Navigating a hotel rate intelligence solution in 2020 is no longer a complex task. Many of today’s options are intuitive to use. The work is effortless and pays off when you know where to begin.

NB: This is an article from HQ revenue

After considering the features of a rate shopper and selecting the one that fits your needs, you are already half-way there. Support your daily hotel business with confidence and access to reliable market data. Gain an advantage over your competitors on your first day when you consider these easy wins.

- Getting an accurate market overview (with real-time changes)

- Highlighting parity violations (on the channels you rely on most)

- Knowing where you stand (among the competition)

Let’s set the scene: Your account is ready to go – the integration of your PMS data is complete, you can see your competitors and the channels they are on, and you mapped your room types to theirs for direct comparisons.

Subscribe to our weekly newsletter and stay up to date

Win #1: Getting an accurate market overview

For many hoteliers, checking the market is a morning routine. Seeing how your competitors react to current market developments is a fundamental component of an accurate overview with which you can:

- see price deviations of competitors and the proximity to the median

- concentrate on the most important online channels

- understand how every room type compares and performs

Noticing competitors dropping or raising prices is vital, because it nudges you to react. To investigate the reasons, and pursue adjustments to your rates. Your hotel market intelligence tool helps you make sense of possible indicators. They can include insights on what the city demand looks like, weather forecasts, events, and holidays.

Configuring the overview to display more possibilities works by filtering shopped rates instantly—for every channel, matching room type, and lengths of stay (LOS).

Working with the right perspective is key, so you can recognize irregularities on your channels before they turn into lost revenue. It should also be the one that makes the most sense for your workflow, whether from a graph, table, or calendar view.

Win #2: Highlighting parity violations

In other words, to solve instances where your direct rate gets undercut by an online travel agency (OTA).

Uncovering price issues on Booking or Expedia, for example, requires live information and probing in-depth. The approach of comparing apples to apples involves breaking down the price by room type and channel. This way you see a double room on your own website next to a double room on Booking and Expedia.

On top of this, toggling the option to include and exclude loyalty programs like Genius—with 10% and 15% discounts—means you can highlight where your price gets undercut or falls below OTA member pricing.

Seeing parity violations can answer many questions. How many exist per day, on what channels, and which rooms are affected? Judging each parity issue is simple, with an orange color-coded scale informing you of the severity.

Win #3: Knowing where you stand

In essence, understanding when not to sell yourself short.

You will want to optimize your standing against the competition in the most strategic way possible. How can you determine this for your hotel? By taking advantage of this nifty solution:

Focus on your reputation and pricing

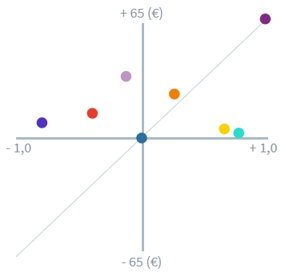

A coordinate system displays every competitor’s aggregated review rating (x-axis) and room price (y-axis) in relation to your own.

Here is what this might look like for a given day, with your hotel at the center:

In essence, you want to keep your competitors above the diagonal line. Above means, they either have a higher rating and sell for more or have a lower rating and sell for less than you do.

Naturally, there are more factors to consider before adjusting your rates. But this gives a great high-level view of where you stand and what potential exists.

Final Thought: Where Can Hoteliers Go From Here?

Orientating and positioning yourself in the market in the best way possible is easy to achieve when leveraging quick wins like the ones above. We are confident these tips will give you a solid foundation.

It goes without saying; there is a lot more to revenue management—from short-term yielding and long-term strategies to budgeting and forecasting. The natural next step is graduating to a more in-depth market analysis where things like recognizing demand drivers and monitoring macro markets in your area become important considerations.

The revenue-boosting Market Intelligence tool helps you get there, and a personalized demonstration will ensure you can get the most out of your 14-day test period.