Travel is back. But this isn’t just a return to ‘normal’; research is indicating this is the year of ‘revenge travel’ and making up for lost time.

NB: This is an article from Triptease

It seems the pandemic will have a lasting psychological effect on the consumer attitude toward travel, and the positive value it provides. So, what’s changed? What do hotels need to understand about the market in 2022? Here’s everything you need to know.

Subscribe to our weekly newsletter and stay up to date

Customer spending & demand is up

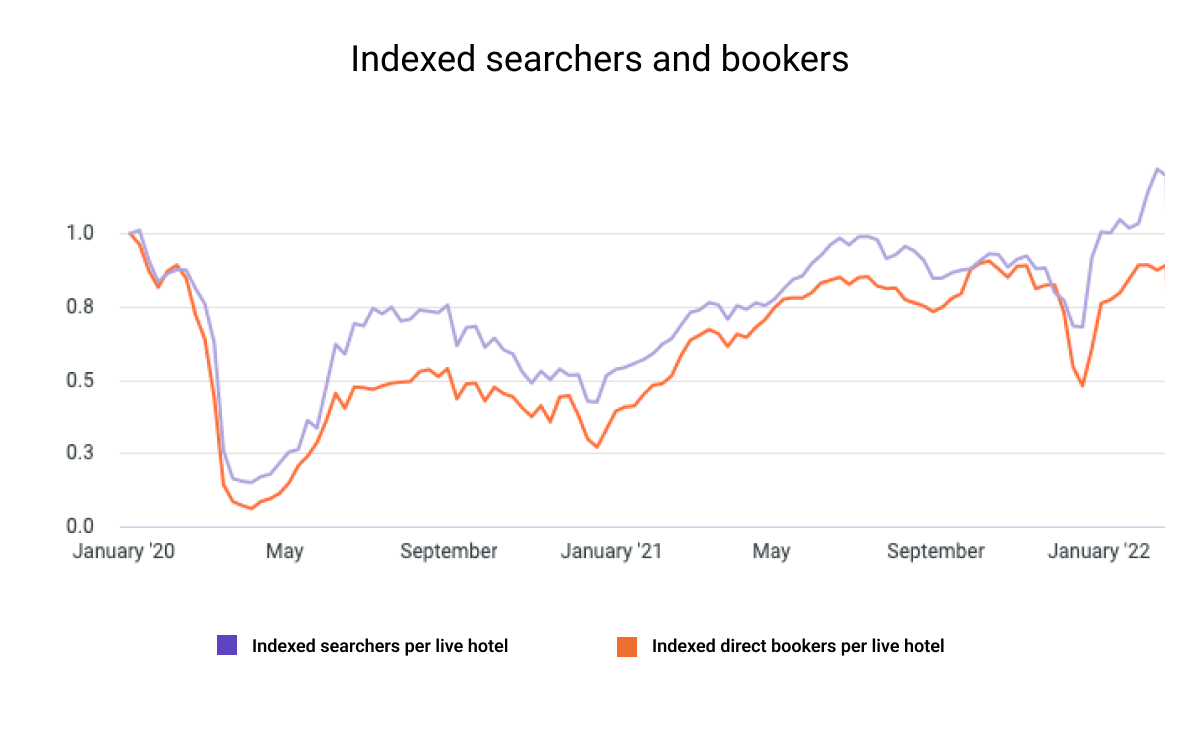

Looking at real booking data from Triptease’s global hotel database, we can see that the number of people searching on hotel websites is now well above pre-pandemic levels, with bookings close to 2019 levels too.

Additionally, it seems that customers aren’t just booking more, they’re booking bigger. After so many cancelled plans, travel companies are seeing a surge in ‘once-in-a-lifetime’ trips that travellers are willing to spend big for. Some 70% of leisure travelers in major countries — such as the US, the U.K., Canada, Japan and Spain — plan to spend more on travel in 2022 than they have in the past five years.

