After the consumer madness and mayhem of Black Friday and Cyber Monday, it’s a good time to look back on whether the results were as we expected or whether we might be jumping on a bandwagon heading for an unknown destination.

NB: This is an article from mirai

We have made an in-depth analysis of consumer behaviour during a period which is very important for many people, extending our analysis to the two weeks before and two weeks after Black Friday so we can get a more comprehensive vision of what actually happened.

Increasing concentration of sales on the Black Friday weekend

Thanks to Google Trends, we can see how the number of searches for “hotel deals black friday” in the United States continues to get even bigger, growing by 25% in 2019. This clearly shows that consumers are holding on and waiting for Black Friday to find out what deals are going to be available before they make a booking.

It’s also fascinating to see how demand is no longer restricted to a single day, but begins to grow several days before Black Friday and continues through to Cyber Monday.

Analysing our own numbers at Mirai, we can confirm that:

- There is an ever-increasing concentration of sales on just four days, with the biggest days for sales being Black Friday and Cyber Monday.

- From Black Friday to Black Week. The Thursday before Black Friday is becoming more and more relevant and sales remains strong until beyond Cyber Monday.

- Black Friday is the biggest day for sales in the month with about three times more bookings than a normal day.

- And it is also increasingly becoming the biggest day for bookings in the entire year for many hotels.

More impact in resort (vacation) hotels than in city hotels

If we analyse the performance of city and resort hotels, we see a very different picture and far greater relevance in resort hotels.

It seems clear that customers increasingly postpone or bring forward booking their holiday depending on the offers available on Black Friday, with the number of bookings consequently much higher than in city hotels where the difference is far less.

Black Friday creates incremental sales

The big question about these huge sales focused around just a few days of the year is whether they are really worth it? The data show us that it appears that they are worth it, and that in the two weeks before and after Black Friday there was a net increase of 2.2% in the number of roomnights sold.

- As expected, sales slow down considerably in the weeks prior to Black Friday, with the pick-up falling by -2%.

- The days immediately before Black Friday see sales beginning to recover, reaching a high of almost +4% growth in pick-up on Cyber Monday.

- After that, it starts to drop off again to leave the average increase at just over +2%, remembering that this is a net change and therefore an indication of incremental demand.

