There is increasingly less doubt about the importance of Google Hotel Ads (GHA) as the fastest-growing metasearch engine, and it already attracts over 60% of all investment in metasearch.

NB: This is an article from mirai

And Google continues to move forward at a giddy pace, surprising us every now and again with new and significant developments: Book on Google, including through Google Assistant, Google Travel, enhanced interface and filters, Price Graph, Room Clustering, etc., together with another functionality that was launched a while ago but is still very little known: the Room Booking Module (RBM).

What is the Room Booking Module or RBM?

RBM is an extra section that Google has added below the hotel prices shown for specific dates which includes photos and features for all the different room types in the hotel and allows users to begin a booking for any one of them directly from the module itself.

Unlike standard Google Hotel Ads results, users that click on the RBM are redirected to the Book on Google (BoG) process, meaning that RBM is also the first Google functionality that requires participation in BoG to use it.

Participating in RBM also involves uploading more content to Google. In addition to prices, RBM also requires photos, cancellation policies, meal plans and descriptions of each of the rooms and rates.

These content requirements and the dependence on Book on Google means that there are only a few OTAs that are using the module, making it a great opportunity for hotels to increase the visibility of their direct channel. Surprisingly Booking.com does not yet appear in the Room Booking Module, although Expedia is already using it. Whenever any other competitor appears, the hotel website normally appears in first position, ahead of all the rest.

Preliminary analysis of the Room Booking Module performance

There is very little research available on how RBM works and its potential, so at Mirai we have analysed all of our aggregated RBM data for the second quarter of 2019 and these are the conclusions:

- Greater visibility. Impression share (the number of times that the direct channel ad appears) for RBM is 16% higher than for Hotel Ads due to the reduced competition from other bidders.

- Worse click-through rate (CTR): the CTR for RBM is 74% lower than standard Hotel Ads, possibly due to the current location of the module below the basic GHA section with the channel and price comparisons, meaning that it is sometimes difficult for users to find. We have just found out that Google is currently testing different locations for the module to improve the CTR. Koddi talks about it in this post.

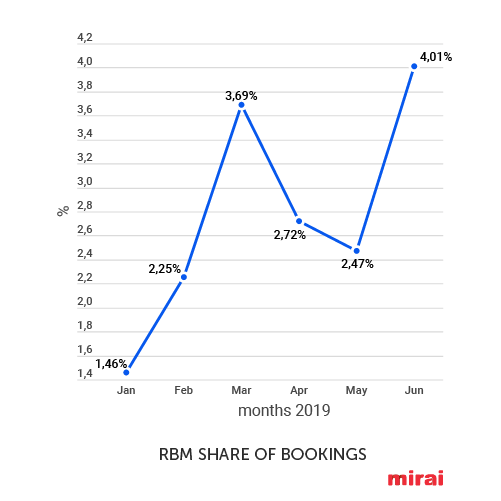

- More incremental visits. RBM is responsible for almost 4% of all Google Hotel Ads visits in June, clearly trending upwards after starting the year with 1.5% in January.

- Top position. One of the most interesting surprises for the direct channel is that the average position of hotel ads in RBM is 1.001, almost unbeatable.

- Lower cost per click (CPC). Limiting the analysis to hotels that use the CPC model (most hotels prefer the 10% commission model), the average cost is significantly lower in RBM: 47% less.

- Higher conversion rates. The conversion rate varies wildly depending on whether it is a domestic sale (to users in the same country as the hotel), for which RBM converts at practically the same rate as standard GHA, or an international sale (to users in a different country to the hotel) for which RBM conversion rates are 25% higher.

- More bookings. In June, more than 4% of total bookings from Google Hotel Ads came from RBM. This number has been growing steadily since the beginning of the year.

- Lower average booking value. RBM is currently performing worse than standard Hotel Ads, with a 19% lower average booking value in June. The trend we have seen, however, is positive and getting better every month.

- Greater profitability. Obviously hotels that take part in the 10% commission programme have a ROAS of 10 in RBM. For hotels that use CPA or CPC formulas, the profitability of RBM is double that of standard GHA.

Conclusion

It seems fairly clear that RBM is a good way of increasing direct sales for hotels.

- It is an additional “showcase” for the hotel to extend its direct sales opportunities. It’s not a matter of replacing standard Hotel Ads with RBM, but rather of adding an extra space to Google results.

- There is much less competition, meaning higher visibility at a lower cost.

- Campaign profitability improves for hotels that use any model other than the Google GHACP commission model.

- It increases the number of direct bookings. A very attractive increase from the moment you activate RBM with a single click.

Given that at all of this is based on last-click attribution, all these numbers could grow even more if we look at assisted conversions, raising the potential of RBM to even more relevant levels.

We should not ignore possible “cannibalisation” between RBM and Hotel Ads. We have no data on this, but it’s something that might well exist. The question, however, should be more whether the sales generated by the two systems combined (RBM plus Hotel Ads) adds up to more than that of Hotel Ads on its own, and everything seems to point towards the fact that it does, making it fairly clear that the Room Booking Module has a high incremental impact.

We cannot see any reason for not activating the Room Booking Module and plenty of reasons to do so. Contact your Google Hotel Ads provider and ask them to activate your hotel as soon as possible.