For many hotels, the line between “distribution” and “marketing” has always been quite blurry.

NB: This is an article from mirai, one of our Expert Partners

Mistakenly or not, commissions paid to OTAs have traditionally been considered a “distribution” cost, whereas it’s arguable that a big chunk of that is “marketing”. Curiously, “marketing” actions have traditionally been a separate line in the P&L named “marketing fees/investment” and have rarely been identified as “distribution” costs, when they might have.

Subscribe to our weekly newsletter and stay up to date

Revenue models of OTAs and marketing platforms haven’t helped much either. On the one hand, OTAs work with commission models, a concept that is deeply rooted in the hoteliers’ DNA as a “distribution” cost. On the other hand, marketing platforms such as Google mainly work on CPC (cost per click) or CPM (cost per 1,000 impressions) models that are paid upfront. For hotels, that is either a cost or an investment, but rarely a distribution cost.

A few years ago, Expedia launched the TravelAds program aiming to give hotels a “marketing tool” within a “distribution platform”. Booking.com now follows suit, with differences though, and introduces native ads, a “marketing” program on top of their “distribution” platform.

What are Booking.com native ads?

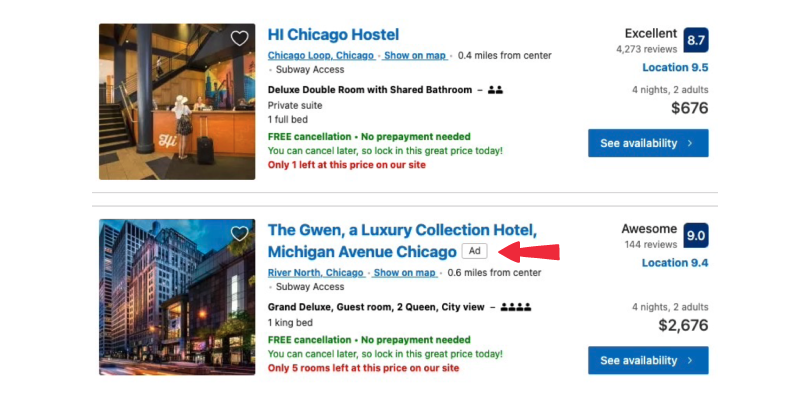

A program that allows hotels to bid in a CPC model to boost their visibility in destination searches. The winner of that bid gets direct access to the second position in the results first page (not subsequent pages). The entry will have an [ Ad ] label, different from the [ Promoted ] one used when hotels participate in booster programs.

As opposed to Expedia TravelAds where hotels can choose whether to link to their website (link off) or to stay in Expedia (link on), users in native ads will, so far, stay in Booking.com. There is no option to link to the hotels’ website in these ads.

Why is Booking.com launching native ads?

A few reasons:

- The main goal is to tap into the growing marketing budget of hotels. This budget had mostly been spent in Google, but other placements such as Facebook/Instagram have started to quickly gain share. Expedia was the first to compete for a share of this big pie, and now Booking.com is following In the eyes of OTAs, it’s mostly incremental revenue for them (something yet to be proved).

- To increase incoming revenue from commissions since hotels in native ads will probably have higher ADRs than those ranked organically. Therefore, Booking.com will not only get the revenue of the CPC but they will also get a higher commission from each reservation. The challenge for Booking.com is to make this native ad as compelling as the original (organically) second position in the results.

- Keep improving their marketplace by offering hotels more options to increase their revenue and return on Booking.com “investments”. Not evolving its platform and business would make the OTA quickly fall behind.

- As Google and other travel big players such as Tripadvisor (with Plus and Sponsored Placements) are increasing competition with OTAs, native ads allow Booking.com to fight back and enter in the marketing placements’ business. The best defense is a good attack.

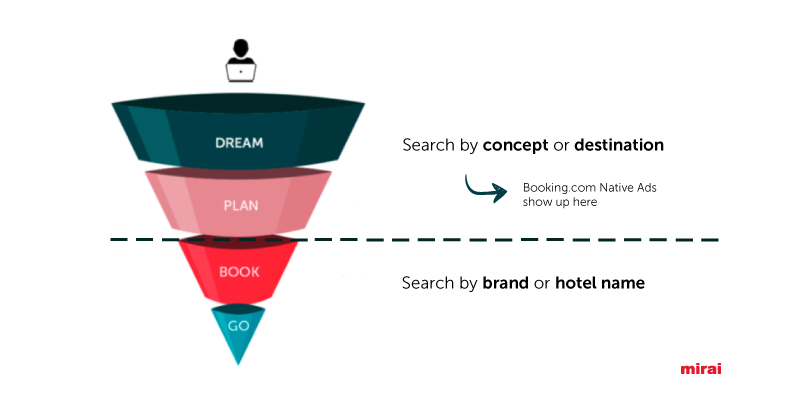

Where in the funnel do native ads play a role?

This is probably the most interesting part, as native ads are mostly intended for destination searches (“hotels in boston”) and not branded searches (“hotel four seasons boston”). So these ads play a role higher in the funnel, where incrementality takes place. OTAs have traditionally claimed it is more efficient for hotels to capture visibility high in the funnel within OTAs than in Google Ads.

Native ads want to play a “share shift” game and not a “channel shift” one. From a hotelier perspective, incremental revenue, even through OTAs, is very attractive and 100% compatible with their direct channel strategies.

How much do native ads cost? What multipliers does it offer?

Participating hotels set a “base bid” ($0.50 minimum, twice as much as the current minimum bid in Expedia Travel Ads and 5x more than when Expedia first launched Travel Ads) based on a travel window (weekdays or weekends 0-21 days or 22 days and beyond). Hotels have the option to set a maximum daily spend starting at $5/daily.

Hotels have the option to apply multipliers or boosters on 3day+ or 6day+ lengths of stay (LoS), mobile device, check-in date for the next 0-48 hours, and type of booking (business, international or group). The minimum incremental bid for the boosters is $0.25. So far, there is no booster for specific markets or audiences (online users with same interests or intents).

Important to note that participating hotels cannot adjust their bids for Booking Genius users. In our view, this modifier is a must-have for the program as the revenue for that sale is significantly lower than an average booking.

How can I sign up for Native Ads?

The program is still in a test phase and closed to a limited number of hotels.

How does the bid to win native ads’ only placement work?

How this algorithm works is still undisclosed by Booking.com, but we may guess that the bid will have an important impact. However, the OTA has a lot to lose if it only considers the bid. The second position in the results is gold in terms of monetization. Hotels that don’t convert or don’t generate a high revenue-per-click (low review rating, low conversion rate, and so forth.) will never be attractive for Booking.com, even if they pay a lot to be there.

One of the trickiest parts of native ads is that, so far, there is only one placement for all participants. It’s true that there are many searches happening daily on Booking.com, but only one placement seems not enough. Therefore, we can expect high inflation to win the bid especially in top destinations where many hotels would compete. In contrast, Expedia TravelAds are shown in many more positions (first 1-5, some in the middle 11-12 and the last 2 of each page). It’s clear they have the program much more refined after more than a decade of research testing different placements and page layouts.

How do native ads co-exist with the Preferred program, commission boosters and organic search?

Native ads placement has the second position reserved, so hotels participating (and winning the bid) would bypass all other hotels (except the first position) even if these hotels participate in the Preferred program or are applying commission boosters. In that way, it’s kind of a “fast pass” solution to be at the very top. It is yet to be seen what average CPCs are necessary to get good visibility. How expensive can it become? Time will tell, but the right approach should be from a profitability point of view and not a mere cost perspective.

When a participating hotel wins the bid and is already organically positioned first or second in the results, the ad is not shown (not even replaced with another hotel). By doing so, Booking.com gives some area of comfort by not cannibalising organic search with paid search. This is a big difference compared to Expedia where the ad is still shown and cannibalisation takes place. This is a smart differentiation strategy by Booking.com, as native ads will be attractive in secondary destinations where there are not that many hotels. Expedia TravelAds struggles to gain adoption grow in these destinations as it’s less clear if the bookings from the ads are incremental.

Can the “add creativity” be customized?

Ad copy is not customizable at this point. We’d expect some customization, unique callouts or other features in future versions of the program.

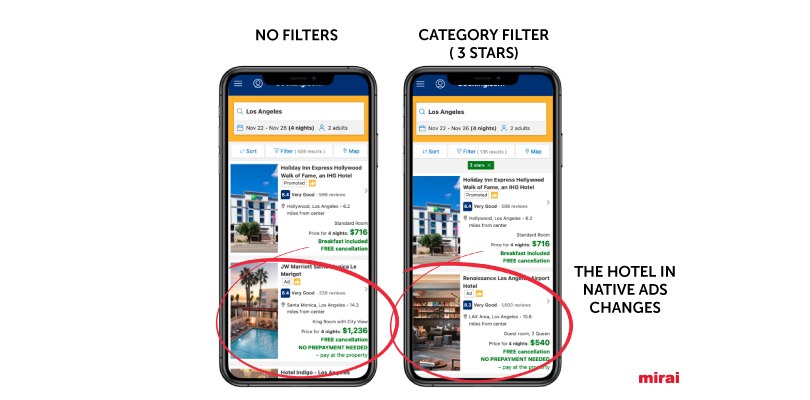

Do native ads change when filtering results? And sorting?

When a user filters the results, the ranking is not affected. What happens is some entries are removed from the results. In our tests, when the hotel in the native ads position “survives” the filtering, it stays visible. When the filter omits the hotel, Booking.com shows a different hotel, unless no participant in the bid meets the filtering criteria.

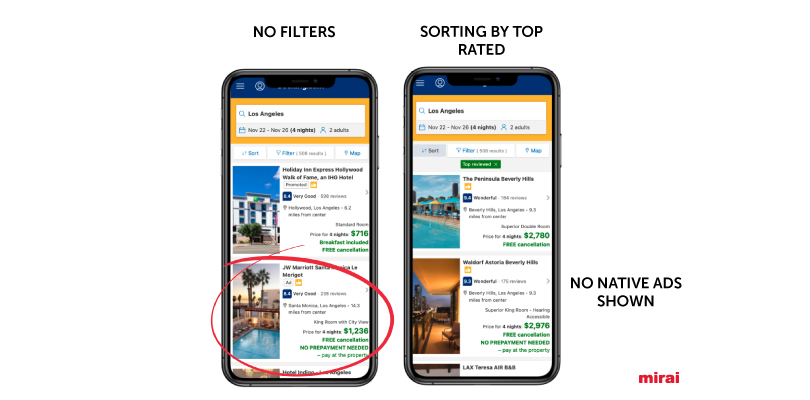

When the user sorts the results by any criteria, what happens is that the Native Ad vanishes. It makes sense as any ad that does not meet the sorting criteria would be a bad experience for the user.

Are Booking.com Native ads available worldwide?

So far, Booking.com is testing native ads in the US as a point of supply (where the hotels are located) and as a point of sale (where the client is located). In other words, only Americans booking US hotels. It is expected that, if the results are what Booking.com is expecting, we might see the program expand to more countries but the timeline is unclear.

What are the pros and cons for hotels?

With all these facts on the table, and waiting to have our own data and conclusions, we anticipate the following pros and cons for hotels:

Pros

- More sales. Incremental demand is always attractive to increase occupancy in low-demand periods or to increase ADR in high-demand ones.

- Potentially higher ADR as a strong boost in visibility allowing hotels to increase ADR. It’s proven that when a hotel is in position #2 in the ranking, the volume of bookings it gets is very high and price is not such a sensible variable as in other placements. However, if hotels use native ads exclusively to promote hotel offers over low-demand dates, ADR will naturally be lower

- More transparency and tracking. One of the biggest problems of OTAs is the lack of transparency as they charge the same commission for all bookings no matter where in the funnel the OTA played a role. This is frustrating as hotels want to pay more to get more sales and not to overpay for existing customers. Native ads provide this needed transparency as hotels pay for what they get, and can track exactly what was generated, like in Google Ads or metasearch.

- More control and granularity (not much yet). With the available multipliers, hotels can shift demand to dates they have an interest in promoting.

- A “fairer” model as hotels only pay for the visibility that will eventually yield incremental sales, as opposed to commission boosters where hotels pay the same for all bookings (new and existing).

- More “efficiency” as hotels pay in a “second price auction” format, where the actual bid is one cent above the second bidder. Especially when you compare it with commission boosters where hotels always pay the set commission, no matter what your competitors do.

Cons

- As Native ads are a “share shifter”, hotels could lose demand if they decide not to participate. So it’s a kind of double-edged sword.

- Higher costs. Despite being incremental, sales will be more expensive and bear a double (or triple) cost: commission + CPC + booster if it applies.

- Higher risk. CPC models are riskier than commission boosters as hotels pay regardless of the sales they generate or whether bookings are cancelled or actualized.

- Future toll for everyone? What will happen if all hotels in a given destination participate in native ads? Wouldn’t it be the same demand than before but with a higher cost for all? Wouldn’t Booking.com be the only winner? Doesn’t it sound familiar with what happened with Booking Genius? Now lots of hotels in many destinations are Genius so, where did the incrementality go? The only real winner was Booking.com. It might be different in Native ads, as more sophistication is needed so we could argue that not all hotels will participate in the program.

- More intermediation. Sales generated by Native ads are still intermediated. It may be a good way to acquire new travelers, but hotels should do their best to convert those customers to direct for future bookings. Hotels need to be aware that if they lean too heavily on OTA’s visibility campaigns, without a real plan to move all that traffic direct, they are going nowhere.

- Native ads only occupy one position (the second) in the results page, so we expect very strong competition to win the bidding, especially in popular destinations. A single placement (position) does not seem enough to consider only using native ads to promote your listing. Instead, as long as there is only one placement, tactics like commission boosts could be used alongside Native ads.

How do you reconcile marketing on OTAs with boosting your direct sales?

At Mirai, we have always challenged the “value proposition” of OTAs. So why do we think Native ads are compatible with a good direct sale strategy? Here is our reasoning:

- There is no doubt that OTAs add value when they act as “gatekeepers,” helping users decide where to go and what hotel to choose. This gatekeeper role plays out high in the funnel where users are still visiting dozens of websites (Google, Tripadvisor, blogs) and apps (Instagram, Facebook, Pinterest). It is still a “share shift” game and not a “channel shift” one. For hotels, it is extremely difficult and very expensive to have an impact in this part of the funnel, unless you are Hilton or Marriott (and even they struggle). However, there are some initiatives you can do (and should try) such as “generic ads” (not branded) or Google Property Promotion Ads, but the impact is limited. Booking.com Native ads play a role in this part of the funnel, so it is compatible with your direct sales strategy, and even complementary as long as you work hard to convert new users into repeat and loyal customers.

- The “dark side” of OTAs, and where they add no value whatsoever, is down the funnel where they compete head-to-head with the direct channel. Down the funnel the game turns into a “channel shift” where there is little to no incrementality. We see some hotels bid on “branded ads” (we estimated back in 2016 they represented 15% of their total sales), metasearch and even organic listing in Google. Why should hotels pay those generous commissions to OTAs when the user was already searching for a specific hotel? The only answer is that they are forced to, as OTAs have refused to step back from these placements, sending an alarming message to the industry that their real value proposition to hotels is not as great as they claim.

Conclusions

As we see it, Native ads are a brave and smart move by Booking.com to give more options for hoteliers to choose from. Additionally, it is the first time we have seen Booking.com move in the direction of providing a more transparent and fairer marketplace where hotels pay more for incremental demand and less for existing demand. It’s certainly not enough as the program should evolve with more placements and modifiers, but it is at least a first step and differentiates them from their competitors.

For hotels, first movers will be the ones that will benefit the most (less competition). Savvy hotels will be better positioned, as always, to benefit as they have the required know-how to choose between commission boosters and Native ads depending on their needs. But as with all innovation and new programs, the first obligation of hotels is to understand what’s new. So our recommendation is to give it a try. Once you have real data, it’s your job to analyse it and make your own decisions based on how it fits within your broader distribution strategy. By data, we mean the calculation of how much more commission you are paying for those bookings. Is it an additional 3%? 5%? 15%? Or even 25%? Would you pay 50% to acquire a new customer who otherwise would have never stayed at your hotel? Each hotel has to find its red line.

Finally, we have two crucial remarks about Booking.com:

- Booking.com’s biggest opportunity, but a challenge at the same time, is to prove that the generated revenue is truly incremental. If the OTA does not send a bold message and tracking tools to show that it is incremental, hotels might turn their backs on native ads.

- Its biggest risk is to avoid cannibalising existing visibility programs (preferred and commission boosters) by giving hotels a more transparent and fairer tool with incremental revenue-generation capacity. Doing so would kill the program, unless the OTA finds the win-win scenario where Booking.com gets more revenue and hotels capture more sales. Given the current conditions of the program, we think this window is too slim to happen.