Why can’t you still get a straight answer when you ask which channels actually make you money?

Because hotel distribution today is basically like an investment portfolio, and most hotels are pretending it’s a spreadsheet.

NB: This is an article from Juyo Analytics, one of our Expert Partners

Subscribe to our weekly newsletter and stay up to date

Every day you’re shuffling money between OTAs, Brand.com, corporate, wholesale, meta, ads, and voice. You have 14 dashboards, and none of them tells you if a booking is actually profitable.

- You don’t have real customer acquisition costs (CAC).

- You don’t know which channels are high-yield and which are eating your margins.

And here’s the painful part:

You’re optimising distribution based on accounting numbers, not economic reality.

Which is how you end up with:

- Overfunding “cheap” channels that silently leak margin,

- Underfunding “expensive” channels that actually deliver incremental demand,

- Chasing direct bookings you can’t afford,

- Negotiating corporate accounts that look stable on paper but destroy contribution.

Why? Because you don’t have visibility.

The Real Reason Hotel Distribution Is a Mess

Ask yourself:

What’s my OTA commission?

“18%, easy”.

What are my direct costs?

“4–6% — I’ve got this”.

Wholesalers?

“10–15%.”

And what about the true cost of each channel?

…long pause, slight panic…

Here’s the reality: The invoice cost is the small cost. The hidden economic cost is the real margin killer.

What’s Destroying Your Hotel Margins (And Isn’t on the Invoice)

- Incrementality loss

A channel that drives bookings isn’t necessarily driving incremental bookings.

10–30% of OTA bookings can displace direct bookings. This means you’re paying commission for business you would’ve gotten anyway. That’s a total leakage.

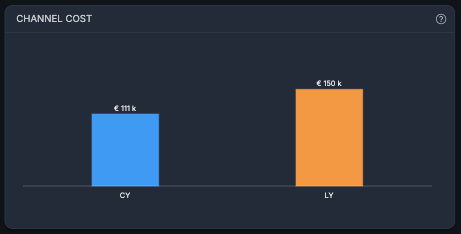

How Juyo Analytics helps: The Channel Cost widget exposes how your direct-channel economics shift over time.

By visualising commissions, markups, and pass-through fees, it highlights where incrementality is eroding so you can course-correct your Brand.com strategy.

- Demand-dependent CPC inflation

Your direct “cost per booking” explodes during high demand. You’re paying €35–€45 for a meta click-through in peak season while screaming that OTAs are “too expensive.”

Here’s how distribution cost actually behaves:

- Low demand: OTAs drop CAC because they subsidise demand creation.

- High demand: Meta and pay-per-click (PPC) spike, making direct suddenly more expensive than OTA.

How Juyo Analytics helps: The Market Insight by Lighthouse widget shows demand surges before your CPC inflates.

This lets you anticipate when advertising gets expensive and adjust budgets dynamically instead of eactively.