During the pandemic, many hotels have seen their direct sales grow exponentially within their channel mix.

NB: This is an article from mirai, one of our Expert Partners

Meanwhile, on the sly, Booking.com has also managed to increase its share with almost no resistance. Given the current situation, where many channels are still not appearing and we don’t know if they will be activated this season, Booking.com has become the basket where most of your distribution eggs are stored.

Subscribe to our weekly newsletter and stay up to date

This past year Booking.com has worked hard to take that significant share, and many hoteliers have probably helped them with this, more or less knowingly. How is Booking.com doing this? In this post we analyze some of the practices implemented by the OTA and how you can compete with them.

Online Payment or how Booking.com follows in Expedia’s footsteps

If there has been a hot topic among hoteliers over the last five years, it has undoubtedly revolved around Booking.com’s famous virtual cards and their online payment.

Seen as a “non-refundable” charging model, taking advantage of the wish of cash and easing the process to charge customers whose cards were not accepted by the hotel, many hoteliers decided to activate Booking.com’s Online payment model at the cost of a relevant (and additional) chunk of commission. A brilliant idea until the pandemic “allowed” Booking.com to unilaterally relax its customers’ non-refundable bookings and all that cash flew away. A warning of what could happen in the future.

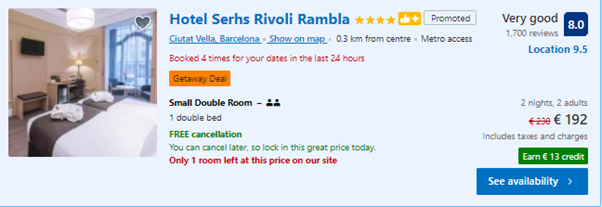

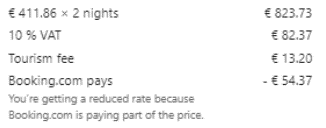

In another turn of the screw, hotels can use Booking.com’s Online Payment to receive prepayment on their bookings (refundable or non-refundable) and generate some cash. Music to our ears? In reality, what this means is that Booking.com is moving to the merchant model, charging the booking themselves, and gaining the capacity to undercut prices , playing the old game of net vs. final prices. In other words, if you play with Booking.com’s Online Payment model, they will play with their margin to offer more attractive rates than your direct channel.:

If you thought Booking.com Basic was already messing up your OTA pricing, you can now add a second programme that moves a little further away from Booking.com’s traditional agency model. In your battle to control your prices against Expedia, Hotelbeds and other bed banks, you are opening the door to the most dangerous opponent. Are you sure this is the right move?

Preferred Plus: Higher, stronger and much more expensive

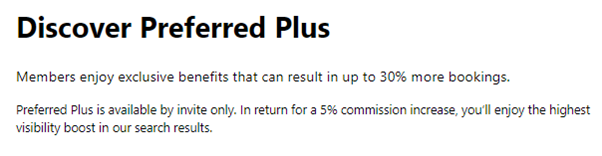

Another new feature the pandemic brought is the option (only available to a select group of hotels, according to Booking.com) to join their brand new Preferred Plus programme.

This is not the first time that Booking.com has sold us one of its programmes as exclusive and limited, as Genius was born in a similar vein of only being available to the best customers. Today that exclusivity is gone and nowadays you don’t even need to be registered to see Genius prices (not only on their website, but also on those of third parties).

Although it sounds very appealing, it is not after taking a closer look at what this Preferred program is all about that one can realize that not all that glitters is gold:

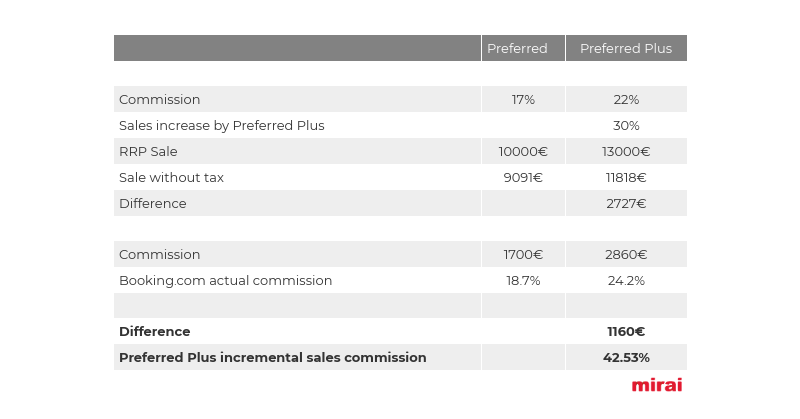

- For an extra 5% commission (on the RRP including taxes) Booking.com promises a 74% increase in visibility over Preferred and up to 30% more bookings. Curious to see how, indirectly, Booking.com says the traffic you will get is of low quality (+74% in traffic versus +30% in bookings).

- The OTA does not explain how the hotel’s visibility is affected and how you are going to achieve it. Currently, in any destination search, hotels that are not “preferred”appear above the hotels participating in both versions of the programme.

