Baidu, one of the biggest internet giants in the world and China’s top search engine, recently released its hotel ads product across multiple platforms.

NB: This is an article from Koddi

This new product, called “Aladdin,” bears a lot of resemblance to Google Ad’s Hotel campaigns. Will Aladdin bring a whole new world to the APAC travel industry? Let’s dive in and find out what makes this product unique and compelling.

Multiple Channels for Publishing Due to Baidu’s Platform Diversity

Similar to Google, Baidu has its own ecosystem to operate on multiple touchpoints. The channel options range from search, to map, to a one-stop lifestyle app, where millions of active users browse for information tailored to their needs. There are three Baidu platforms on which you can find Aladdin:

- Baidu.com: The largest Chinese search engine with over 660M monthly active users and more than 161M daily active users.

- Baidu Map: Similar to Google Maps, a desktop and mobile web mapping service application with 300M monthly active users and 80B location-based service queries per day.

- Baidu Nuomi: A multifunctional lifestyle app with 70M+ monthly active users, providing location-based services such as entertainment, transportation, hospitality, travel, etc.

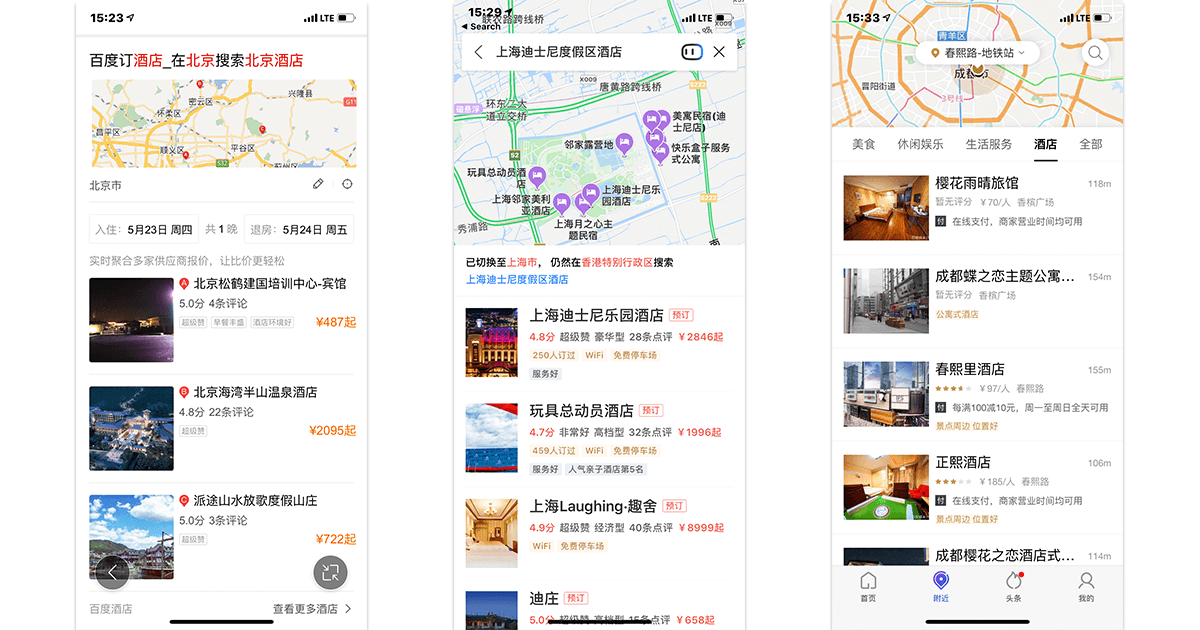

(Left to right: Baidu.com, Baidu Map, Baidu Nuomi)

