Over the last several years, we’ve seen Google become a major player in the travel industry. In the last six months in particular, Google has gone from search engine to booking engine, causing more than a few worried glances among those who rely on direct online bookings for revenue.

NB: This is an article from Vizergy

Google had previously been an ally in bringing qualified visitors to hotel websites but has now become your biggest competitor.

In October 2018, Google rolled out a desktop treatment for hotel booking that aligned with the mobile experience that had been live for several months. It allows the searcher to filter by location, dates, number of guests, budget, and preferred amenities. No one can argue that it isn’t a great way to find what you’re looking for. However, it’s what happens after you narrow down your search results that is having an impact on direct bookings.

Google provides a handful of ways to book that room, with the eye-catching photos, hotel information tabs, reduced rate messaging, reviews, and nearby competitor rates far more appealing than the little “Website” button that actually takes you to the hotel website. We’ve seen a distinct reduction in website traffic from Google in response to this approach already, and it appears Google has recently taken it a step further and integrated hotel results in their incredibly popular flight search tool.

In a quiet non-announcement of sorts, Richard Holden, Google’s VP of Product Management for Travel published a blog post in March highlighting the new features and capability of their new travel insights tool. With an impressive list of features, like the Deals filter that “uses machine learning to highlight hotels where one or more of our partners offer rates that are significantly lower than the usual price for that hotel or similar hotels nearby” and a Packages tab to show flight and hotel bundle rates, and even non-hotel vacation rentals in the area of interest, the tool itself is a powerful search engine for travelers.

The problem is that Google is keeping all of that browsing and booking traffic on Google, and away from hotel websites. Industry chatter regarding the tool is that Google is trying to compete with, and take business away from, OTAs. But for hotels already elbowing their way to the front of the room to capture direct bookings, this is another obstacle in the way of that valuable revenue channel.

I was recently looking up flight and hotel options for a trip and wanted to see how Google’s search experience on mobile has changed and if it would impact my own booking decisions. Since I was logged into my own Google account, I got the added bonus of rate reduction offers as a Google One member, with a lower rate shown than I could find elsewhere for the property.

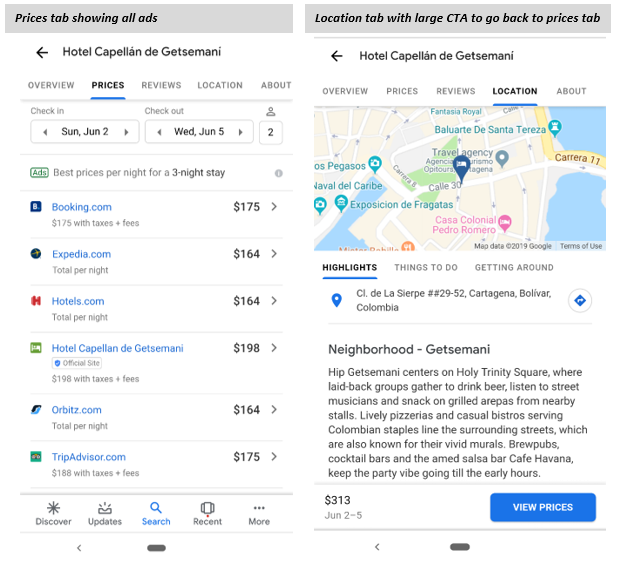

After browsing a few hotels, I noticed how difficult it was to get to the hotel website directly and how much effort was placed into directing clicks to the Hotel Ads. In the Prices tab, the ads are the only option for rates and more information, and if you go to any other tabs to get further location info or read reviews, there is a clear CTA to View Prices at the bottom of the screen that takes you back to – you guessed it – the ads. While Google’s nudge toward ad clicks that bring them so much annual revenue is nothing new, this brazen and blatant push without organic options is surprising.

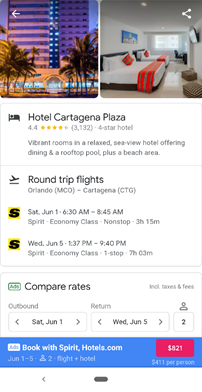

I wanted to see what else I could do with the tool and checked out the Packages tab (previously labeled “Flights + Hotels”). It had the same great filters, map view, date and price range, and amenity selection. But what happened once I clicked on a hotel to see the package price is noteworthy – you can’t actually book a package.

The CTA at the bottom includes a bright button with the total price of the package, and you assume that clicking it will take you to where you can book everything together – as, you know, a package. But when you click it, you get a pop-up saying you have to book the hotel and flight separately, and the only option for each is via an ad with an OTA. The CTA was labelled as an ad, but I searched for other opportunities to make the direct bookings, and none existed. It appears the entire Packages tab is one big ad for OTAs.

So, after falling down the rabbit hole of Google’s travel tool, the one thing I was getting further away from with every click was the hotel’s website. Also, at no time did I consider checking organic results to see what came up in my searches. Considering the OTAs tend to dominate organic results, it’s clear how Google is impacting their traffic with their entrance into the booking world. But after all the time and money hotels spend on being visible in organic results, it seems that Google’s moves are making their own results pages obsolete for travel. Clicking on a hotel in the local pack brings you to a variety of ways to get you to click on an ad and keep that cash register ringing over at Google headquarters.

How this will translate for your website is a reduction in organic traffic year over year, especially for non-branded searches, even as search trends for hotels in your city remain steady or grow. Google is investing a lot to develop ways to keep people searching and also converting on Google, with the lucrative travel industry becoming their bread and butter. It seems we’ve been ushered into a new era where the friend you relied upon has become the foe.