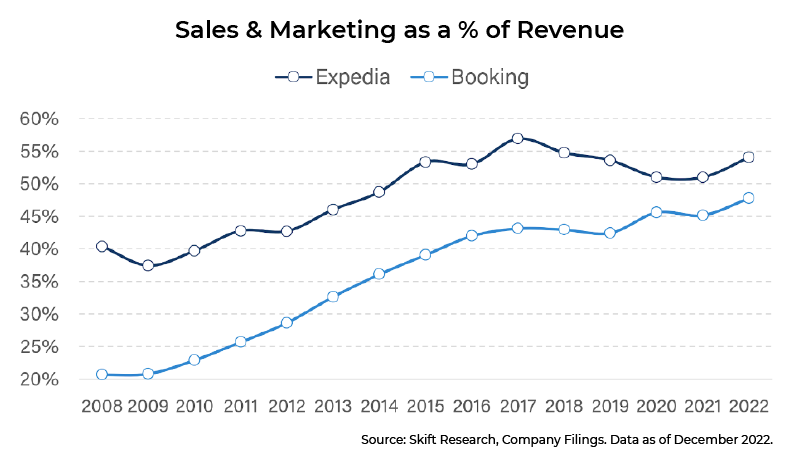

If we analyze the public accounts of the leading OTAs, we see how they are investing heavily in sales and marketing, investing around 50% of their revenues, and with this percentage clearly increasing:

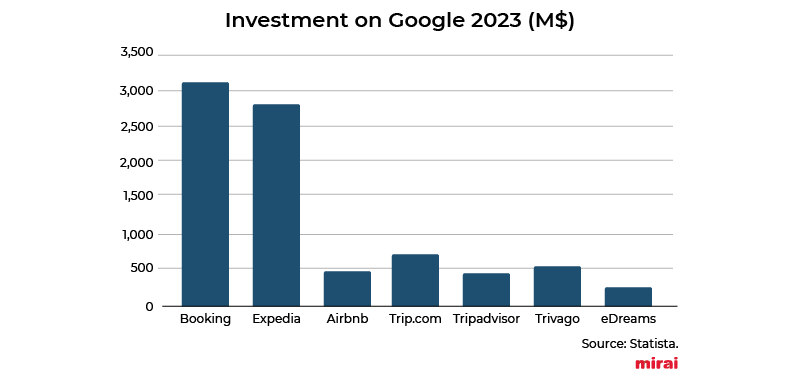

This major commitment to investment in marketing makes Booking.com the biggest partner for Google Travel, with an estimated investment of close to $3.1 billion in 2023, much of this financed by the commissions received from hotels. In total, according to a recent analysis by Hosteltur, OTAs paid almost $9,000M to Google in 2023 ($22,500 per hotel per year).

Source: Statista

However, the million-dollar question is why do they invest so much? Is it profitable?

Well, the fact that they increased their investment by 46.5% over the last 3 years, and that this growth is linked to record levels of growth in their revenues and profitability, seems to leave little room for doubt. As an example, up to Q3-2023, Booking.com had already earned 29% more than in the entire previous year, and had also more than doubled its profit (117%). Source: Macrotrends

In short, yes, it’s very, very profitable. It’s a good strategy.