As the number of compression nights continues to decrease overall in the U.S., will pricing power be a concern in 2019?

Compression nights have long served as opportunities for hoteliers to achieve peak pricing performance. But as the number of these continues to decrease, operators need to be mindful of how best to leverage them.

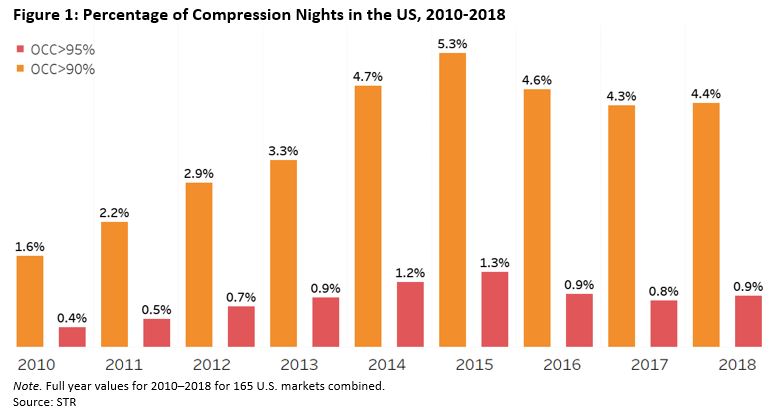

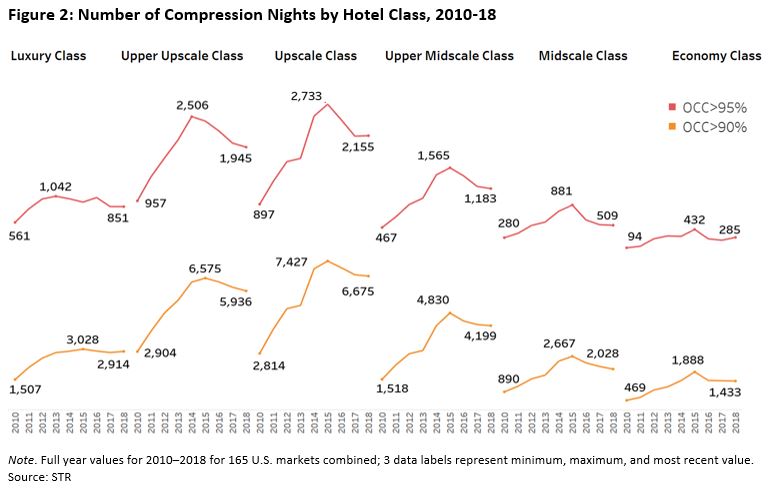

Here are three things about compression nights, the high-demand periods in which occupancy exceeds 90% or 95%, every hotelier needs to know.

1. Compression nights are becoming more rare.

Compression nights increased quickly after 2010, a year which was relatively stabilized following the declines from the Great Recession. After 2015, however, they became rarer. With that said, it is worth noting that there was slight growth in 2018, because the 2018 U.S. hotel room supply number was higher than ever.

The same trend is true for all six hotels classes: Compression nights increased rapidly from 2010 to 2015 and have decreased ever since. This trend was particularly pronounced in the upper-upscale and upscale classes. The rapid demand growth for those two classes contributed the compression night counts between 2010 and 2015.

Although the downward trend is cause for concern, the U.S. hotel industry on average has seen more nights than ever in which occupancy was greater than 80%. A closer look at supply and demand data reveals that the dips have resulted more from increased supply than any decreases in demand. Hotel demand has grown at a healthy pace for several years now.

Additionally, compression nights don’t always equate with profitability. As Joseph Rael, senior director of financial performance at STR, has shown, hotels achieve peak profitability (in terms of gross operating profit percentage) when occupancies are at or slightly above 80%.

2. Pricing premiums are higher than ever

Hotel room rates on compression nights have been increasingly higher in all six U.S. hotel classes since 2010, and are currently the highest ever, despite the fact that the volume of compression nights has declined since 2015. The same is true for ADR premiums, or the percent difference between ADR on compression nights versus non-compression nights.