As more guests start to use predictive pricing tools when booking their travel plans, hoteliers are figuring out ways to benefit from this.

It’s a constant back-and-forth: Hoteliers will always try to get the highest rate possible, and in return, guests will always try to figure out a way to pay the lowest amount possible.

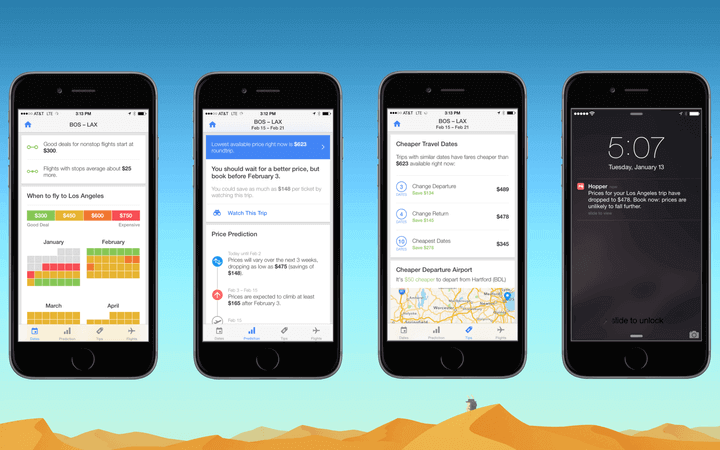

As technology in the travel industry advances, guests are finding an advantage in the evolution of predictive pricing tools, such as those offered by Google Travel or apps like Hopper, which predict future hotel room rates to tell guests whether they should book now or wait until the rate lowers.

While that might on its face sound like a problem for the hotel industry, some revenue managers don’t see the need to work around the emerging technology. In fact, they believe hoteliers could take advantage of it.

Limited Use

Many of the consumer-facing predictive pricing tools are fairly new, said Trevor Stuart-Hill, president of consultancy Revenue Matters, and those that aren’t quite as new aren’t seeing a tremendous amount of adoption at this point. Even one of Expedia’s tools, which allows travelers to book a reservation and then the system can cancel a reservation and rebook it at a lower price point, aren’t seeing a lot of activity.

“I am sure the adoption rate will be growing in the future, but I’m not seeing much of it right now,” he said.

Two of Paramount Hotel Group’s properties in the Charleston, South Carolina, market have seen a slight impact from the use of predictive pricing tools, said Andrew Director, VP of revenue management and distribution. However, it hasn’t been enough to force the company to change its revenue-management or pricing strategies.

“This is sort of like deciding whether or not you should manage to the rule, or should you manage to the exception to the rule,” he said. “At this point, we continue to manage to the rule. There is not enough volume yet to encourage us to change practices.”

As the volume of travelers using these tools expands, it might be best to identify these customers as their own individual market segment and implement a pricing strategy specifically for these travelers or segment, he said. Countermeasures could include different advanced purchase rates with tighter cancellation rules, he said.

“In our opinion, we are not yet at that juncture,” he said.

As the technology and its use among consumers grow, hoteliers will have to look at their revenue-management philosophy, Stuart-Hill said. There’s a misperception among consumers that hoteliers are participating in gamification, that the industry is trying to pull a fast one on them, he said.

“That couldn’t be further from the truth,” he said.

Hoteliers would be happy to shift demand to dates where pricing is lower for a property while leaving room for additional demand to be absorbed in other times when higher rates can be absorbed, he said.

Revenue managers have a fiduciary duty to their hotels’ owners and asset managers, he said, but that doesn’t necessarily conflict with the best interest of consumers.