- In addition to the 22% commission, Booking.com will offer credit to customers who book at your hotel to later book any other hotel in the OTA. A perfect plan … for Booking.com not for you. By joining Booking.com’s Preferred Plus programme you are increasing Booking.com’s margin and, with it, its ability to undercut your direct channel. This move is potentially very dangerous as Booking.com will move your loyal customers away from your direct channel and as the OTA can offer better prices than you.

- At no point will Booking.com break down which bookings have been generated by this increased visibility, and the increase of the commission will be applied to all your Booking.com sales. That means you have no way of measuring whether the increase in costs pays off. But even believing Booking.com’s hypotheses, numbers don’t add up. Would you pay 42.53% commission on this additional sales? That is exactly what you would be doing when joining the Preferred Plus program.

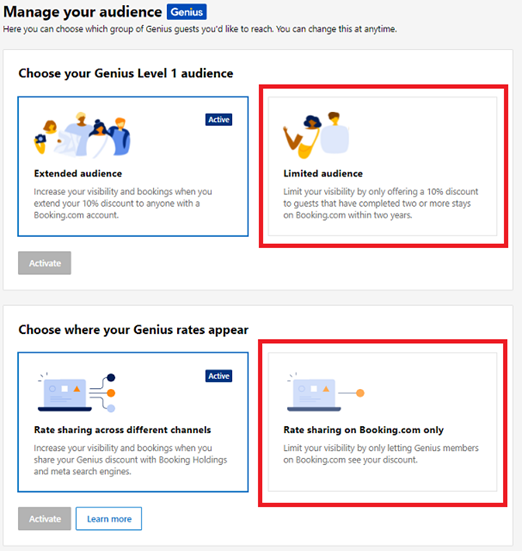

Genius rate sharing: the globalization of your “opaque” prices

Most hotels have already been notified in the last few days that their Genius rates (increasingly less opaque) will also be available on the booking engines of their partners and affiliates (agencies, other OTAs, airlines, etc.).

The news comes after expanding its special pricing program to all those who have an account with Booking.com. According to the latest news, your prices will now be available by default on the following channels:

- Booking Holdings Group (Priceline, Agoda, etc.)

- com partners, such as corporate search engines

- Meta search engines such as Google, Kayak and Trivago

In other words, if you don’t take action, your hotel’s Genius rate will now be available throughout Booking’s network of affiliates and partners (as is the case with some OTAs).

A real life example: A customer books your hotel on getaroom.com with a discounted Genius rate and the booking comes to you through Booking.com, with instructions for Online Payment.

We lose all price traceability of Booking.com and it becomes just another middleman (and like all of them, hard to control).

Remember, Genius has 3 levels and applies discounts between 10% and 20%. Now these rates are “out there”. What a smart and machiavellian change of concept compared to the original idea behind Booking.com genius.

Changes to the general contract

Undoubtedly one of the changes that went unnoticed by many hotels and which clearly shows how Booking.com operates in times of crisis.

At the end of 2020 Booking.com sent its customers a change to the general terms and conditions (also unilaterally) where it focused particularly on the clauses relating to parity with the direct channel. This is nothing new, but it is worth highlighting 3 points:

- They do not apply to prices distributed to other OTAs. Booking.com knows that direct sales is its rival, and this is where it wants to keep hotels on a leash.

- It warns that they will lower the RRP on Booking.com online payment bookings as an “incentive” and will bear the cost themselves.

- All parity clauses do not apply to hotels located in wide parity or non-parity There’s still hope for the future.

During the pandemic Booking.com has had few rivals when it comes to selling hotels, the only ones that have come close (and even surpassed them in some cases) have been the hotel’s direct sales (either online, via email or telephone). The new clauses pave the way to protect its new intermediary model (redistributing rates across its network and with an agency payment model).

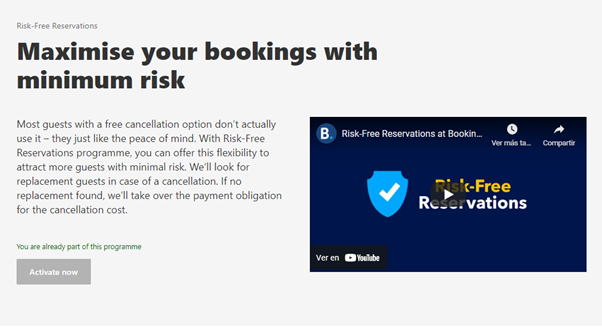

Risk-free reservation: for Booking.com, of course

It is common practice for Booking.com to use any argument, no matter how ridiculous, in its best interest. If there is one point that most hotels are in complete agreement about Booking.com, it is the high number of cancellations for the flexible rate. Add this to the uncertainty of the different markets during the pandemic, the price swings and the current conditions for trying to keep up with surges in customer demand and standstill, and you have a staggering volume of cancellations.

It is in this context that Booking.com has decided to revive the Risk-Free Reservations (or hold my drink) programme. Back in 2018 we explained this programme in detail, which has been lurking for some time. What is new is that Booking has decided to unilaterally activate the program for many hotels.

There is the option to deactivate this programme (and other interesting options that we suggest you consider) in the Booking.com extranet if your hotel has been automatically activated and you were not aware of it.

