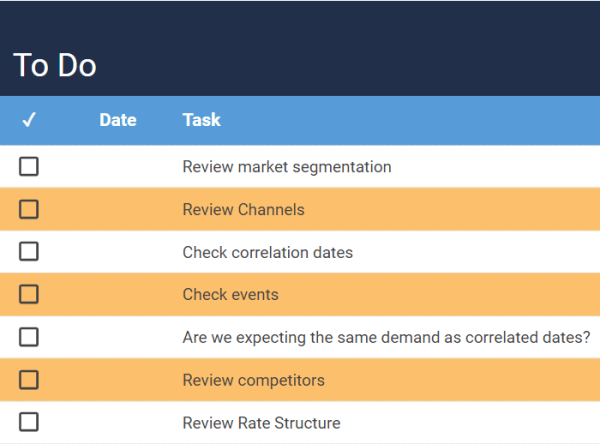

The changing trends in the different markets, following the changes experienced in the last two years, make it necessary to review our segmentation strategies and rate structure.

NB: This is an article from Beonprice, one of our Expert Partners

We are all aware that the last two years have been far from normal for everyone, on each single market, but as a Revenue Manager, I cannot help but worry about the hospitality sector.

Since 2019, we have been through different stages, going from worrying about our hotels ADR, to dealing with the cancellations during lockdown, to completely changing our way to do Revenue Management due to the peak on Last Minute bookings during the last months. This made me realise that the rate structure and strategy I use to follow in 2019 was completely useless and needed readjusting.

Subscribe to our weekly newsletter and stay up to date

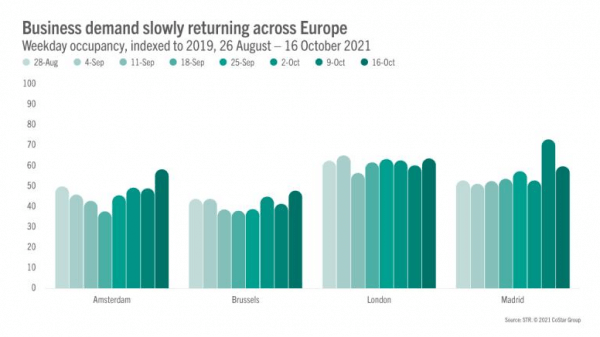

Same as you, I have been reading articles about the changes of trend for different markets, and according to STR, Corporate demand is slowly returning across Europe as well as Groups Demand. This makes me think that our segmentation and rate structure might need reviewing.

That said, we need to make sure that our RMS is ready to understand the change of trend and optimice accordingly.

Segmentation

I strongly believe that an excellent configuration is a MUST for each RMS, so that the AI will have good data to be able to Forecast and Recommend accordingly. For this reason, we want to help you with your hotel configuration.

Before starting to work on our segmentation, we should be aware of the aspects to bear in mind in order to identify segments correctly and effectively. We need to identify client groups based on their response to marketing strategies: each identified segment should be differentiated from the rest by this behaviour.

In addition, the segments should be measurable and accessible via different communication channels. (Talón, González, & Segovia, 2012).

Market Segmentation

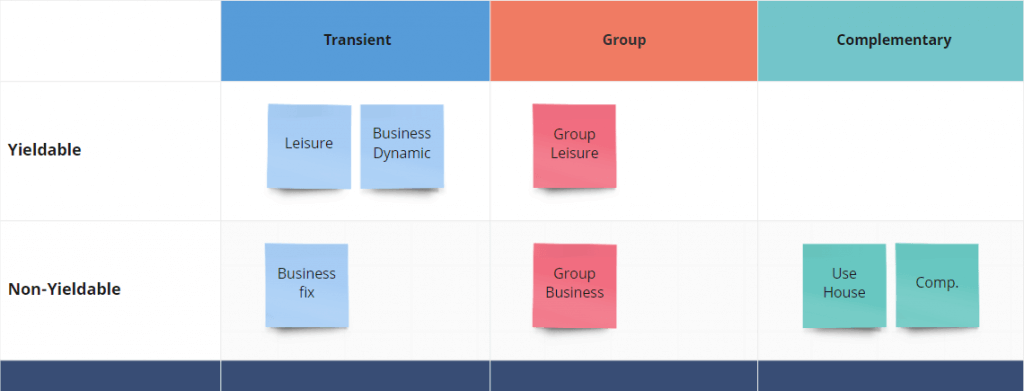

Depending on the business your hotel has, we recommend three macro-segments:

- Transient: Transient business is defined as individual guests.

- Group: Normally bookings of more than 10 rooms.

- Complementary: House use, Friends and family, complementary…

Once we have our macro-segments defined, we can start working on our Market segments for each macro segment, and consider whether the segment to analyse is Yieladble (is susceptible to changes on prices or restrictions) or not (conditions have been discussed and contracted for a period of time).

Transient

- Leisure: Individual reservations made directly through the hotel or OTAs

- Business Dynamic: Reservation made by companies for their employees. The rate for these reservations is normally a discount over our BAR.

- Business FIT: Reservations made by companies for their employees at a fit rate. This rate has been previously agreed on.

Groups

- Group business: Groups reservations made by companies whose rates and conditions have been previously agreed upon for a short-medium term.

- Group Leisure: Groups reservations quoted individually by the hotel. The rate for this segment is normally a discount on BAR or an ad-hoc quoted rate.

