Parity is a deciding factor influencing where visitors on hotel metasearch sites like Google Hotel Ads, Tripadvisor and Trivago decide to book.

NB: This is an article from Triptease

When your direct price is in parity or cheaper direct, our data shows that bookings increase by 3x. By contrast, conversions decrease drastically when you’re consistently undercut by OTAs. Keeping your metasearch parity in top shape should be a major priority for every hotelier as we enter a new ‘diamond age’ of travel in 2022.

Subscribe to our weekly newsletter and stay up to date

But what constitutes good parity health on metasearch anyways? How often do direct prices tend to be undercut by OTAs on meta, and what benchmark should you ultimately be aiming for when it comes to improving your parity?

We looked into our data to analyze how often metasearch users have seen direct prices as in parity, cheaper or undercut in comparison to OTA rates this year. The data focuses exclusively on Google Hotel Ads, by far the most used metasearch engine accounting for over half of all meta traffic and conversions – and therefore a good indication of how users are seeing prices on other meta engines.

It takes all OTAs participating on meta into account and shows a “guest-centric” view, meaning the data shows how customers are actually seeing direct prices from their point of view – if just one OTA in the metasearch results has a cheaper rate, you’re regarded as undercut.

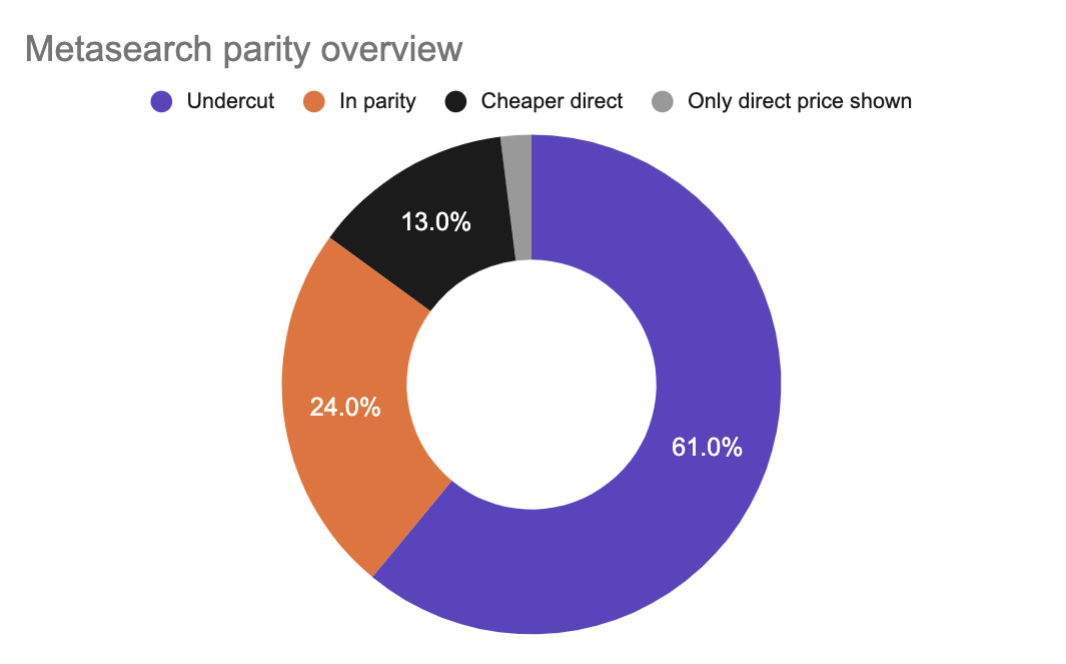

Pie chart showing on average how often metasearch visitors see direct prices as in parity, cheaper and undercut (January – May 2022).

On average, 61% of all direct prices that have appeared on metasearch since 1 January 2022 were undercut by at least one other OTA. 24% of impressions appeared in parity and just 13% appeared cheaper than all the other displayed rates. A small percentage (2%) reflects instances where the hotel’s direct price was the only displayed rate.

