Price is one of the key factors in any commercial transaction, whatever the product or service.

NB: This is an article from mirai, one of our Expert Partners

In fact, for certain commodities with little differentiation, it is the main factor. Perhaps it is not always the most important in hotels, but it is certainly relevant. It is true that the more unique and luxurious the hotel, the less the price matters.

Subscribe to our weekly newsletter and stay up to date

But on the other hand, the less differentiated the hotel is from the competition and the lower its category, the more relevant price becomes.

Unlike during the search phase, price becomes a key factor once the customer has decided which hotel to visit and is working out which website they should use to make their booking (OTA or direct sales).

Is it possible to quantify the importance of price for your direct sales? How much are you losing by not controlling your prices and allowing other channels to sell cheaper than you do on your own website?

Basis of our study

We have analyzed the price competitiveness of almost 1,500 hotels on their own website against the prices offered by OTAs for the same hotel during the second half of 2022, a fairly healthy period in terms of bookings.

All this data has been extracted from Google Hotel Ads, Google’s price comparison tool and source of a wealth of information. For each search/query made by a user, Google categorizes the results into four options it calls Price Buckets:

- Not lowest: Nice way of saying that your price is worse (with a 2% margin) than other OTAs. The number of these cases relative to the total is what we call %Lose.

- Tied for lowest: You have the best price in parity with other OTAs for your product.

- Unique lowest: You have the best price and you are the only one offering that price (the others have a higher price).

- Only partner shown: You are the only alternative, there are no other options selling your product for those dates (all other channels are closed).

We have downloaded all the enquiries made for all these hotels (10 million impressions), aggregating all the information and grouping them into each of these four buckets. We have decided to analyze only the data related to “Traveller-set dates“, which is when the end-user interacts with the dates and shows a clear interest (the alternative of “Default dates” includes many cases where there is no real interest shown by the end-customer, who may have been looking for something else).

Hotels are still not controlling their prices

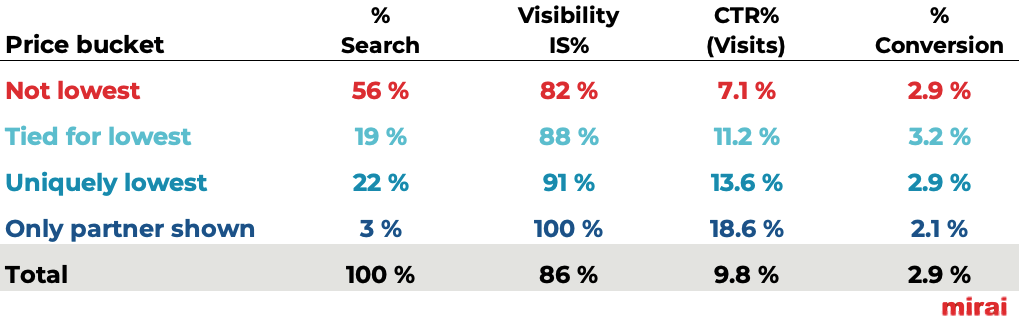

As you can see in the table below, in 56% of the inquiries there was one or several OTAs that offered a better price than the official website. Unfortunately, Google doesn’t tell us who, so in this case it doesn’t matter whether it is a third-rate pirate OTA (there are many of them) or Booking.com or Expedia. As you can imagine, the impact is not the same. Still, it’s bad news that hotels are still not getting the price under control.

In 19% of the cases there was real parity, and in 22% of the cases the hotel was offering the best prices on its website. The last 3% are those brave ones that offered rooms on their website when the other OTAs were closed.

The better the price, the more visibility, more visits, more conversion and more bookings

The most fascinating and neat thing about the table above is the obvious correlation between price buckets and the three fundamental, invaluable variables for the direct channel: