In our recent Email Benchmark Report, we saw that even through a global pandemic, email continued to reign as the favored channel of communication for marketing and business.

NB: This is an article from Cendyn

It has forged its way as one of the most effective ways to stay connected in a socially distanced world.

As stated in our report, we saw a spike in email open and click-through rates and an increase in nights per booking in March and April 2020. This increase in nights per booking was due to a number of factors and different circumstances across the globe, but namely because those hotels who were still open and taking bookings were accommodating longer stays for fewer guests.

As our first follow-up to our Email Benchmark Report released in May 2020, we are now able to look at data from both May and June 2020 to see how the slow reopening of some hotels has affected email engagement levels.

We look in-depth at four fundamental email marketing metrics for hotels; open rate (OR), click from open rate (CFOR), average nights per booking (NPB), and average daily rate (ADR).

We analyze emails from 40+ countries and consolidated findings into regions: Americas, EMEA, and APAC, as well as class including Luxury, Upper Upscale, Upscale, and Upper Midscale.

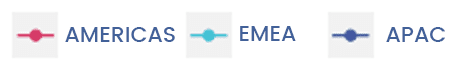

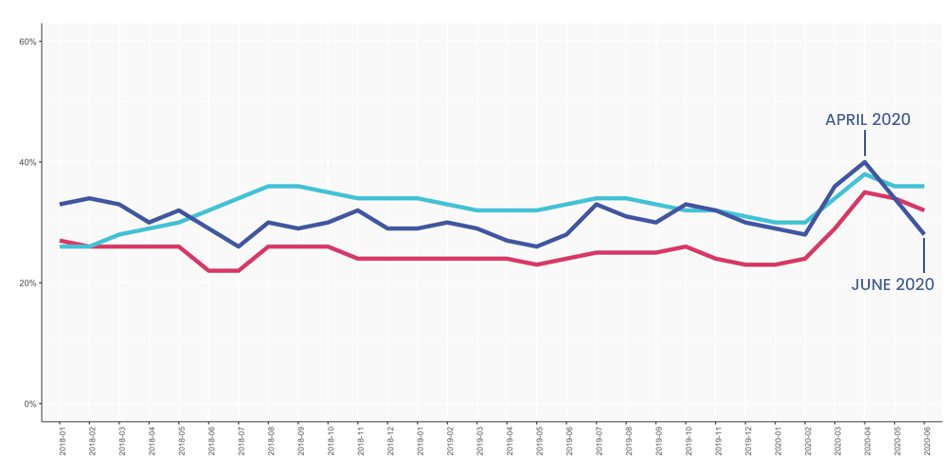

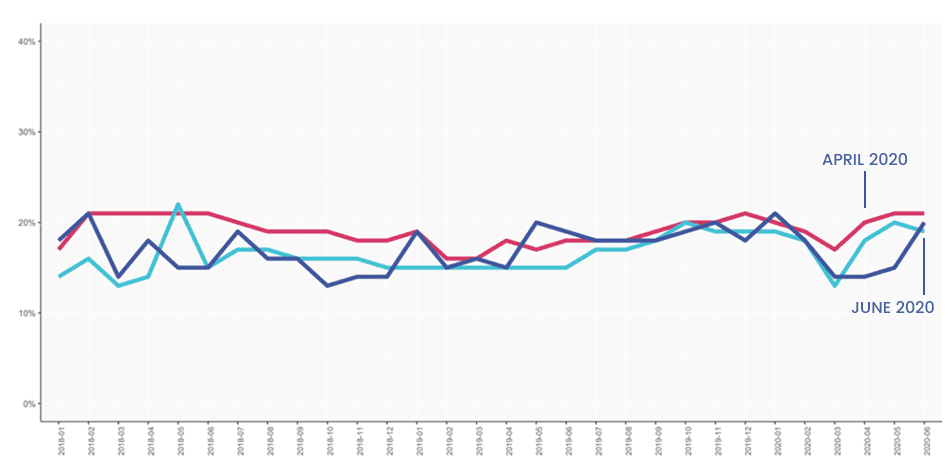

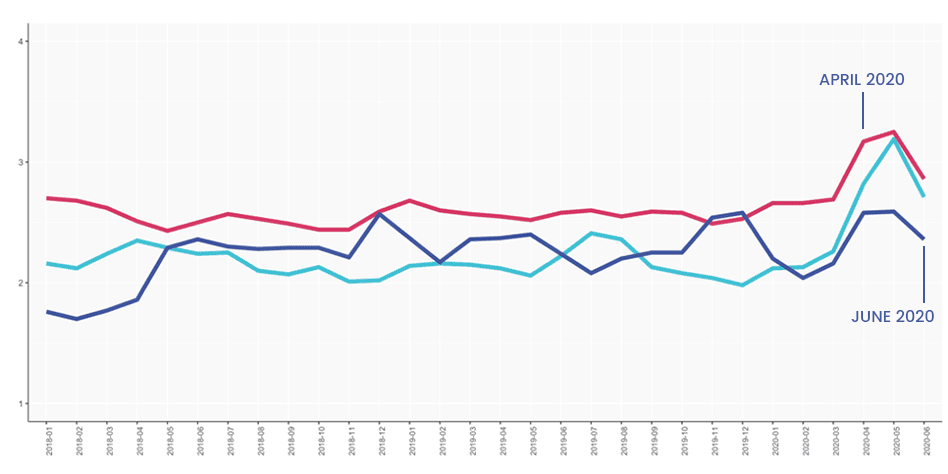

Email open rates

Email open rates by region

Email open rates by class

Findings