The premise seems interesting as it aims to ensure that Booking.com bookings are paid for, due to the high cancellation rate (although the programme states that customers hardly ever use it). But the hotels concerned had already published non-refundable rates that protect their revenue.

What does this programme really represent?

- Booking.com unilaterally decides what to do with your prices and conditions of sale (dumping and policy relaxation).

- Potentially, a large proportion of the sales you are going to generate on Booking will be taken away from your own website (current demand is unfortunately limited, once the customer already knows which hotel they want to go to it becomes a fight between channels and you will be giving the sword to Booking while you are left with a fork for battle).

- A majority of your Booking’s sales will come in as flexible at the expense of your price parity.

- If a room is no longer available, Booking.com will be exempted from paying the total amount of the booking.

- Your website will be at a disadvantage compared to Booking.com (not only in prices but also in cancellation policy) and the hard work done during these months could be ruined in a short space of time.

See if there is something you can do on your own website that will help you boost sales without impacting your pricing and help you keep control of your inventory.

Booking.com customer loyalty: ultimate goal

Booking.com has long been promoting various actions to build loyalty among its (your) customers. In this post we are only looking at a small fraction of them. Strangely enough, this club is financed by the hoteliers, giving Booking.com a competitive advantage instead of investing in their own loyalty programs that would would help strengthen the relationship of your customers with your hotel.

Some examples we have seen recently:

- Credit for future bookings:

- Promocodes with discounts

- Or free taxis

It is of course legitimate for any platform to try to build customer loyalty in order to retain customers in the future. We’ve always said that it is much more effective to manage and draw from existing demand than to generate new demand. But many hoteliers do not see the benefit of investing in their own programmes or attractive customer benefits on their website while subsidizing those of third parties.

Booking.com knows the importance of customer loyalty (which it will always protect above hotels), but it also knows that it needs the hotels to increase its sales. So, we have also seen various actions that aim to incentivize hoteliers to sell (even) more on Booking.com:

Savings on commissions for each registration you refer to Booking.com (you make their sales and recruiting work easier for €200).

Discounts on commission during the summer (which, remember, has already gone up if you have accepted their Preferred Plus programme). What does this mean? Booking.com will pay you a volume discount if you exceed a sales target. This discount is 30% commission on the difference between the total sales and the sales target for those months (interesting that Preferred Plus is applied to the total and not to the difference in sales increase as a result of the programme).

A discount on the commission sounds good, but there are two requirements to join the programme:

- 10% mobile discount

- Active Flexible Rate

Booking Holdings, in their Q4 2020 results published that two thirds of all room nights were booked on a mobile device (especially on the app). So, we can assume that on average 66% of sales could be with a mobile discount. In other words, our mobile rate has become the BAR and the price at which everyone can access, and we have already reduced it by 10%.

If you meet your target by selling more through the mobile channel at a lower price you will have needed more stays and your ADR will be affected and therefore your revenue. The question, therefore, is not how much can I save on my bill by joining the programme, but how much more will it cost me to belong to it.

If you compare what you may be losing in terms of revenue from your direct sales and realize that the advantages always seem to benefit them, you will realize that the only one that these programmes really pay off for is Booking.com.

Some easy solutions

We’ve recently explained some actions to maintain or grow your direct sales after the pandemic, many of them can be applied to what we are discussing today. Only you can regulate your relationship with Booking.com and determine how much they will control your prices. Remember, as you grow your direct sales share (whether online or through other channels), you gain independence and control over your inventory, as well as increasing your hotel’s revenue. Our different levelled recommendations (we recognise the “fear” of taking these steps):

- Desired: Use Booking.com exclusively on its “Pay at hotel” model and dispense with the Genius or Preferred programme. Your website should always have the best possible sales conditions (mobile discount, differential, etc.), a good loyalty club and exclusive values.

- Favourable: Deactivate the Online Payment option and prevent Booking.com from dumping your RRP. Limit distributing your prices through third parties (you can limit this option within the extranet in the Genius “Choose your customers” section). If you keep the Genius programme, you can build loyalty among your direct customers with a bigger discount. Decide whether the incentive actions offered by Booking compensate you at the cost of your direct sales.

- Minimun: Any action you take with Booking.com must at least be replicated on your website.

Conclusion

We’re living in a time of uncertainty never seen before in the sector, as well as a change in the paradigm of online shopping in the wake of the pandemic, and Booking.com knows it.

Fighting for its own survival and growth in hotel distribution, it has not hesitated to pull out its heaviest artillery and take advantage of the hotelier’s need at a moment of great crisis. This has meant a significant increase of the channel in the hotel channel mix, where in most cases, it is the undisputed number one, giving it more power and freedom to impose its own conditions on hotels.

It is understandable to pull out all the stops in order to overcome the current crisis and try to generate as many sales as possible. But you also have to keep a cool head and crunch the numbers, because small actions with a lower investment cost in the direct channel can lead to a higher return. There are interesting tools on Booking.com that you can try, but you can also deactivate them if the numbers simply don’t add up. Adjust the relationship with Booking.com according to your needs without letting it drive your hotel’s sales and taking actions on your behalf that you can do yourself at a lower cost.