NB: This is an article by Phocuswright

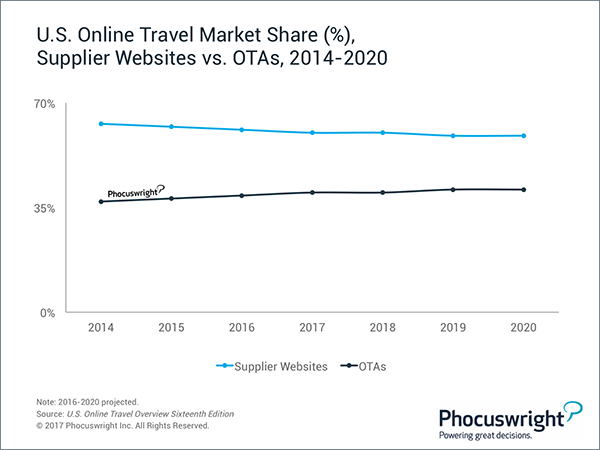

U.S. online travel agencies (OTAs) continue their upward climb and have increased their share of the total travel market. Bolstered mainly by hotel and mobile, OTA online bookings are now growing faster than suppliers’, which are on a downward trend.

OTAs’ share of the online travel market reached 39% in 2016 and will slowly continue to increase to 41% by 2020, with US$81.4 million in online gross bookings.

Hotels now account for more than half of OTA domestic gross bookings and will continue to increase through 2020 as OTAs focus on growing the hotel segment and widening hotel inventory. Rate parity clauses still hinder hoteliers from undercutting OTA prices, and OTAs are creatively outmaneuvering suppliers.

“One hotelier, Red Lion, partnered with Expedia allowing travelers to book Red Lion’s rewards program rates, sign up for the loyalty program, and earn membership points and benefits through Expedia.com and Hotels.com,” says Phocuswright’s senior research analyst, Maggie Rauch. “Travelers receive loyalty points with Red Lion as well as Expedia Rewards Points, which in the long run could incentivize travelers to continue to book through OTAs and ‘double-dip’ on loyalty points.”

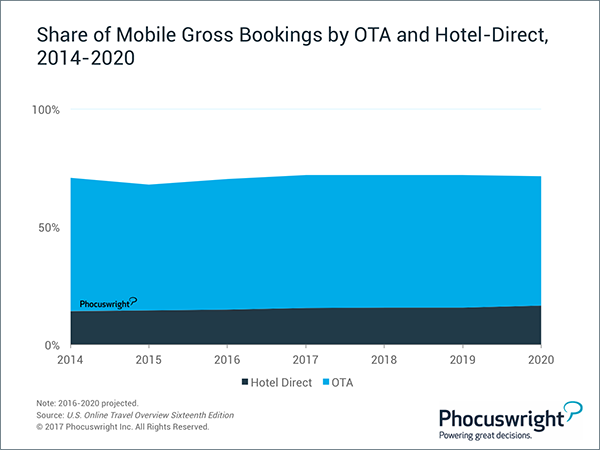

Mobile is also driving rapid growth by providing OTAs access to customers where they are increasingly connected. Mobile now accounts for more than a quarter of OTA gross bookings, and will rise to 40% by 2020 – more than doubling in just six years.

OTAs outpace suppliers in the mobile space and held 55% share of total mobile bookings in 2016. With more resources than smaller suppliers to develop mobile channels and fund customer acquisition initiatives, they are expected to keep growing their share to 57% in 2017.

OTAs are ideal for mobile shopping since travelers can compare many options and buy products in a consolidated location.