Every hotel wants to reach new potential customers. It’s a difficult task and many hotels don’t know where to start.

NB: This is an article from mirai, one of our Expert Partners

This is because incrementality only happens at the top of the funnel, where customers are still deciding where to go and which hotel to stay in. And this upper funnel is dominated by large companies that aggregate and sort all the information, such as Booking.com, Expedia and growing competitors like Google and Tripadvisor.

Subscribe to our weekly newsletter and stay up to date

Unfortunately, it is very difficult for the direct channel to play a role in the highly competitive upper funnel, especially for independents.

Despite some initiatives such as Google Property Promotion Ads and Tripadvisor Sponsored Placements, where direct can access incremental demand, the biggest value proposition of OTAs for hotels is the ability to reach new customers. This incrementality is the love part of the love/hate relationship hotels have with OTAs. An expensive relationship, but a love relationship nonetheless. The hate part occurs at the other end of the funnel, where OTAs compete with hotels when customers are already searching for them using their names and brands. In the lower funnel, there is no incrementality and OTAs add little or no value.

The hotel industry adopted the word “visibility” when referring to “incremental demand”. I guess visibility was an easier concept to understand and buy into. And that is exactly what hotels have done. Over the last decade, they have bought every one of the “visibility boosters” OTAs have launched, dreaming of that incremental demand, but not thinking much about the impact on the net ADR of their properties.

The idea is simple: hotels pay more to OTAs for additional customers. Sounds fair, doesn’t it? But shouldn’t this new cost only be paid for new idemand (incremental reservations)? It should, but that’s not always the case.

Additional cost/discount applied only to incremental or to all revenue?

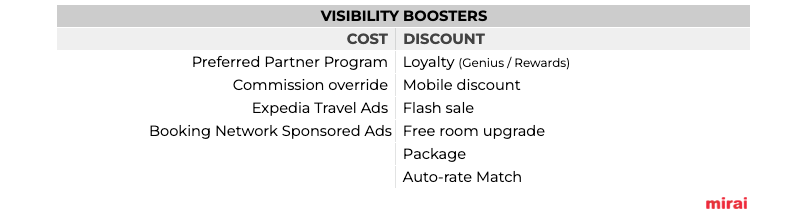

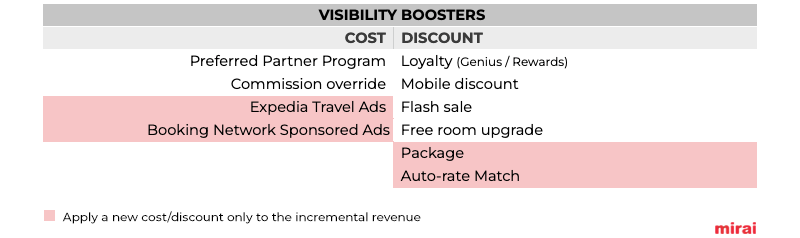

Let’s classify visibility boosters according to these criteria.

Let’s start with those that apply a cost/discount to all revenue (both what the hotel was already getting and new revenue):

- Booking.com’s Preferred Partner Program: you move from 15% to 17% (on prices with taxes in some countries such as Spain) on all bookings, not just the new ones generated by the program.

- Commission override. Hotels select the dates on which they want to pay extra commission, in order to gain more “visibility”. Unfortunately, the existing bookings they have already received for those dates are also affected by this new commission.

- Expedia Rewards and Booking.com Genius programs. Existing revenue (the revenue you would have received anyway) is affected by this new discount. The idea behind this booster is that new incremental revenue will offset this loss.

- OTA mobile discount. All of your mobile revenue with these OTAs (already 70% or more) will automatically be discounted by this new discount. It’s hard to believe that this mobile discount will generate enough incremental revenue to offset this impact.

- Flash sale. Again, the existing bookings that hotels have already received for these dates will be affected by this big discount. It’s your gamble (and hope) that the additional visibility will offset this initial negative impact on your revenue.

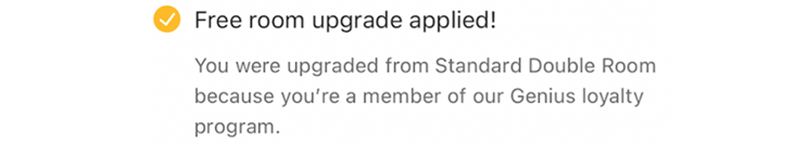

- Free room upgrade. OTAs will automatically offer this free upgrade to all your existing reservations, so the first impact is negative, as you will be offering an upgrade to all the bookings you were going to have anyway. New bookings from this extra visibility should offset this initial impact. Again, pretty hard to believe and prove.