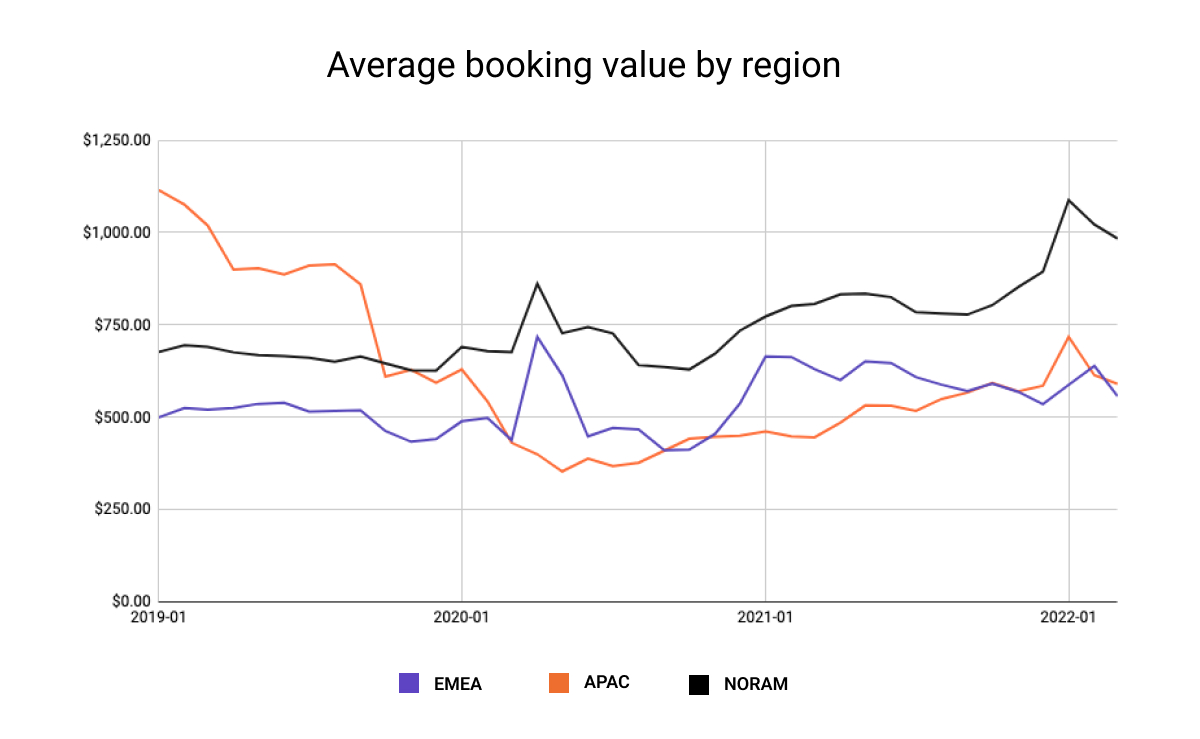

At Triptease, we’e seeing a marked rise in Average Booking Value (ABV) across all regions. While in some parts of the world such as APAC and EMEA (where Covid-19 is still impacting customer confidence and ability to travel) that uptick is a little slower, in NORAM it has skyrocketed. And as the pandemic continues to recede globally, we can expect the other regions to catch up.

