Given the immense sway that Google holds over the hotel industry, any new release from the search giant tends to be met with a mix of both apprehension and excitement.

NB: This is an article from Triptease

So when Google announced the rollout of their ‘free booking links‘ a couple of weeks ago, the industry was rife with speculation about their impact on hotel marketing.

We’ve been monitoring the performance of the new organic listings since their launch and so far they’re delivering a meaningful increase in click volumes across our metasearch portfolio – but the size of that increase is strongly dependent on region.

Subscribe to our weekly newsletter and stay up to date

In this article, we break down the data on free booking links and give you the actionable advice you need to turn those extra clicks into bookings for your hotel.

The impact of free booking links by region

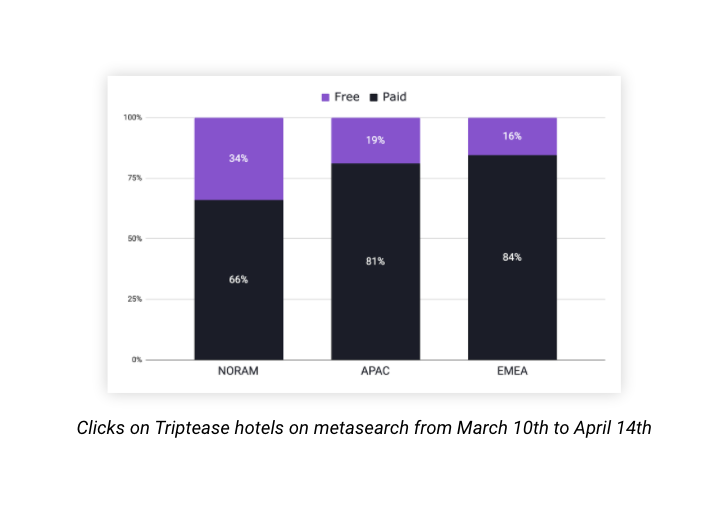

Since their official launch on March 9th – Google had been testing these for several months beforehand – free booking links have had the most sizeable impact on hotels in North America – delivering over 30% of clicks from metasearch on average. That’s in contrast to hotels in Europe, the Middle East and Africa, where free booking links only account for around 20% of clicks in the same time frame.

Those volumes will be a mix of incremental and non-incremental clicks. It’s hard to scientifically quantify their incrementality given that (a) Google has been testing these in various forms for a while and (b) digital marketing performance continues to be very volatile as hotels recover from the impact of COVID-19.

While it’s hard to know for certain, it could be that the relatively high volume of free clicks for hotels in North America is partly due to the organic listings being shown in more formats in the region. We’ve tended to see free links appearing more on the initial search results page when searching from the US, rather than hidden on the ‘Prices’ tab after clicking to view more rates.