Let’s go now with the boosters that apply a new cost/discount only to the incremental revenue which are:

- Expedia Travel Ads and Booking Network Sponsored Ads. In these programs, hotels pay an additional cost (in a CPC or cost-per-click model) to boost the visibility of their hotels in searches by destination. These visits are conceptually fully incremental (you wouldn’t have got them if you hadn’t paid). There is no additional cost for existing bookings you have already received.

- Package rates. OTAs will bundle your hotel with hotel+flight transactions. A placement you did not have before. So again, we could argue that it’s 100% incremental. Two comments:

– If OTAs misuse this package rate and leak it to room-only bookings, the supposed incrementality is no longer there. Package rate leakage is a big problem and OTAs overuse it much more than hotels think.

– It is worth debating, though, whether it makes sense for a hotel to discount the rate for the mid and high season, or to limit the package rate for the low season.

- Auto-rate matching. This booster is tricky because OTAs will supposedly only lower your rate if they find a cheaper alternative elsewhere. Let’s consider this further. If they get the sale by lowering the rate, we could say it’s incremental revenue for you (at least with that channel) and that the discount was only applied to the incremental revenue. There are so many assumptions here that it makes it difficult to assess this booster. But we had to evaluate it because it was on the list.

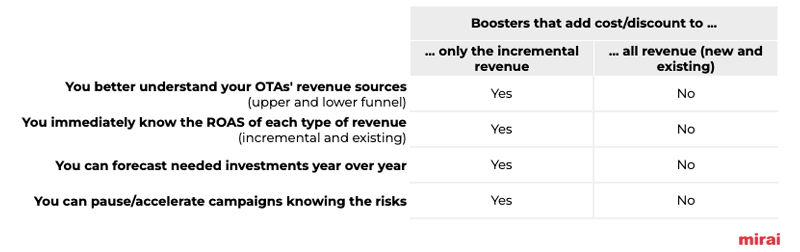

From a monetization, transparency and decision-making perspective, visibility boosters that apply the new cost/discount only to incremental revenue are always a better choice. There are several benefits down the road.

Let’s compare and contrast the two types of booster

We’re going to crunch the numbers on how to convert one booster that applies the cost to all revenue to another that applies the new cost only to incremental revenue. For our example, we’ll use the Booking.com Preferred Partner Program and Booking Network Sponsored Ads, although you can use any of the visibility boosters from your favorite OTA.

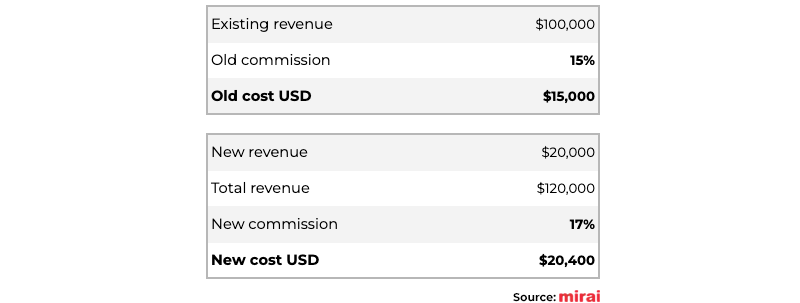

- A hotel decides to join the Preferred Partner Program. As a consequence, the commission jumps from 15% to 17%.

- The hotel was already making $100,000 in revenue.

- Let’s assume the extra visibility helps the hotel generate 20% of new revenue ($20,000).

