None of the main metasearch sites or metasearch engines, among which we include Trivago, TripAdvisor, Google and Kayak have fully convinced hotels, especially independent ones, to “connect” their direct sales. This is somewhat paradoxical because it would be a highly positive relationship for both parties.

- Hotels would reduce their dependence on OTAs and would have the perfect partner if they were to offer exclusive prices on their website.

- Meta search sites would have the only channel different to the rest (there are many OTAs but only one official website), which in many cases offers the best price. To be a price-comparison website without having the best price would be a failure.

This lack of understanding between hotel and metasearch sites paves the way for OTA sales, especially for Booking.com, the undisputed king of this industry in Europe, who always wants to be in the top spot at no matter what price.

The other big loser is the final client, who shall have to expressly google the hotel’s official website in order to find its price.

Reasons why hotels and price-comparison sites do not understand each other

At Mirai, we work with hundreds of hotels to whom we explain the advantages (and disadvantages) of investing in metasearch engines. From our point of view, the real reasons are:

- Cost. Price-comparison sites look to capitalise on each click and tend to treat hotels (chains and independent ones) like if they were OTAs, with high rates that make it hard to make a profit from these investments.

- Slowness in registering process. Many hotels find it hard to register, especially chains. Lack of service, slowness in the reply, technical problems in the registering process or high demands are just a few examples as to why.

- Daily management – lack of tools. Once everything is “connected”, every hotelier has to manage these investments, which he cannot afford. Increase or decrease the bids? Which markets to be in? Which budget should be set every month per market? All of these questions are posed by the hotel, which increases an already heavy daily workload.

- Mistrust. Hotels are tired of paying more every year to sell the same in the direct sales. They see price-comparison sites as a threat rather than an opportunity. It’s obvious that it’s not pleasant to pay to have a presence in them but, if they don’t do so directly, they will do it anyway with the commissions paid to OTAs.

There are two factors that are NOT a reasons for lack of understanding, although they may seem so at first:

- The technology that connects with the price-comparison sites exists, is affordable and tested (in other words, it’s not a technological challenge).

- The hotel doesn’t have investment problems (in other words, it’s usually not because the hotel doesn’t want to invest).

The perfect meta search site that would have a place for direct sales

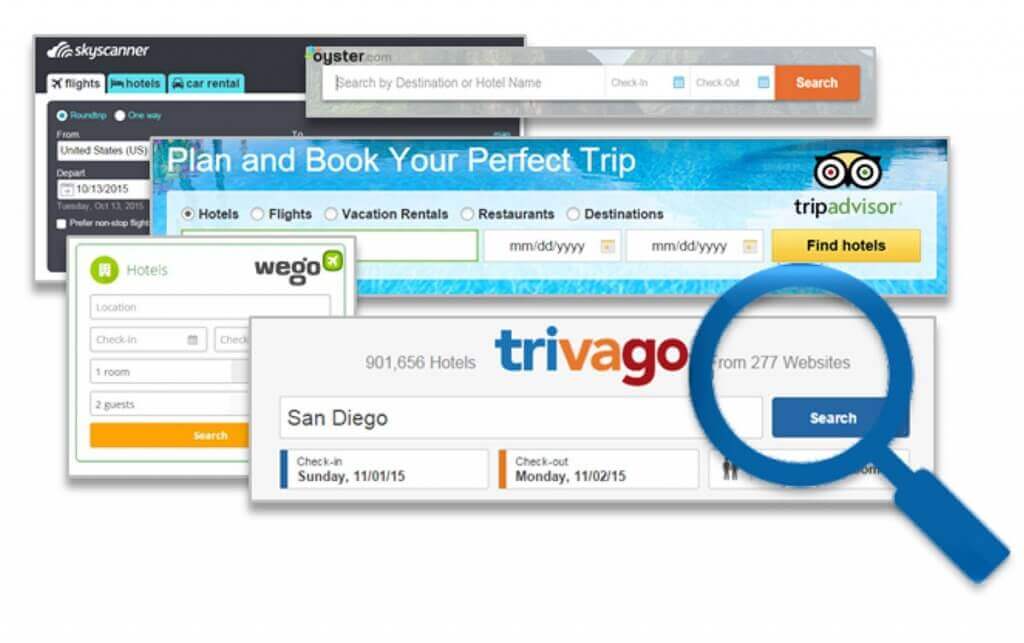

The four main ones, once again TripAdvisor, Kayak, Trivago and Google, more or less have attributes of what would be the “perfect meta search site”. However, none of them meet all the fundamental requirements to be it:

Read rest of the article at Mirai