The hotel business can seem fickle. Weather, pandemics, and other things outside your control impact your revenue. Yet, the discipline of revenue management demonstrates you have more control than you may think.

NB: This is an article from Revenue Team by Franco Grasso, one of our Expert Partners

Consider revenue predictions. Some hoteliers look at the past two years and think they don’t impact this year. Yet, if you practice revenue management, you know accurate revenue forecasting depends on the data from the recent past.

Subscribe to our weekly newsletter and stay up to date

For example, hotels that practiced revenue management pre-pandemic and throughout the pandemic ended 2021 with a revenue increase despite restrictions and other pandemic difficulties.

This article reviews the recent two years and shows what some hotels achieved with revenue management principles. Despite the worst tourism crisis in decades, revenue-managed hotels maintained their cash flow throughout pandemic restrictions and now can project healthy scenarios for 2022. 2019 data provides a benchmark in the following graphs.

350 Hotels Provide a Representative Sample

This data comes from a representative sample of 350 3 and 4-star Italian hotels. These hotels use the Franco Grasso Revenue Team consulting services and RMS (revenue management system,) and they also enjoy 8+ ratings on Booking.com and 4+ on Tripadvisor. They all use revenue management methodology to manage their cash flow.

When comparing these hotels with those that don’t use revenue management, the contrast is stark. Such external data is available via OTAs, STR and local hotel associations reports and press releases.

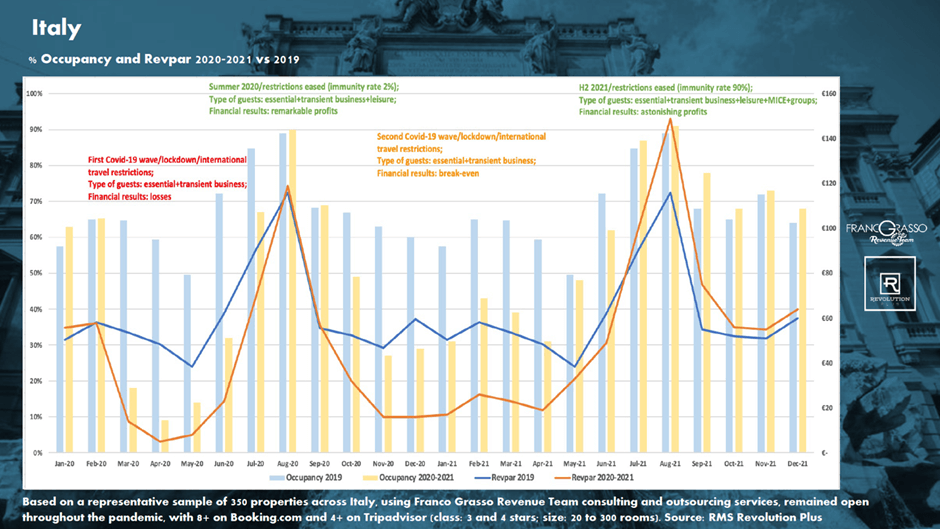

Regardless of local restrictions, these observations are applicable around the globe. The below graph summarizes recent trends, and you’ll see it’s possible to compare 2020 and 2021 data with 2019 results to make 2022 revenue projections.

Early Pandemic

As every hotelier knows, the pandemic devastated the hotel business. The graph shows the effect of the local restrictions from March 2020 to May 2020. As you know, some hotels shut down rather than remain open and adapt to changing regulations.

The hotels that closed didn’t practice revenue management and chose what seemed the best option at the time. Yet, those that stayed open and did have revenue management principles in place maintained cash flow. Yes, they sustained months of losses, yet, their cash flow allowed them to keep online channels active and up-to-date.

One thing revenue management principles shows is that maintaining online visibility is essential. Your hotel gets found, your rooms are booked, and guests leave positive reviews. It’s a virtuous cycle that pays off well as you’ll see.

Yet, it takes patience. During lockdowns, these hotels only achieved a 10%-15% occupancy. After all, few people were traveling, mainly essential and transient business travelers. Yet, despite this low occupancy rate during those months, it was a critical decision that paid off for these hotels.

It paid off in summer 2020 when borders re-opened and eager leisure travelers packed their bags. The hotels that’d remained open happily received these guests. They were well-positioned due to their continued online visibility and maintained staff.