Other

- Use house: Reservations made by employees of the hotel at a special rate or free of change.

- Complementary: Reservations free of charge.

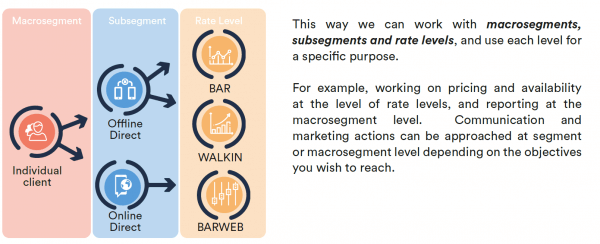

Once we have identified our market segments, we should identify on what channels we are selling our spaces.

Channel segmentation

In order to identify where your reservations are coming from, we suggest the following channels:

- Direct online: Reservations made directly through our own website.

- Direct offline: Reservations made with the hotel directly over the phone, o a walk-in.

- OTAs: Online Travel Agencies: Reservations made through third party websites which consolidate and sell rooms and travel products online (e.g. Expedia, Booking.com, HRS).

- Tour Operator: Reservations made through a tour operator. Rates and conditions are normally agreed by seasons.

- GDS: Global Distribution Systems. Reservations made through electronic databases where hotel availability can be consulted and booked. GDS are primarily used by Travel Agents to book negotiated rates, however all public rates are also bookable.

- Travel Agency: Reservations made directly through a Travel Agency.

With double segmentation, you will be sharing all the reservations information with your RMS, and this will be able to help you optimize your strategy, and what is even more important, your time. This is only the first step towards hyper-personalization.

Correlation dates and demand impact

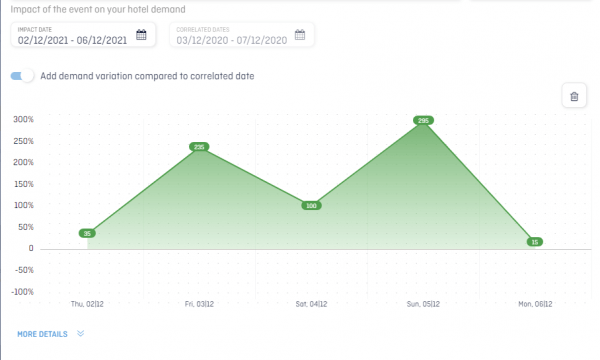

Once we have reviewed our segments and channels, we should make sure that we are happy enough with the correlation dates the RMS is taking as reference, especially for the medium and long term.

Correlation dates

We all know how important it is to do a comparison like for like, as it wouldn’t make sense otherwise. When I think of correlation dates, the first example that comes to mind is Easter, as it is in a different week every year, irritating but hey ho! It is the way it is, and we all love that little random break.

Back to the topic, when we are comparing Easter week, we know that we cannot just take away 324 days of each day; we need to check the calendar and find out when the last good-to-compare-Easter was, and we also want to keep an eye on the YoY comparison. This makes manual Revenue Management quite complicated and we end up missing opportunities on our strategy.

When using a RMS, all we need to do is tell the system what the comparable dates are, including shoulder nights, and it will do the comparison for you. But not only the comparison, will forecast and recommend price and restrictions so you will maximize your hotel RevPAR, so that you can focus on monitoring your rates and segments strategically.

NOTE: From Beonprice, we not only recommend correlating dates by the total finishing position, but by the business mix and booking pace too.

Events

If we define an event as something different to the ordinary that will affect in some way the demand of our hotel, then it is to expect the previously mentioned correlation date might need reviewing, as well as the expected demand for this day, comparing it with the correlation date.

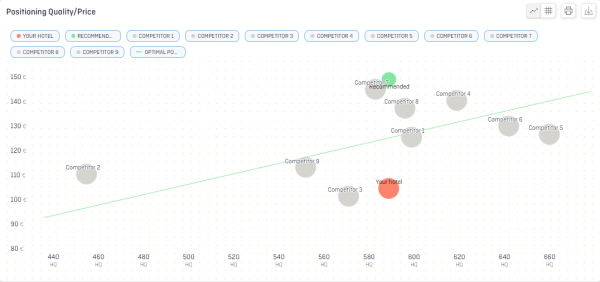

Competitors

As we are reviewing our hotel, we need to take into consideration whether our competitors are the same as they have been in the last two years, or whether they need reviewing. The same way as we would not compare a Fiat with a Tesla, even though they are both car brands, we can not compare with any hotel that it is around our hotel, as the public for it might be different to the one we are expecting in our hotel.

Following this principle, us in Beonprice use HQI, which not only takes into account the selling price but the objective quality and the reputation of our hotel and the competitors. In this way, we will always recommend the best price that combines sales opportunities and RevPAR maximization, ensuring loyalty from your guests.

You can find more information about our HQI in this ebook.

Rate Structure

Last but not least, once we have reviewed our Segments, channels, correlation dates, and competitors, we need to make sure that our rate structure is the right one for what we are expecting this new and exciting year.

In this way, we want to have a very clear rate structure linked properly to our segmentation, such as shown below:

Read more about improving your hotel’s pricing strategy in this article.

Closing-up

As 2022 is just around the corner, making sure we have our structure up to scratch, we will be ready for a change of trend and our way to our old-normal.