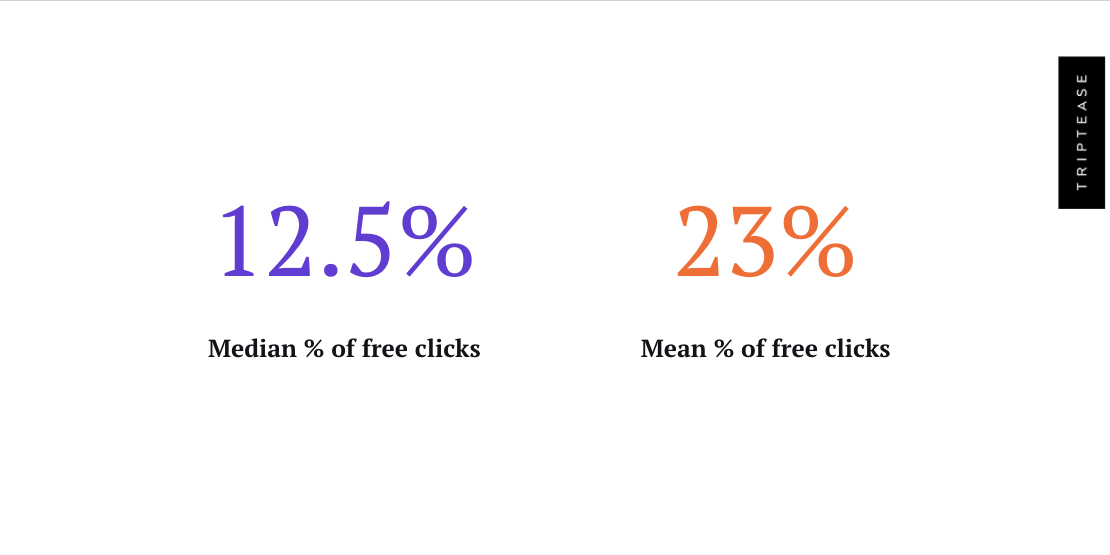

It’s also worth noting that the proportions vary widely at a per-hotel level. The mean volume of free clicks may be 23%, but the median is only 12.5%.

That means that, as an individual hotel, your proportion of free clicks is more likely to be around 12%.

There are just some hotels where free clicks are making up a very large proportion of their traffic, and that ratio may be down to low click volumes overall (if you only get 3 clicks and 2 of them happen to be free, your free click proportion would be 66.6%).

How free booking links vary by device

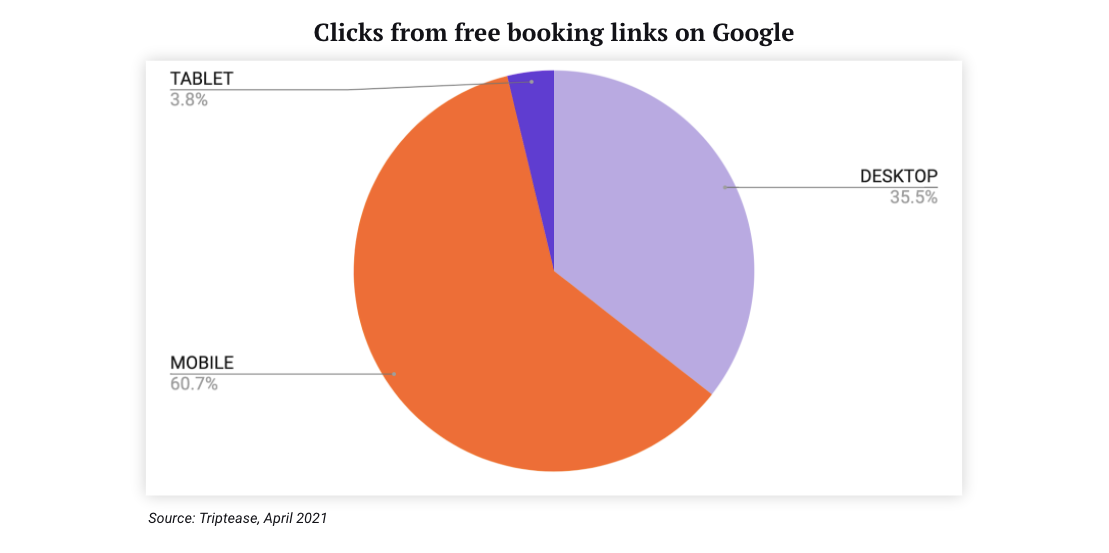

We’ve also found that clicks on organic booking links skew strongly to mobile. About 61% of free clicks come from a mobile device. This is higher than the proportion of mobile clicks on regular, paid metasearch in North America and Europe; both of those regions tend to see about a 50-50 split between desktop and mobile overall. However this isn’t the case in Asia-Pacific, where around 70% of clicks on regular meta are made on mobile.

