Designated as a “gatekeeper” by the EU, Google implemented the Digital Markets Act or DMA on 19 January 2024, a few weeks before the law came into force on 4 March 2024. Google Hotels had been growing consistently at an average of 14% in terms of both clicks and bookings to the direct channel, both in the EU and in the rest of the world.

NB: This is an article from mirai, one of our Expert Partners

Subscribe to our weekly newsletter and stay up to date

However, from 19 January onwards, the figures within the European Union slowed significantly and turned red up to -17%, resulting in a slightly higher than 30% diversion to markets outside the European Union. A major setback that leaves many questions unanswered. Where are the clicks and bookings going? Is Google Hotels losing metasearch share in Europe? Are other metasearch players such as trivago and Tripadvisor taking advantage of it? Are the OTAs the ultimate winners?

Google Hotels’ share of total direct bookings down 17% in the EU

Metasearch has long established itself as a reliable source of traffic and bookings for hotels through its direct channel. Its contribution peaked at 24% of total bookings during the pandemic in 2021. With the new normal and various changes in the digital ecosystem, metasearch had lost some of its share but stabilized in the 14% to 16% range.

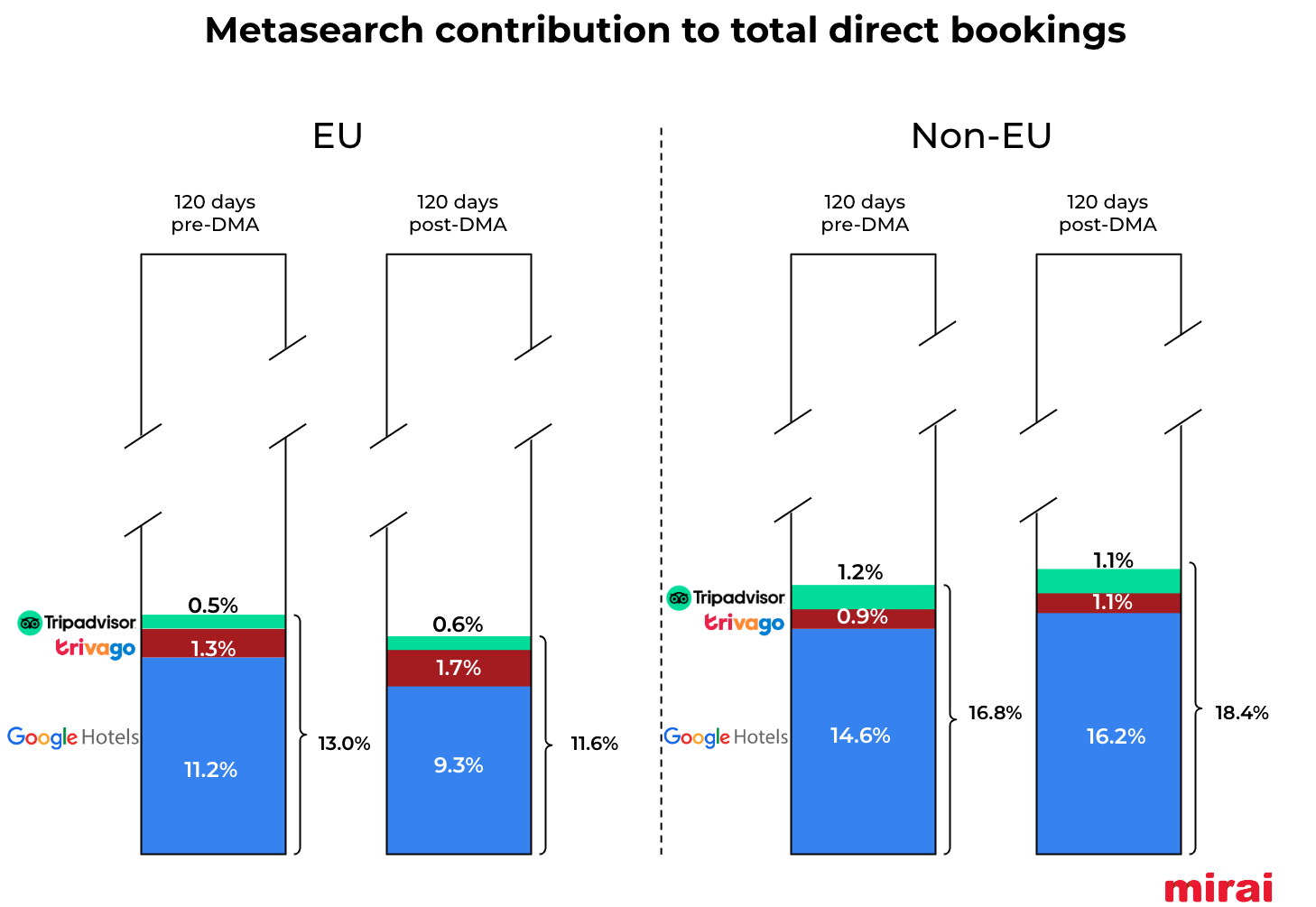

We compared the number of metasearch bookings 120 days before and 120 days after Google implemented the DMA on 19 January to see if there was a change. There was indeed a big one, with completely different trends in DMA and non-DMA markets.

- EU (DMA markets): While Google Hotels lost 17% of its share, trivago and Tripadvisor gained 36% and 6% respectively. Despite the growth of the latter two, metasearch as a whole lost 11% of its market share and now accounts for 11.3% of total direct hotel bookings in the EU.

- Non-EU (non-DMA markets): Google Hotels and trivago gained 14% and 11% share respectively. In contrast, Tripadvisor lost 13%. The overall metasearch share increased to 18.4%.

25% of EU bookings lost by Google were regained by trivago and Tripadvisor

In our study, trivago and Tripadvisor together gained 0.5% of bookings, while Google lost 2%. This leaves a net loss of 1.5%.

trivago’s bold growth of 36% and Tripadvisor’s positive 6% helped hotels mitigate the impact of the DMA in Google by winning back 0.5%, or 25% of the lost bookings. For those hotels not present on these metasearch platforms, it’s a good time to reconsider, especially now that both companies support a commission-based program (learn more about the trivago net CPA model and Tripadvisor CPA).