- We can see that open rates are down from their April peak, but the Americas and EMEA regions are still above their ’18-’19 run rates.

- This tells us engagement levels are still higher than previously seen since the pandemic began and should be leveraged by hotels with highly relevant and personalized communications to help drive conversions.

- With travel restrictions constantly changing, it’s important to keep an eye on who you are communicating to and what messaging you are sharing with them.

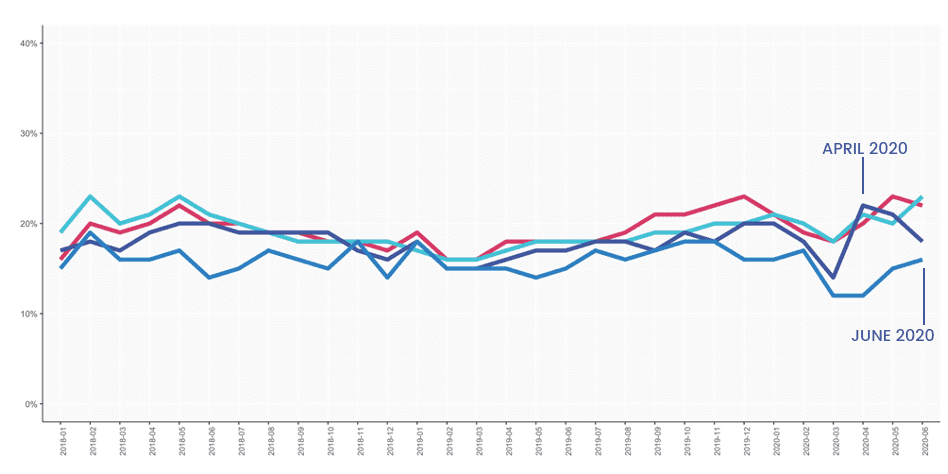

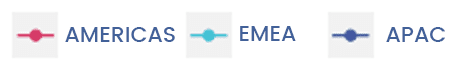

Click-from-open rates (CFOR)

Click from open rates by region

Click from open rates by class

Findings

- While all regions saw a considerable dip in CFOR for March 2020, since April, we have seen continuous uptick in engagement reaching average 2018/2019 levels. We see the dip in March due to many emails being sent without call to actions (CTAs) and them simply including statements about the closure of properties.

- This could suggest a shift back towards pre-crisis content, where guests are more prone to take action on the marketing emails they do receive and read.

- Americas’ and EMEA’s upward trends are encouraging in terms of hoteliers being more likely to achieve ROI on their campaigns.

- Upper Midscale Class seems to buck recent upward trends of other hotel classes, despite higher open rates. This could be due to messaging in emails focusing on COVID-related content that may no longer be as effective at pulling in the conversions.