These hotels reached occupancy rates between 60% and 90% which meant they could recover from earlier losses.

Yet, those hotels that’d closed and then tried to reopen a few months later were in a bind. They’d lost visibility, laid off staff, and continued to face losses. The data shows they only booked 20%-40% occupancy compared to the hotels that practiced revenue management.

Such hotels struggled through the summer, and when the cold weather returned and with it a rise in infections, they faced more losses.

On the other hand, the hotels that practiced revenue management and stayed the course throughout the lockdowns had renewed cash flow.

Comparing the Two Hoteliers From Fall 2020 and 2021

New restrictions meant hotels had more tough choices. Yet, those that employed revenue-management principles remained in a better position. Thanks to strong occupancy rates in the summer, they’d ramped up their cash flow.

As the second wave of covid picked up steam, these hotels could adjust. They had a positive cash flow and had few or no layoffs.

The hotels that didn’t use revenue management principles were again floundering. Many closed for good. Others adopted a short-term business model of becoming a covid or quarantine hotel.

This short-term pivot was a necessity for many but also sacrificed long-term profits. These hotels closed their online channels and lost their visibility so needed to attract new guests (people who tested positive or had quarantine obligation) that don’t leave positive reviews. On top of that, the ADR of quarantine hotels was just half, if not one third, of pre-covid levels, and in any case much lower of what revenue-managed hotels were able to charge to normal guests through online channels.

The revenue managed hotels continued to at least break-even. With less competition and continued online visibility, they attracted guests and continued to receive positive reviews. Their occupancy rates of 30%-50% are statistically break-even numbers between costs and revenues.

If the hotel can’t break even at those percentage points, there are usually two problems:

- Inefficient cost rationalization

- Lack of revenue management (ADR is too low)

2021: The Summer of Freedom (or at least higher immunity)

We know that people were eager to get out and travel come summer. And the jump of immunity rate (percentage of vaccinated+recovered) to 70% in July 2021 was a big boost. As restrictions dropped and people traveled, the open hotels (revenue managed) achieved or exceeded their 2019 results with increased leisure travelers, the return of groups and MICE.

This trend remained in force throughout the second half of 2021. We did see a bit of a lag with city hotels due to hybrid events and attendance restrictions. Yet, it’s a small gap of only 8% from 2019 and late 2021.