Unique User Flow and Bidding Method

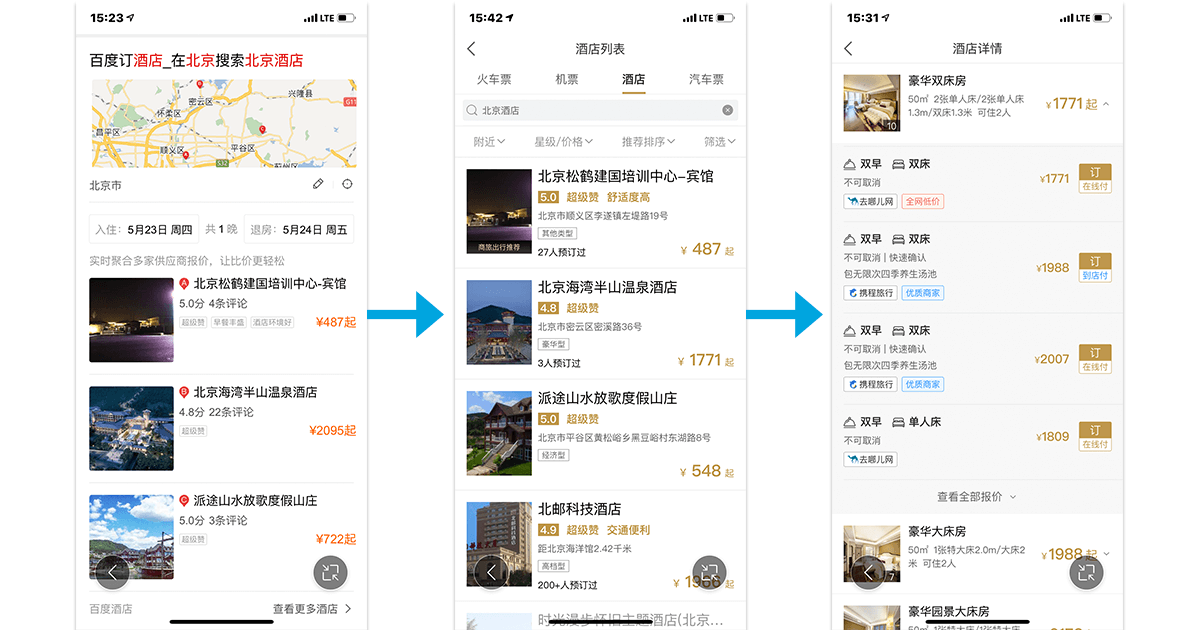

Unlike the majority of metasearch products where advertiser listings are triggered by a hotel search, Aladdin has developed a distinctive user flow. In the screenshot below, you can see that the advertiser listings are not displayed until users click onto the exact hotels and room types they are looking for.

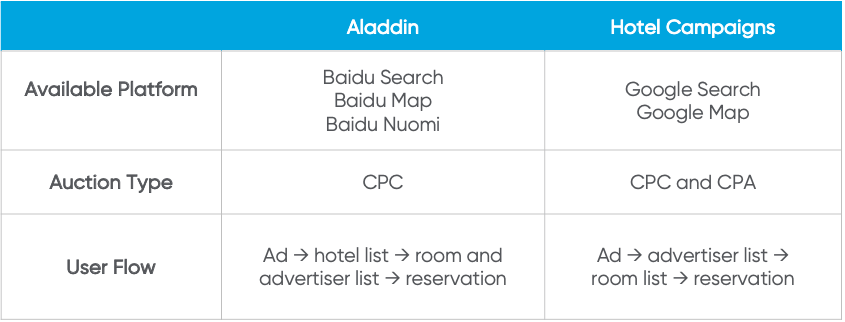

Here’s a side-by-side comparison of Aladdin and its counterpart in Google Ads. Other than the user flow, another difference to note is that even though Aladdin uses CPC-based bidding, Baidu only accepts bid changes once per month with no bid levers available for strategic targeting. Therefore, the current Aladdin auction is more of a CPA and CPC hybrid bidding type, instead of the traditional CPC bidding familiar to most advertisers.

What’s Next for Aladdin?

At the moment, we believe Aladdin is still in the incubator phase. So, what can we expect from the product on its way to maturity?

Expansion to Other Channels within the Baidu Ecosystem

As participation with Aladdin grows, we believe that Baidu will open up more advertising channels to test out Aladdin’s profitability. In the future, we may see Aladdin appear in other service areas, such as Baidu Video or Baidu Knows.

International Hotelier Brands to Join the Game

With Baidu’s investment in Qunar, as well as its long-term partnerships with Ctrip and Yilong, Aladdin has an abundance of OTA participation in the APAC region. When it comes to hoteliers, they have started to integrate with global hotel groups to attract other suppliers to participate in the auction. We’ve noticed a number of key international hotel groups land on the Baidu search page. We can anticipate these players to appear in the Aladdin auction if more brands are willing to embrace the Chinese market to increase global exposure.

Optimized Mobile User Experience

Koddi data shows that mobile represents a larger gap in opportunities and bookings, compared to desktop, when it comes to the APAC market. As the largest metasearch engine in the region with a great number of mobile app users, Baidu constantly updates its mobile interface to optimize the user experience. We expect they will continue to enhance its mobile service to engage users to interact and convert via Aladdin.