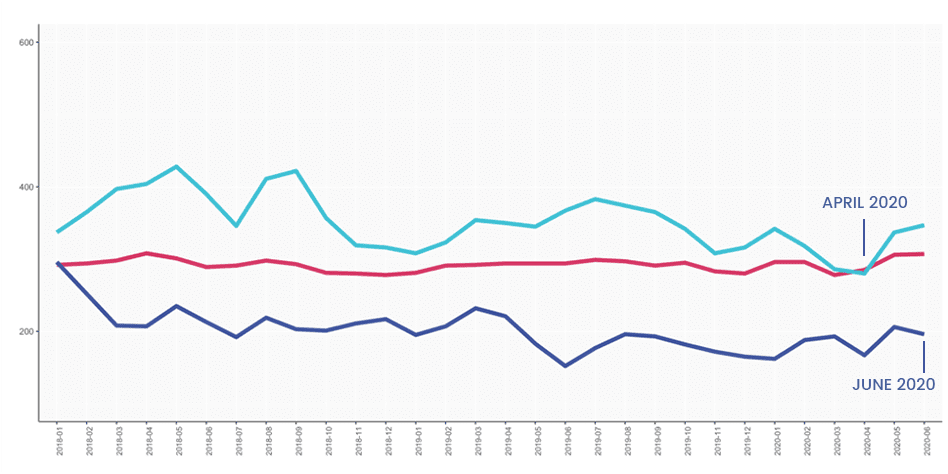

Nights per booking

Nights per booking by region

Nights per booking by class

Findings

- As would be expected, the nights per booking spike in April and May was only temporary – as detailed in our report we explain that this could be due to the type of bookings that may have been taking place during this time.

- Depending on available capacity, hotels that are not constrained could continue to promote longer lengths of stay and hotels that have imposed hold times for housekeeping will benefit from increasing average length of stay (LOS), as they would require fewer room turns.

- To learn more about capacity constraints and determine what capacity your hotel can run at, download our capacity calculator.

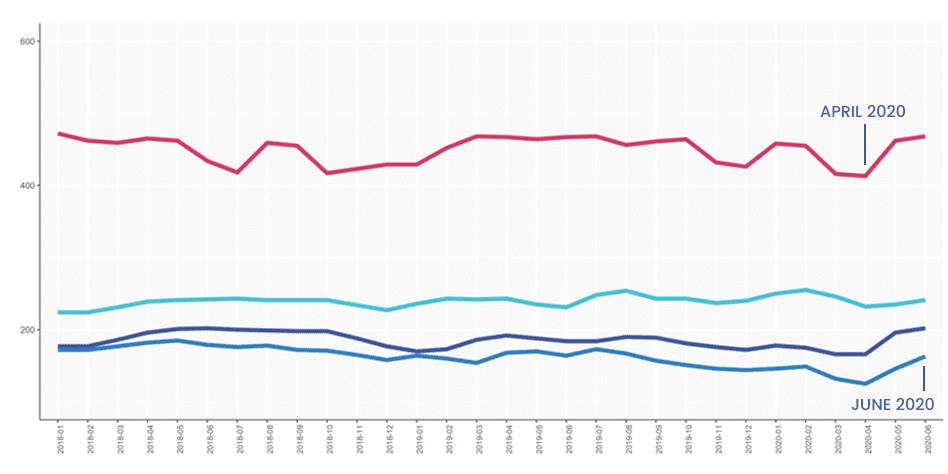

Average Daily Rate (ADR)

ADR by region

ADR by class

Findings

- Average Daily Rate appears to be fairly steady across regions and classes, with a bit of an upward trend in EMEA.

- For now, hotels may realize that demand in the near-term will not be a function of price, i.e. people traveling out of necessity rather than desire or impulse but this should be monitored carefully, as it is common to discount in order to stimulate demand as it returns.

- If you’d like to read more about why heavily discounting is not the way to go in times of crises, check out our email benchmark report.

Key takeaways

As our industry starts to reopen and the pandemic evolves across the globe, we can see that email marketing continues to be a fundamental aspect of the usual marketing toolkit.

We’ve seen that during ‘normal’ periods, email marketing is a vital channel aiding in driving demand, revenue and maintaining brand awareness and that this is even more the case since the global pandemic took hold across the globe in April 2020.

Hotels have the opportunity now to leverage the prolonged ‘awareness’ stage during global lockdowns and start converting those engaged recipients into bookings.

Email is a highly effective channel to do just this and using platforms like a customer relationship management (CRM) tool allows you to target different audiences in your database with different messaging. Combining this with an effective web and social strategy, hotels will be well placed as bookings start to come in.

In addition to their communication strategies, hotels should also closely monitor ADR at both a campaign level and overall, so as to try to avoid the “race to the bottom” that occurs when hotels in a market compete too aggressively on rate.