We have been tracking booking trends throughout the summer season to monitor the impact of COVID-19 on hospitality. While progress across the United States can vary drastically from one market to another, we see signs of overall improvement.

NB: This is an article from TravelClick

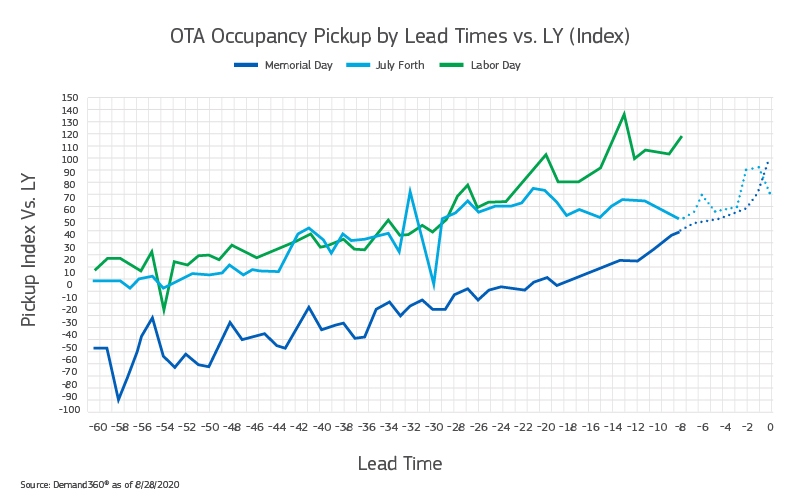

The data in our Demand360® business intelligence solution as of August 21st shows the forward-looking booked occupancy for Labor Day achieved 135% of the forward-looking booked occupancy at the same time last year (i.e. 14 days before arrival). Updated data as of August 28th demonstrates the continued strength of bookings compared to the same time last year as we move closer to Labor Day weekend.

Looking back, forward-looking bookings for Memorial Day did not come close to last year’s demand until the last few days leading up to the holiday as travelers made last-minute decisions to book accommodations. July 4th showed promise until a surge in COVID-19 cases tempered demand.

The trends we are currently seeing for Labor Day reflect a positive pattern of improved demand compared to the earlier summer holidays of Memorial Day and July 4th. We anticipate this is a reflection of growing traveler confidence.

Labor Day Market Insight

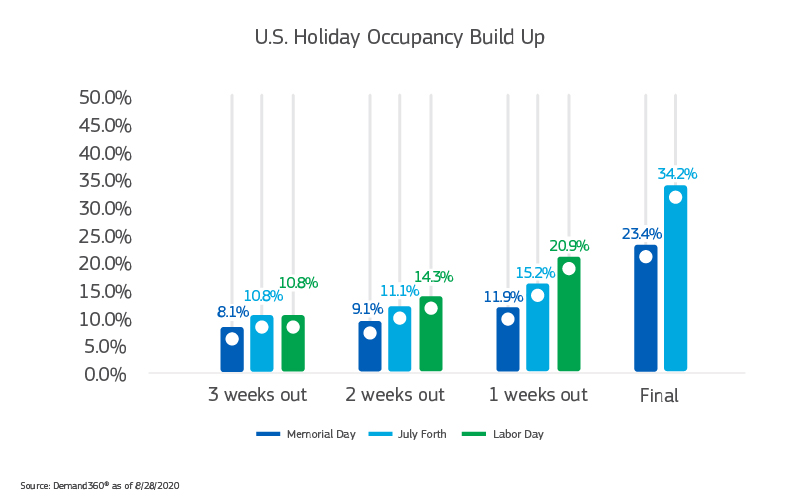

The increased lead time demonstrated in the graph above is a strong indicator of increased occupancies for Labor Day compared to the prior two summer holidays during COVID-19. When looking at occupancy over the three weeks leading up to the summer holidays in the chart below, we see continued improvement week over week and from one holiday to the next.

Subscribe to our weekly newsletter and stay up to date

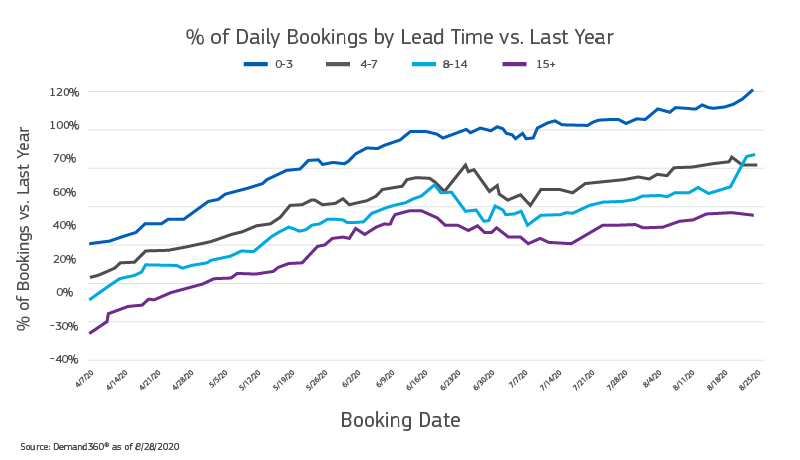

Though we are seeing growth in the overall booking lead time window, we find that the majority of bookings are still made 0-3 days prior to arrival, with 109% more bookings coming in that period than the same time last year. Given this consistent trend, we anticipate that there will likely be a large increase in occupancy this week.

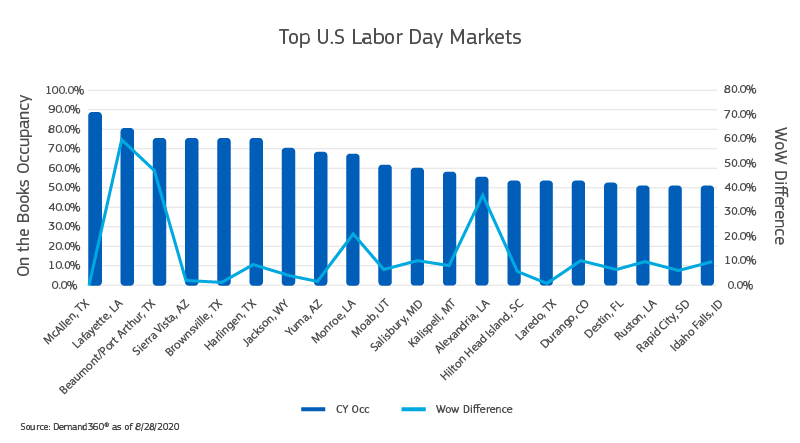

While the US average occupancy is currently low compared to previous years, this is mostly attributed to the lack of demand in major urban markets across the United States. Based on current booking trends, the majority of travelers are visiting non-urban areas. The list of top markets for Labor Day has shifted since our last post with HSMAI as Hurricane Laura impacted Southwest Louisiana. The increased occupancy and strong week over week growth in Lafayette and Alexandria, Louisiana, and Beaumont, Texas can be attributed to the storm. But putting that aside, the leisure markets saw steady growth, with Sierra Vista, Arizona, and Jackson, Wyoming topping 70% occupancy.

What Happens After Labor Day?

Based on booking lead time data, traveler booking lead times continue to improve through COVID-19 recovery. While the 0-3 day lead time continues to remain the strongest with 109% more bookings coming in that period than the same time last year, the 4-7 day booking window is improving with 74% of last year’s numbers. Further out, bookings continue to climb, and we see the 8-14 day booking slowly increase with 68% of the bookings we saw last year. While the further out booking windows are still struggling, demonstrated by overall lower occupancies, the trend is moving in the right direction even as we face the unknown – moving into Fall with little to no group/corporate business.

Hotelier Next Steps

Given the steadily changing market conditions and the fact that every market is experiencing a recovery in different phases, you must have access to the most current, forward-looking data for your market. To build an effective recovery strategy, you will have to track the performance of your market in the context of COVID-19 recovery, not in historical references. Consider building marketing strategies that target your “new” ideal guest. Keep in mind that guests’ top concerns are likely to be related to your COVID-19 safety and sanitation processes, so be sure these are clearly communicated across all of your booking channels. Given the very short booking window, you likely continue to have an opportunity to capture some of the demand for the upcoming Labor Day holiday.