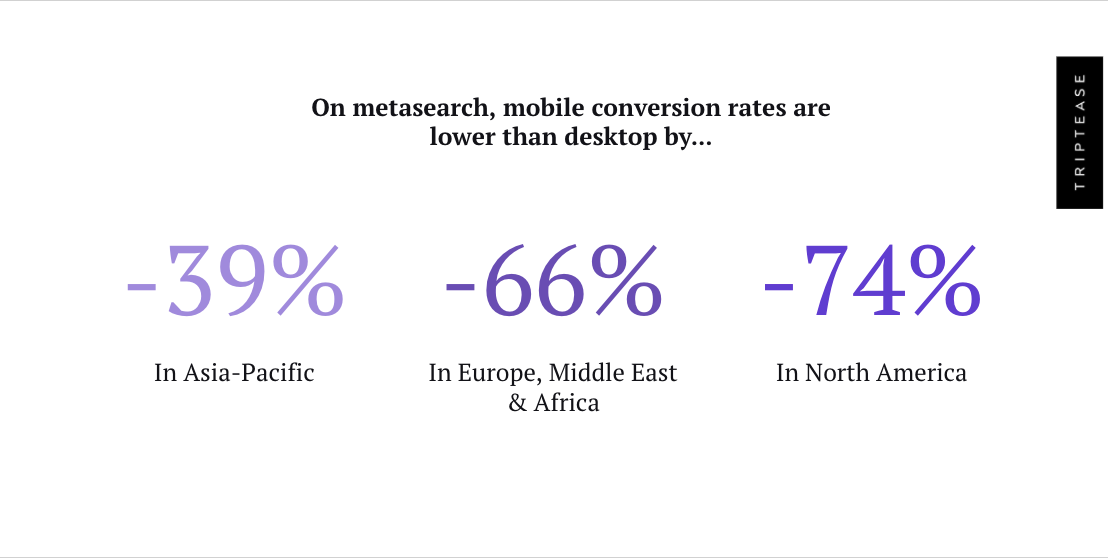

Google is constantly testing how they present these free links across different devices and different regions, so there’s still likely to be a huge amount of variation in the way these links are shown. Two people sitting next to each other and searching for the same hotel might see different layouts! But, on balance, it does seem as though guests are more likely to see and click these links on mobile – and that could significantly reduce their value, depending on the quality of your mobile booking experience.

Hotels in North America – who, remember, are most likely to benefit from high volumes of free clicks – only convert one metasearch user on mobile for every four they convert on desktop.

So while free links might send your hotel a decent chunk of traffic, the value of that traffic will remain relatively low if your mobile booking experience is not optimized to convert it.

How Google decides your ranking on free booking links

In the absence of an auction, where the highest bid determines who gets the top spot, the order of these organic listings is determined by several factors, including:

- Price feed quality – How accurate are the prices you’re sending to metasearch? Can a user see the same rate on your booking engine as they saw on meta?

- Landing page quality – How well-optimized is your booking experience? Does it load quickly once you click the direct link?

And although Google hasn’t explicitly stated this as a ranking factor, your price competitiveness is crucial for differentiating yourself from other advertisers.

For a thorough explanation of the ranking mechanism and advice on how to optimize your position, you can check out this quick video with our Senior Product Manager for Metasearch. But for now, it’s important to note that Google assesses landing page quality based on the mobile version of your booking experience.

That means that the quality of your mobile booking experience doesn’t just matter when it comes to converting traffic from free booking links – it also has a direct impact on your hotel’s ranking on metasearch. Even if you’re present in the free listings with the best price, your ranking could be penalized for a low-quality mobile booking experience.

Why you need to prioritize your mobile booking experience in 2021

It’s worth noting that we wouldn’t recommend any hotel to rely too heavily on free links as a traffic acquisition strategy, as it’s still very early days and Google could well reduce their prominence as time goes on. But if you’re not participating in metasearch yet, free booking links are a fantastic opportunity to get connected and start driving some extra traffic. And if you’re already on meta, they’re a great way to supplement your performance.

To really succeed on free or paid meta, though, you need to make sure you have a high-quality mobile booking experience.

Combining a great mobile booking flow with a competitive price and a highly-accurate price feed is key to driving high booking volumes from metasearch. And right now, many hotels we work with are doing just that – revenue per hotel from metasearch is higher than it’s ever been for hotels in North America.