When three global technology trends combine with two industry-specific trends, can the planets align to transform the online relationship between airline and travellers?

For decades, airlines have worked to perfect network- and flight-based revenue management, forecasting demand by origin-destination market by fare level and employing sophisticated optimisation models to allocate scarce seat capacity across the network. Airlines may now seek instead to optimise individual customer interactions.

The opportunity is revolutionary for airlines: designing and pricing the product around individual customers rather than the existing legacy methodology. The new process – sometimes termed ‘total offer optimisation’ – positions an airline more like real e-merchandisers. It means giving individual travellers the right product (not just the seat but the entire travel experience) at the right price (an attractive price for a bundle of services) at the right time. At Amadeus’ revenue optimisation conference in Monaco, ‘offer management’ was a key topic.

5 steps to totally optimising offers

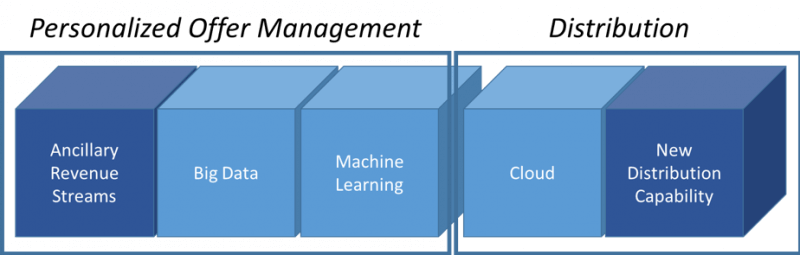

’Total offer optimisation’ can’t realise its potential without five capabilities. Each of these has emerged over the past five to ten years bringing ‘total offer optimisation’ now much closer to reality. Two of them (ancillary revenue and NDC) are industry-specific breakthroughs. Three of them (big data, machine learning, and the cloud) are broad technology initiatives that complement the industry breakthroughs. But none of the above capabilities existed in the same way as ten years ago. The development and expansion of each of them now positions the industry for the most dramatic change since American Airlines introduced yield management in the early 1980’s.

These trends mark the beginning of a new era in the travel industry and, potentially, the beginning of a revolution in travel merchandising.

Let’s first take a closer look at the three global technology trends.

- Ancillary revenue streams

In 2008, U.S. airlines introduced charges for checked bags; worlwide ancillary revenue has grown every year since. According to Ideaworks’ 2017 report, the top ten airlines in ancillary revenue generated $2.1 billion while in 2016, nine years later, the ancillary revenue reported by the top ten airlines had grown more than ten-fold – to more than $28 billion. Some of the leading airlines in ancillary revenue have almost as much revenue in ancillary options as in their base fares.