In early-April 2024, a Total Solar Eclipse will once again pass over cities across North America and drive an influx of spectators in need of overnight accommodations. That means a lift in hotel performance is once again on the horizon, but there are key differences from the last Total Eclipse in 2017.

NB: This is an article from STR

Subscribe to our weekly newsletter and stay up to date

- With a duration of totality almost double that of the eclipse in August 2017, the number of spectators looking to be a part of the experience is expected to increase.

- The eclipse will also reach more larger hotel markets than 2017, which means more available rooms and more well-known destination offerings for travelers to potentially extend trips for the eclipse.

- While the solar eclipse in 2017 attracted millions of visitors, there was no modern precedent at the time for how the spectacle would stack up against more common high-travel events (i.e. Super Bowl). This time around, there is recent data to demonstrate the impact, and travelers are in-the-know about what to expect.

- This year, there is a major holiday in the year-over-year comparison that will provide added lift to % changes.

With those differences established, we can set more sound expectations as the Total Eclipse darkens cities but shines light on hotel performance.

Highlights from 2017

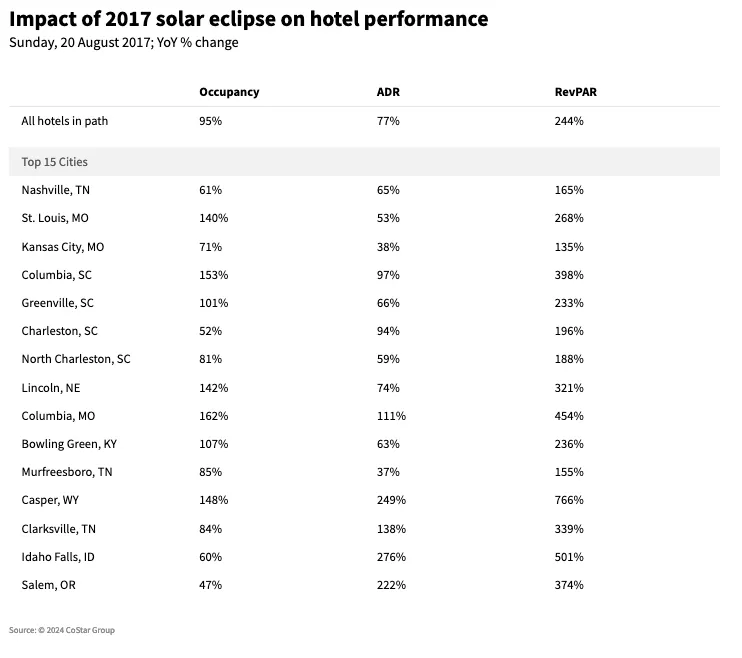

Before we dive into some of this year’s forward booking data, let’s travel back seven years when STR analyzed the 2017 Great American Eclipse. The highest impact was seen the day before the eclipse (Sunday, 20 August), when hotels in the path of totality saw a 244% increase in revenue per available room (RevPAR). Hopkinsville, KY, one of the many smaller markets in the path, saw a staggering 1,644% increase in RevPAR that night. It’s important to keep in mind that smaller cities like Hopkinsville have limited hotel supply, making it easier to reach compression levels in occupancy and push pricing premiums.

Hotels in Columbia, MO, saw the highest year-over-year occupancy increase, while hotels in Idaho Falls posted the largest gain in average daily rate (ADR).

When looking at the three-day impact (Friday-Sunday), RevPAR increases were lower than just those for Sunday night, although hotels in the path of the eclipse recorded an impressive 87% gain in the metric. Again, Hopkinsville recorded the highest RevPAR jump (+522%) for the three-day period. Larger markets still felt a RevPAR impact, such as Columbia, SC (+152%) and St. Louis, MO (+121%), which also recorded occupancy increases of 59% and 60%, respectively. More modest, a higher room supply market like Nashville saw a three-day occupancy increase of 18% and a RevPAR jump of 57%.