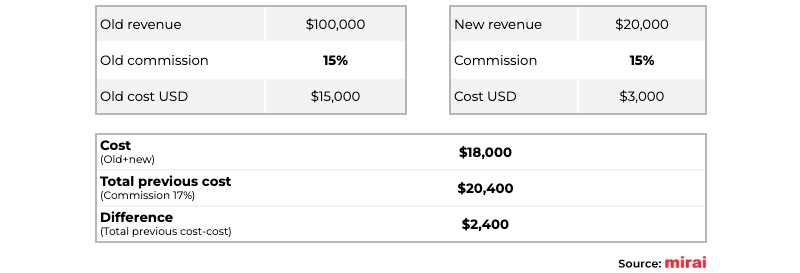

- This is the traditional cost analysis the hotel would or should do:

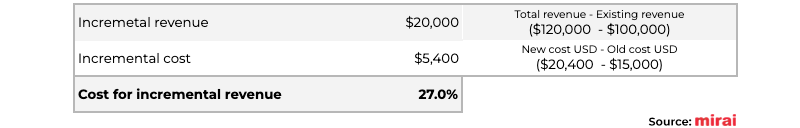

While the above analysis is correct, it’s not done properly. We should keep the 15% commission on the existing revenue ($100,000) and calculate the commission on the incremental revenue ($20,000), also known as “marginal cost”.

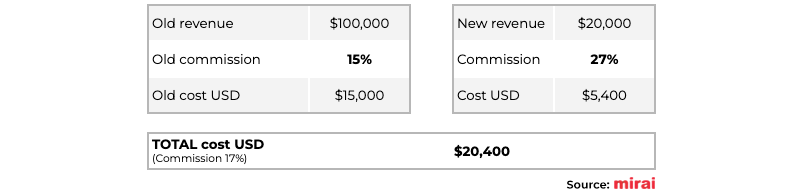

We can now see that the 17% blended commission is actually a composition of two different commissions: 15% and 27%.

Thanks to this analysis, we know how much more we are paying and how much more we are getting. If we were to generate an additional $20,000 in revenue with another booster like Booking Network Sponsored Ads, what would the numbers be like? What would be the break-even point to be as effective as the Preferred Partner Program?

The math is as follows. We’d pay the same 15% commission on total revenue (existing + new) or $120,000. This would be a cost of $18,000. Comparing that to the $20,400 cost we had, we get a difference of $2,400. This would be our budget to spend on Booking Network Sponsored Ads.

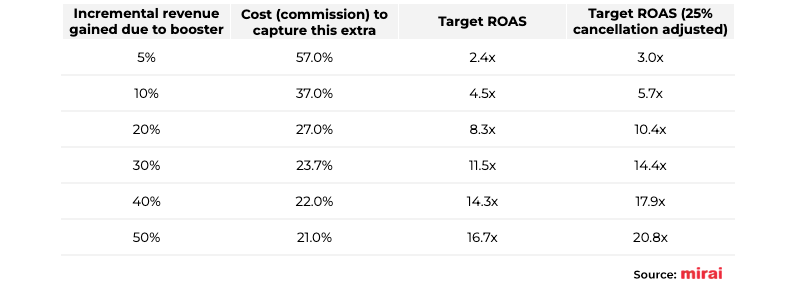

In order to generate $20,000 in revenue with an investment of $2,400, we would need our campaigns to have a ROAS of 8.33x, which sounds quite doable. Even with a 25% cancellation rate factor (you pay commission on net bookings, while you pay CPC regardless of whether the booking is ultimately canceled or not), the target ROAS would still be 10.4x. The best part is that if you are able to improve this target ROAS, the profit is on your side and not in the OTA’s pocket.

All of these numbers are very meaningful to the variable “how much extra revenue the booster gives you”. If you’re going to test a booster that will cost you all of your revenue, never make assumptions and measure performance properly. Read the reports from the OTAs, but don’t trust them completely, as they are traditionally biased towards their interests.

Depending on this extra revenue and the cost of the booster (the table below is based on the +2% commission of the Preferred Program), the real cost you’re paying and the target ROAS you’d need to achieve with other boosters can change significantly.

Conclusions

Visibility boosters have always been an easy win for OTAs and an easy loss for hotels. Certainly, more qualified traffic may be worth a fee. However, not all boosters work the same or are as efficient. Hotels should rigorously analyze the performance of these initiatives and revisit them on a regular basis (quarterly or even monthly) as boosters may make sense today but not tomorrow. Unfortunately, very few do this and most hotels end up implementing many boosters, rarely moving away from them.

Having an analytical approach to visibility boosters is critical and will help you assign the incremental cost to the incremental revenue correctly. Once you have these numbers, you will be in a position to consider migrating your existing boosters to those that apply costs/discounts to incremental revenue only.

One last thought. Doesn’t history repeat itself? New boosters come out. Most hotels buy them. Once a majority of hotels implement them, visibility is evenly distributed, the same as before. So, same visibility, but at a higher cost. Who always wins?