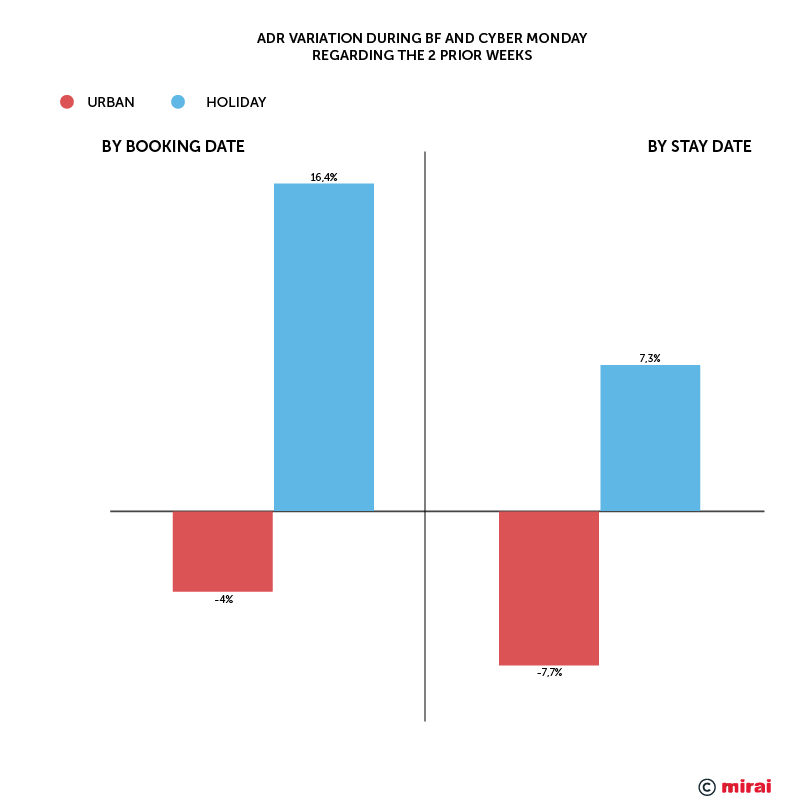

Increases in average rates for resorts and decreases in city hotels

We now know that there is an increase in net roomnights, which is great news. But what about the average daily rate (ADR)? This is not easy to answer as there are two different ways of looking at the “average price” depending on who is making the analysis.

- The e-commerce or marketing view: average price by booking date. This helps us analyse the profitability of investments made at a given time. Not always shared by the view from the hotel.

- Hotel view: average price by date of stay. This ignores when the booking was made and focuses on the date of arrival. A view not always shared by marketing teams.

The reality is that both visions are correct and have to be taken into account. Logically, over a period as long as a year, the average price by arrival data and by booking date tend to be equal. But when we talk about short periods of time, there can be major differences. We have analysed both variables, defining a specific period for stays (January-March in city hotels and May-August in resorts).

- In city hotels

- The price by booking date falls -4% compared to the previous two weeks.

- On the other hand, if we look at the next nearest period (the following three months), we see that the fall is even greater, reaching -7.7%. It seems clear that city hotels rely heavily on Black Friday to sell low-demand periods (generating incremental sales, even though they are at a lower price) with higher discounts than for high-demand periods.

- In resort hotels

- The average booking price doesn’t fall, it actually rises by 16% compared to the previous two weeks. This is mainly because people wait until Black Friday to book their holidays (for the high season and therefore at higher prices).

- The price per stay also rose by 7.3%, indicating that bookings for the high season were made at a strong price (compared with what had already been booked up to that date)

Conclusion

It’s obvious that Black Friday, whether we like it or not, is a very important date for sales and a great opportunity to boost your hotel sales and prioritise your direct channel. You don’t get many opportunities like this and you should really make the most of them.

Doing nothing is no longer an option, for the simple reason that all of your competitors, all the other hotels and the OTAs, will be taking part, meaning that there’s a risk that you could lose sales to others who are more active than you.

Once you have decided that next year you are going to make the most of Black Friday, here are a few final tips to help you do so. These are the same steps we use at Mirai with all our customers that require our help.

- Plan your strategy well. This is a key sales period which generates incremental sales. Don’t leave it all to chance. This is a unique opportunity to boost your direct sales: decide what discounts you want to offer, for which dates of stay, for which room categories and meal plans, as well as for which markets.

- Don’t apply exactly the same discount to all your dates. Use a lower discount for the high season (or no discount) and generate greater sales for low-demand periods with higher discounts.

- Prioritise your direct channel by applying better conditions on your website either directly for all users or using promo codes.

- Finely tune your marketing campaigns. Brand searches increase during Black Friday. Your ads have to be perfect and accurately communicate your sales pitch if you want to do well. Remember that on Black Friday many users do a lot of searching and comparing, so it’s quite likely that you won’t get a booking from the first clicks on your ads. You will probably need remarketing campaigns if you want to succeed.

- Take advantage of your visibility in metasearch engines, especially Google Hotel Ads. The GMB (Google My Business) hotel fact sheets are highly visible in Google results and generate more clicks during periods of high demand.

- Don’t forget mobile. Currently more than half of Paid Search happens on mobile devices. You have to make sure you design your marketing strategy well and have a perfect booking process for mobile devices.

- Make the most of your CRM. You have extremely valuable information about your customers. Black Friday is the ideal time to strengthen your relationship with them and make them feel even more special: offer them a private pre-sale discount, make certain room categories available only to them, etc.

- Highlight your promotions on social media using flash messages that create a sense of urgency and warn that the promotion ends tonight or that only the first X bookings get a discount.