Uncertainty in the global economy has made budgeting and forecasting especially tough this year, leaving many hoteliers unsure what 2026 will bring. But a closer look at data from 2025 offers some valuable clues.

NB: This is an article from Duetto

Subscribe to our weekly newsletter and stay up to date

As part of our new strategic partnership, Duetto and Cloudbeds have teamed up to produce our first-ever Hotel Market Pulse report. This is part of our shared mission to empower hoteliers with advanced tools – and insightful data – for optimizing revenue and operational efficiency.

This analysis covers guest booking and hotel performance data from January 1 to July 31, 2025, comparing the results to the same period in 2024. We focus on two key areas: traveler booking behavior and hotel profitability.

Methodology

This analysis is based on aggregated, anonymized data from Cloudbeds and Duetto customers, covering approximately 20,500 independent lodging properties across 177 countries. The sample includes properties ranging from boutique hotels and bed & breakfasts to vacation rentals and small hotel chains, with representation across economy, midscale, upscale, and luxury segments. Data reflects actual reservations, revenue, and operational metrics reported through the Cloudbeds property management system and Duetto revenue management system during the specified period.

Traveler booking behavior

What key booking trends emerged this year? Analyzing data from tens of thousands of independent lodging businesses worldwide, the team found notable shifts in distribution channels, room rates, and length of stay (LOS).

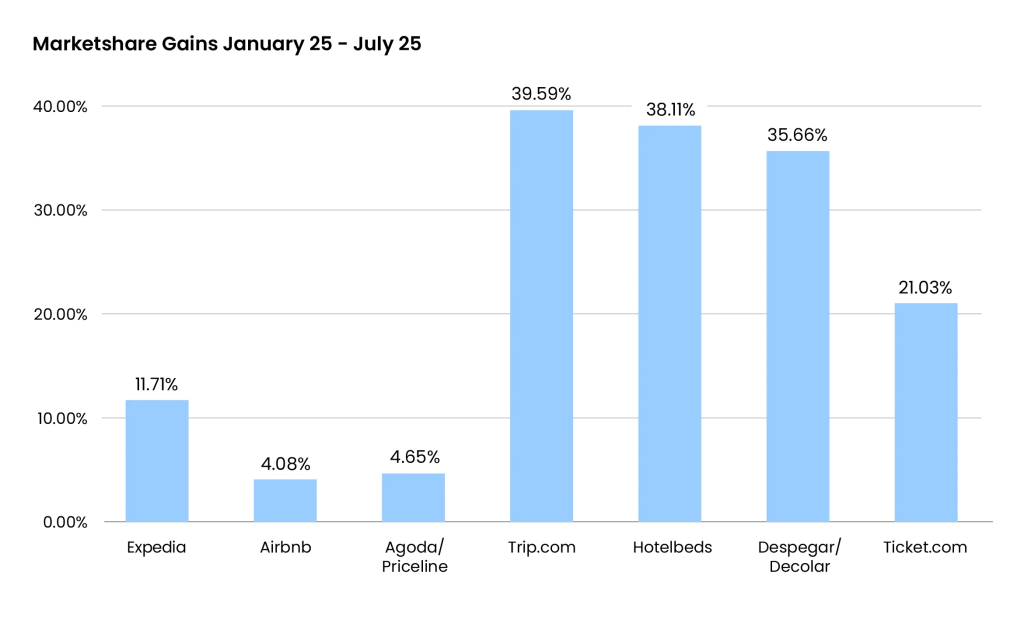

Marketshare Gains January 25 – July 25

Distribution: The race for bookings

Tracking distribution is a bit like watching a Formula 1 race, with some channels zooming ahead while others lag behind. This year, four players picked up significant momentum in the race for market share.

Expedia pulled ahead in room-night volume by almost 12% year over year (YoY), while Trip.com, Hotelbeds, and Despegar (Decolar in Brazil) each jumped by more than 35% year over year, based on booking data from properties in the Cloudbeds network. These gains came largely at the expense of longtime frontrunners like Booking.com, Agoda, and Vrbo.

The shift in the standings points to growth in three important markets:

- Asia Pacific. The surge from Trip.com, a powerhouse online travel agency (OTA) in the region, aligns with a rise in international arrivals in Asia Pacific (excluding mainland China) of 9% in the first half of 2025, according to CBRE’s Hotel Horizons report.

- Latin America. The momentum gained by Despegar, a leading OTA in Latin America, mirrors strong growth in international tourism in South America, which grew by 14% in Q2 2025, according to UN Tourism’s World Tourism Barometer.

- Wholesale business. The world’s leading bedbanks are growing fast. Hotelbeds’ parent company, HBX Group, reported double-digit growth in H2 this year, while rival WebBeds posted a 20% increase in bookings.

Direct bookings: A channel under pressure

The direct channel – which includes walk-ins, telephone, and website bookings – continues to hold its ground. According to Cloudbeds’ 2025 State of Independent Lodging Report, OTAs accounted for 61% of bookings for independent properties worldwide in 2024 – a small but telling increase from the previous year.

So far in 2025, the balance between direct and OTA bookings hasn’t dramatically shifted. Yet the ground beneath this balance is beginning to move. As travelers increasingly turn to AI-powered search platforms like ChatGPT, Google’s AI Overviews, and Perplexity for trip planning, hotels risk losing visibility where it matters most – at the start of the booking journey.