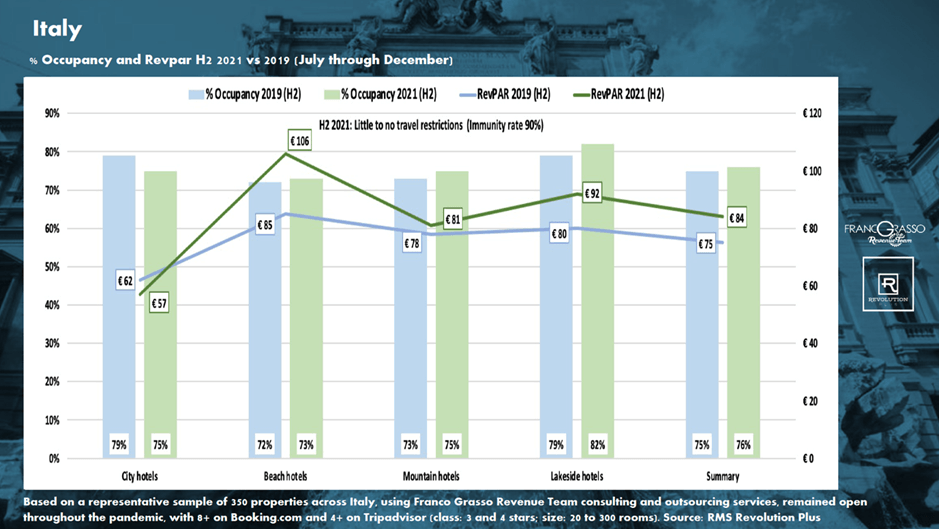

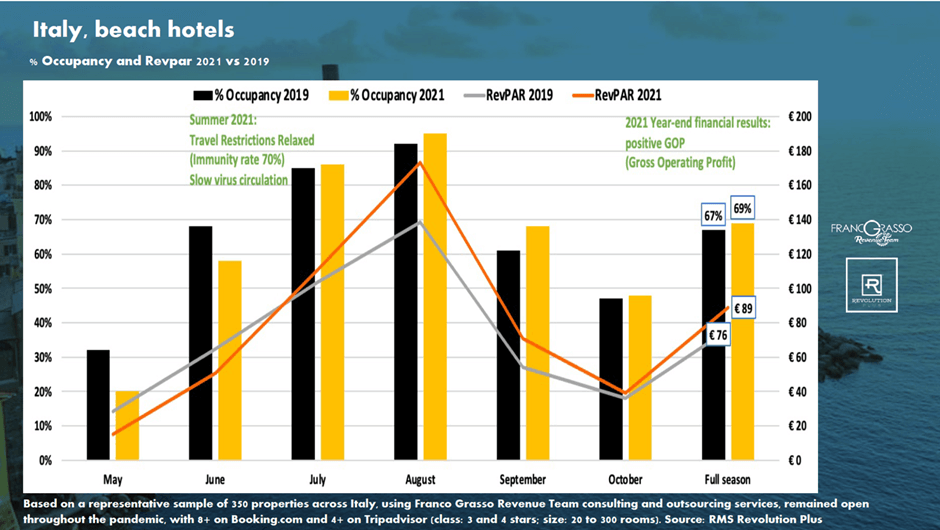

You can see from the graph below hotels that specialize in vacationers did well in 2021. Mountain, beach, and lake hotels that used revenue management saw higher results than in 2019 before the pandemic upended the world. This graph shows an increase in occupancy, ADR, and Revpar.

Let’s explore how that could happen.

Some Leisure-focused Hotels Grew Their Overall Profits

The pandemic restrictions weren’t equal everywhere. Even comparing hotels within one country shows location-based differences.

For example, city and mountain hotels were the most affected in the beginning of 2021. This isn’t surprising since most travelers head to the beach in the summer and not the winter. Yet, those city and mountain hotels faced a strong second half of the year. In fact, it was so robust it saved the entire year. Such properties ended 2021 with a positive gross operating profit (GOP.)

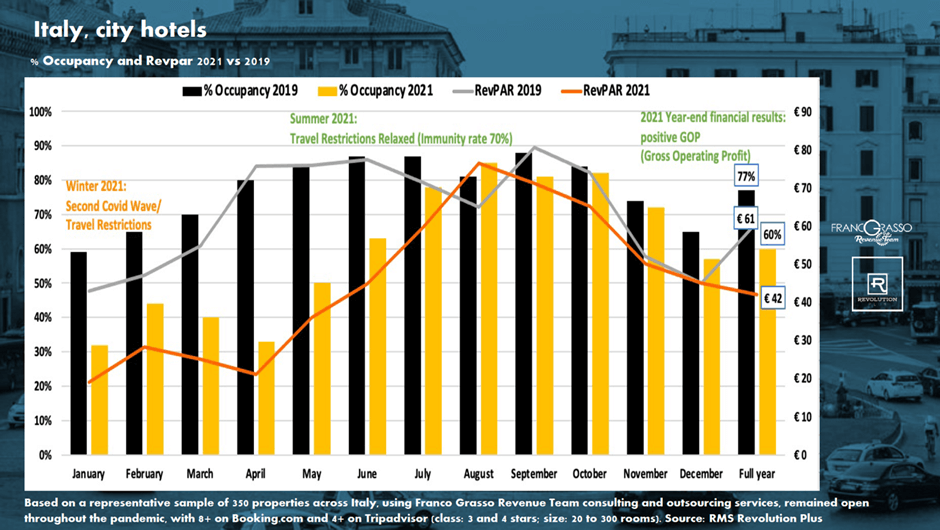

In the chart below, you can see city hotels that practice revenue management ended the 2021 year with an annual occupancy of around 60%. This meant the hotel enjoyed a positive GOP even when Revpar was lower than in 2019.

By now, you’re seeing the pattern. The hotels that closed and tried to reopen later found their properties were no longer as visible online. As a result, it was harder to attract guests and they faced steep revenue losses up to 70% when compared to 2019.

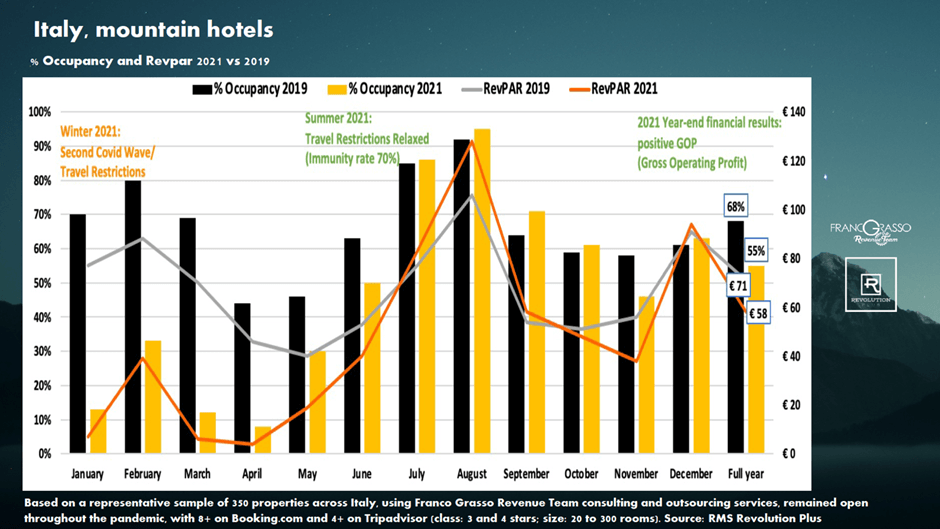

While the city hotels always had some essential travelers, mountain resorts didn’t have that option. However, their revenues still grew throughout the second half of 2021 leaving them with a positive GOP.

This is the power of sustained revenue management.

Seasonal summer hotels fared well too. They closed 2021 with a seasonal occupancy of around 70%, which made the final turnover much higher than 2019 (between 15 and 20%.) We see a similar trend with lake and countryside hotels.

As you can see, the hotels that implemented revenue management (pre-pandemic and throughout) achieved a positive GOP. One reason why was because they maintained high online visibility. This led to bookings, positive reviews, and higher online rankings due to the way algorithms work. Good reviews and conversions contribute to higher rankings in a virtuous cycle.

Combined with smart revenue management practices, some of these hotels saw 2021 increases in ADR as much as 30% more than in 2019.

However, those hotels who didn’t incorporate revenue management practices closed the year with lower revenue than in 2019. This is true even if they were fully booked some nights, because they sold rooms at reduced rates and weren’t able to make up for lost revenue.

The Rise of Omicron

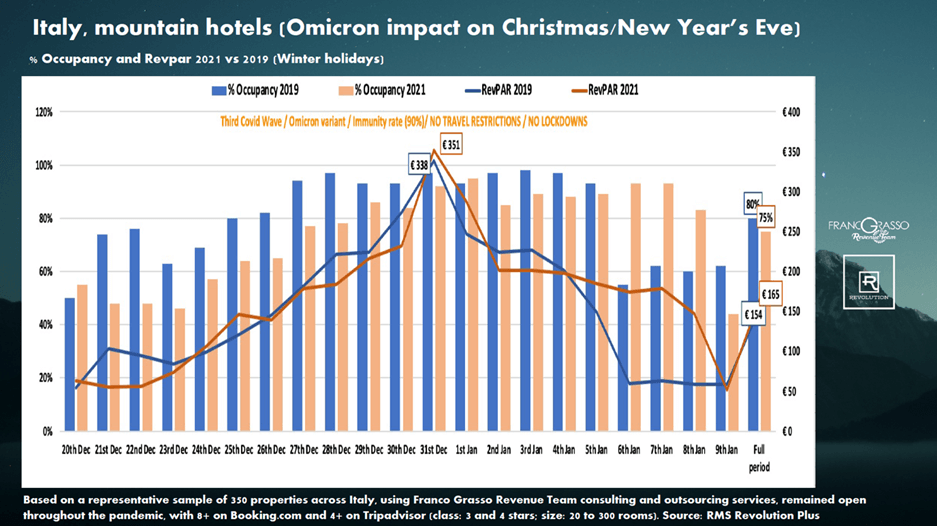

Again, the colder weather brought a rise in infections. Yet, during this third wave caused by Omicron variant, there were fewer travel restrictions which meant more people traveled. Additionally, hotels had a better handle on the entire scenario.

This graph shows some mountain hotels had a lower occupancy rate during the 2021 holiday season (December 20 to January 9) when compared to 2019. Yet, it was only a 5% difference. A +15% ADR led to a Revpar (revenue per available room) +7% higher than in 2019 so the hotels still came out ahead because the rooms sold for a higher rate than before even if they’d sold fewer hotel rooms.

If you’re wondering why there were fewer hotel rooms sold in the 2021 holiday season vs. 2019, it’s due to two primary reasons.

- The Omicron variant forced millions of people to cancel their travel plans. Many of these mostly asymptomatic people quarantined at home due to exposure or a positive test.

- Some of these people were hotel staff, and many hotels had to reduce their capacity.

This brings us to the paradox. While hotels wanted 100% occupancy in 2020, by 2021, things had changed. The contagiousness of Omicron led to labor shortages and hotels didn’t want to host more guests than they could handle. Yet, those hotels with revenue management still exceeded the 2019 winter turnover by 10%. If Omicron hadn’t been an issue, they could have achieved +30 or 40% vs 2019.

The 2020 and 2021 Lessons for Forecasting 2022

Over the past two years, everyone has learned more about viruses than they ever considered. Science lessons aside, hoteliers can apply these biology basics to 2022 financial projections.

Let’s recap three science facts:

- Lockdowns and border closures failed to eradicate the virus, and they only did postpone the spread but not without social and psychological collateral damage (1)(2). That’s something many governments eventually took into account.

- Warm weather tends to reduce the spread of viruses (3).

- Viruses aim to replicate as much as possible without killing the host cell, otherwise they would die too. That’s why mutations tend to be more contagious but less aggressive than the original as virus variants try to peacefully coexist with host cells (4).

As a hotelier, you can use this knowledge to your 2022 predictions. Many smart hoteliers started doing that in March 2020. As an example, in the past two years, some hoteliers discovered 4-5 months of maximum revenue through revenue management could make a big impact on the year. In fact, it could make the difference between a positive gross operating profit and not. Those hotels that operated throughout the restrictions and changing covid protocols and practiced revenue management found financial stability. Bonus, due to their stable position some of them also received tax credits, incentives or subsidies from governments and banks.

As you’ve seen, hotels that remained open continued to host guests and collect reviews which meant they had high rankings in search. They also had a positive cash flow that allowed them the opportunity to invest in the improvement of service and rooms or upgrade technology.

Each time there was an uptick in travel, these hotels were open and ready to receive guests.

Those hotels that didn’t practice revenue management faced a different reality. They lost their online visibility, which pushed them down in the online rankings, and they had to fire staff. Upon reopening, they had to compete with other hotels to find qualified employees and train them. Many such hotels have closed for good.

Hotel Revenue Forecast for 2022

In reviewing the past two years, trends point to fewer quarantine requirements. As mandated quarantines lessen or disappear, hotels practicing revenue management can increase turnover and see large gains.

For example, the revenue-managed hotels can increase 2022 turnover by a minimum of 10% compared to 2019 numbers. If mandated quarantines for vaccinated or recovered asymptomatic people who test positive disappear (5)(6), that number can go as high as 40%.

Some hoteliers misunderstand revenue management. They think it’s only useful to manage demand and if there’s no demand, it’s useless. Yet, that’s not the way it works at all. Hopefully, you’ve seen the way revenue management principles (or lack of them) can impact a hotel’s revenue stream even during a pandemic.

This study demonstrates the power of revenue management in taking a multi-faceted approach to pricing. Hoteliers that maintained the underlying principles of revenue management throughout the pandemic are stronger and they’re poised for profit as travel ramps up.

Those hotels that either never practiced revenue management or stopped it in 2020 may not survive. Trends show the pandemic is turning into endemic and hotel surviving via quarantine business is on the decline. Additional government aid is unlikely. However, revenue management helps hoteliers manage their cash flow and make strategic decisions, no matter what’s going on in the world.

Discover how your hotel can implement revenue management by downloading these ebooks:

10 things to know about revenue management

5 revenue tips for city, beach, mountain, and countryside hotels

Read more articles from Franco Grasso Revenue Team

References

(3) https://www.frontiersin.org/articles/10.3389/fpubh.2020.567184/full

(4) https://news.northeastern.edu/2021/12/13/virus-evolution/

(5) https://www.cdc.gov/media/releases/2021/s1227-isolation-quarantine-guidance.html