Google Search Trends are rising

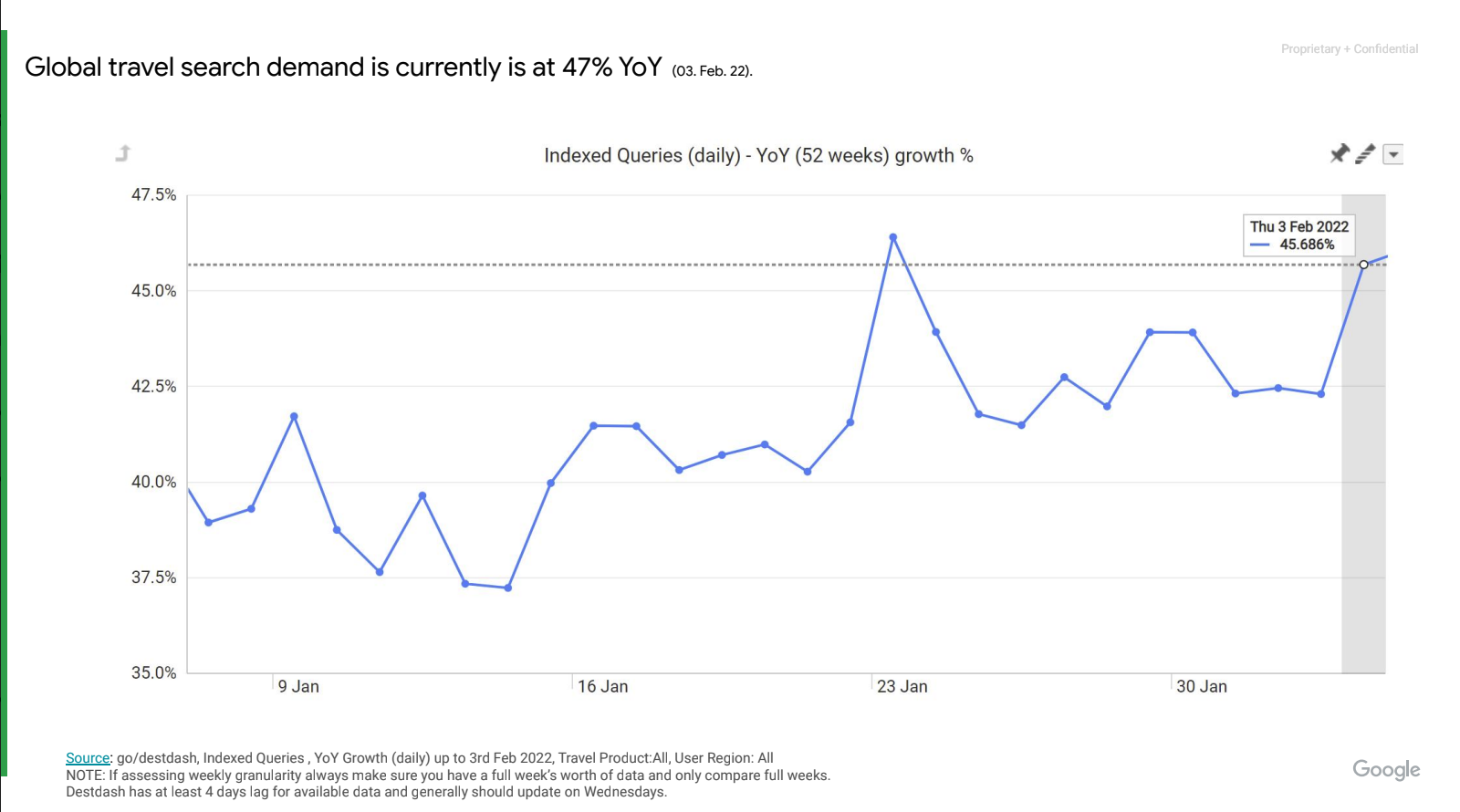

And how are people searching for, planning and booking these trips? It all starts with Google.

Looking at data shared exclusively with Triptease, global travel demand is showing a steady increase in queries year on year, currently at +47% – making this channel more important for traffic acquisition than ever. Europe is at +70%, with the highest YoY growth verticals being: ‘City breaks’ +213%, ‘Air travel’ +144% and ‘Holidays’ +140%.

However, increased searches are also driving up the cost per click on paid search advertising globally: currently up +50% YoY. This means that, while Google presents the greatest opportunity for hoteliers to attract direct bookers, it can also become expensive if not managed properly. Does this mean the winners on Google can only be those with the biggest budgets? Not necessarily. Smart bidding can make a smaller budget go a long way if you know how.

Online Travel Agents (OTAs) are investing heavily

OTAs are well aware of these increasing costs, and are allocating budgets accordingly.

Since the start of this year it’s been announced that Expedia Group’s sales and marketing spend will increase 150% year-on-year to $1.3 billion.

Booking Holdings investment in marketing also saw significant growth at the end of 2021, almost doubling year-on-year to $1.38 billion in Q3. CEO Glenn Fogel said the company was benefitting from performance marketing channels, such as search engine marketing and display advertising – indicating this is where spend will be focused for them.

An unparalleled opportunity for hotels

Even though competing with these astronomical budgets may seem daunting, it’s important to remember that it’s an overall positive trend for the industry. If OTAs weren’t confident in a full recovery, they wouldn’t be investing so heavily. Overall, this is a good prognosis for everyone.