This means that for every ten customers who’ve used metasearch over the course of this year, around six saw the direct price as undercut by a better rate, two saw it in parity and just one saw it as cheaper direct.

Which regions are seeing the most undercutting on metasearch?

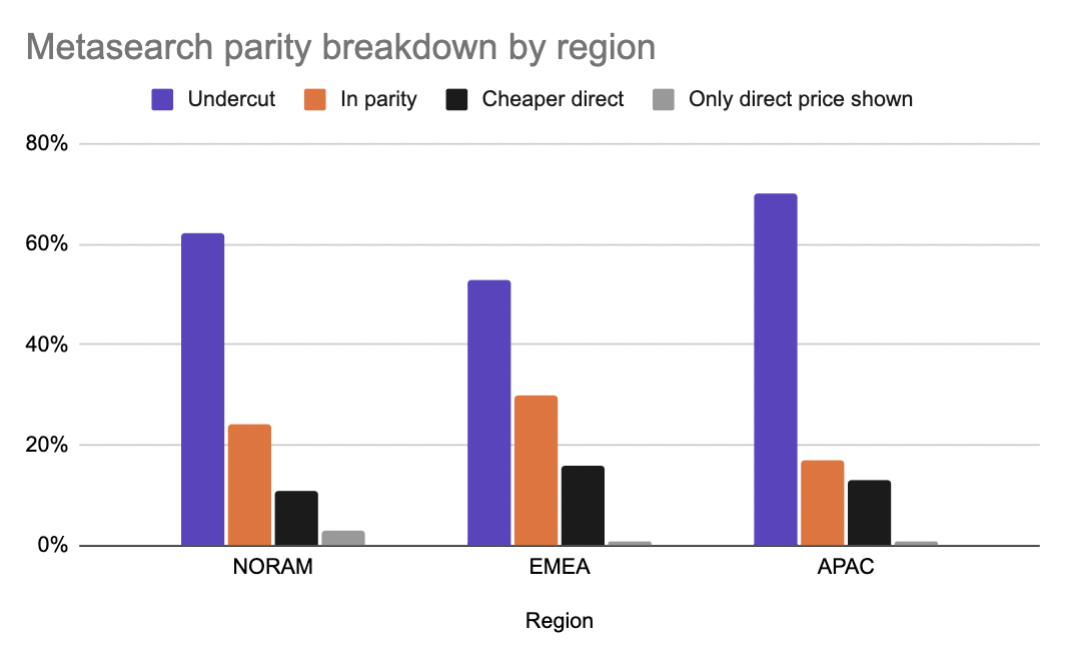

This is a general overview spanning properties across the globe. When we break the data down by hotel region, we can see which ones in particular have experienced the most aggressive OTA undercuts. In the graph below you’ll see the average number of times direct prices were seen as undercut, in parity and cheaper direct on metasearch for hotels located in the NORAM, EMEA and APAC regions.

Breakdown of metasearch parity by hotel region (January – May 2022).

The most aggressive OTA undercuts were for hotels located in the APAC (71%) and NORAM (62%) regions, with significantly fewer undercuts for hotels in EMEA (52%).

There’s a likely explanation for this. Travel has returned to normal fairly quickly in the USA while travel demand for countries across Asia is on the rise, so it’s without surprise that OTAs are readily adapting their rate strategies for these regions. By contrast, lagging restrictions in some European countries means that EMEA will likely be seen as less of a priority. That said, travel demand is rising globally and OTAs are fully prepared to seize the opportunity. Hoteliers should be ready to respond with full force if they want to drive more direct bookings.

Who are the worst undercutting OTAs on metasearch?

The data takes all OTAs participating on metasearch into account, even smaller rogue OTAs you may never have heard of. However, remember that not all of them carry equal weight when it comes to undercutting power. Our data shows that some of the most frequent OTA undercutters on metasearch are: