Direct bookings have become essential to any independent hotel’s distribution mix.

NB: This is an article from Cloudbeds, one of our Expert Partners

A direct booking strategy is a powerful force in reducing customer acquisition costs, increasing occupancy, and improving profitability by building greater brand loyalty and giving you direct access to guests.

Subscribe to our weekly newsletter and stay up to date

Still, it’s important to note that all bookings are innately good. Often when we discuss the importance of direct bookings, it sounds as if we’re arguing that somehow third-party bookings are bad when they’re not. Different types of bookings will bring you varying amounts of revenue and profit. While OTAs take a percentage of your nightly rate, it’s still revenue you may not have obtained elsewhere.

Before jumping into concrete tactics for capturing more direct sales, let’s review trends and the most common booking channels, including metasearch engines, online travel agencies, and a property’s website. This brief review will give you the foundation to understand the place of direct sales within your distribution strategy.

Direct booking trends

How has the direct booking landscape evolved over the past few years?

In Cloudbeds’ 2023 State of Independent Lodging Report, we looked at data, surveys, and trends collected from thousands of independent properties to answer this question and more.

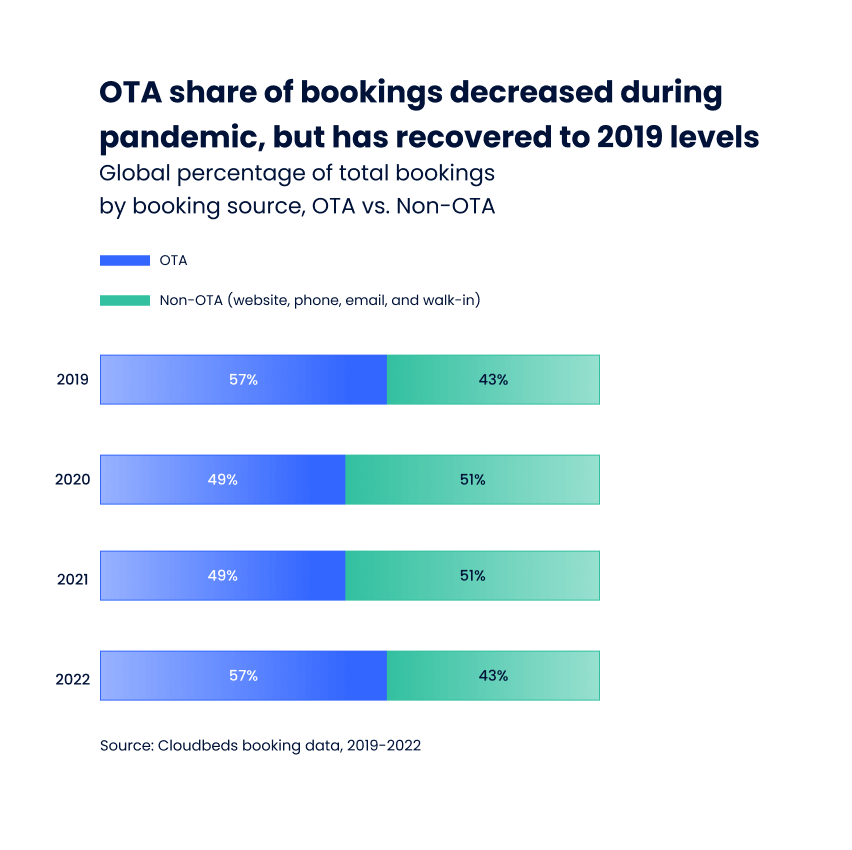

Within our global dataset, we found that in 2019 OTA-sourced bookings made up 57% of all reservations, while non-OTA bookings (website, phone, email, and walk-in) made up 43%. During the pandemic, there was a significant shift towards direct bookings, and in 2022 the balance shifted back in favor of OTAs.

It’s interesting to note that when we broke down booking sources by region, we saw that North America had a significantly higher direct booking rate at 56% — with 32% of all bookings being made through a property’s website (the rest of the world had 12% of bookings made through a property’s website).

This data shows the fluctuation between different channels and the importance of a well-balanced distribution strategy.

Top booking channels

Part of creating a winning distribution strategy is meeting your customers in real-time. Three of the largest booking sources for lodging businesses are online travel agencies, metasearch engines, and your direct website. Each booking source has advantages and challenges, so it’s helpful to know the differences when deciding on your channel mix. Developing a robust mix to fit your hotel business’s needs is crucial to increase direct bookings.

Online travel agencies (OTAs)

41% of travelers prefer to use online travel agents, like Expedia, Airbnb, and Booking.com. The majority of OTA bookings come with a commission fee. This means that guests create their reservations and process payments via the OTA website, and the OTAs keep a negotiated commission per booking before distributing the remaining payment amount to the property. Commission fees for some channels can be as high as 30% per booking, so it’s crucial not solely to rely on OTAs for reservations. Most properties use a channel manager to share their inventory to keep all their channels, rates, and rooms in one place.

Benefits:

- Brand power to attract travelers worldwide across target markets and demographics

- Access to niche markets via region-specific OTAs, like Ctrip, or property-specific ones, like Mr & Mrs Smith

- Visibility to travelers that may not have been aware of your property before searching (also known as the billboard effect, where consumers visit an OTA for research and eventually book direct)

- Marketing incentives or special offers and inventory allotments give you control over the share of OTA sales in your distribution mix

Challenges:

- High commission fees for the more popular OTAs and rising commissions every year

- Access to very little information about guests who book your hotel on an OTA

- Less control over the guest experience as their first point of contact is with the OTA and providers own guest data

- Need to track and maintain rate parity between OTAs and direct channels

Metasearch engines

Metasearch sites like Kayak, TripAdvisor, and Trivago allow consumers to compare prices across OTAs and a property’s website. Hotels can bid on metasearch advertising placements and pay when consumers click on the ad. Metasearch differs from OTAs in that you can direct travelers back to your website to drive direct bookings, and it works on a non-commission model; instead, you pay a cost per click (CPC). You can set a budget for how much you want to bid for each click and adjust bids to optimize your overall strategy.