As every month, 123Compare.me publishes the results of the World Parity Report, a monthly tracking that analyzes the evolution of price parity in the global hotel industry.

Subscribe to our weekly newsletter and stay up to date

For April’s edition of the WPM, we focused specifically on whether a hotel’s price position relative to its local market average reflects different pricing strategies.

SUMMARY

- The lose rate increases when a hotel’s price is above the market average.

- This effect is more pronounced in independent hotels, which are also more exposed to price aggressiveness from non-major OTAs when their prices exceed the market average.

- The average direct price from January to April 2025 was 6.3% higher than in the same period of 2024.

- Direct prices increased steadily from January to April 2025, mirroring the pattern seen in 2024.

1. BML Average

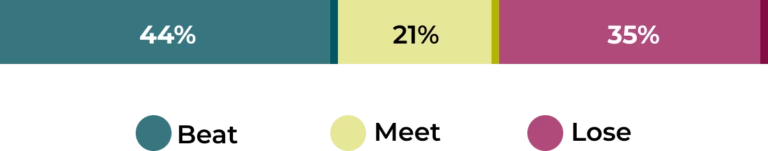

April’s BML reached 35%, representing a 5-point increase compared to March, as shown in Graph 1:

Graph 1. Average | April 2025 | Beat, Meet, and Lose

Source: World Parity Report | April 2025

When comparing the hotel’s direct rate to the best available OTA offer, we see that in 75% of cases at least one OTA displays a lower price than the hotel’s own website.

2. Most Aggressive OTAs

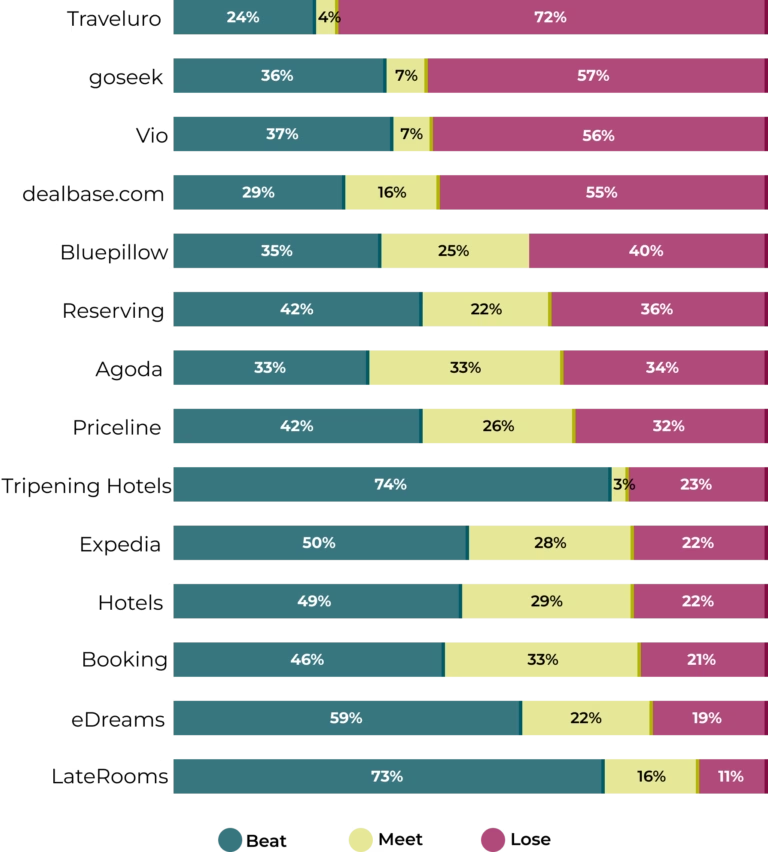

Regarding OTA pricing strategies, the major groups – Booking and Expedia – continue to apply less aggressive pricing tactics compared to other intermediaries (see Graph 2).

That said, Expedia breaks from its earlier trend and surpasses a 20% lose rate again this month.

Graph 2. OTAs and Metasearch Engines with the Most Aggressive Pricing | BML | April 2025

Source: World Parity Report | April 2025

3. Changes in Pricing Strategy Based on Market Price Levels

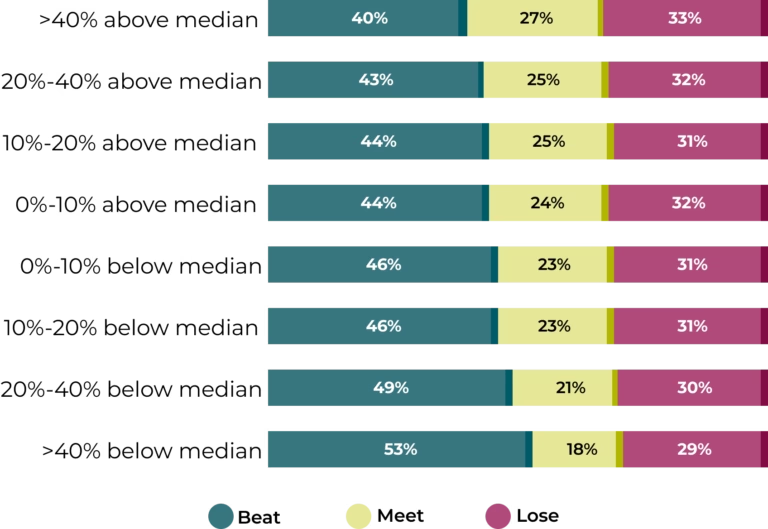

Overall, the lose rate increases as the hotel’s price rises above the local market average (Graph 3).

Graph 3. BML by Price Segment: Major vs. Other OTAs

Source: World Parity Report | April 2025

4. Who Becomes More Aggressive at Higher Price Levels?

Major OTAs do not significantly increase their price aggressiveness when the hotel’s rate is above the market average – their lose rate remains relatively stable across all price segments.

In contrast, the direct channel becomes more competitive in lower-price segments (with higher beat rates when hotel prices are below the market average), while meet rates increase in higher-price segments (Graph 4).

Graph 4. BML by Price Segment: Major OTAs

Source: World Parity Report | April 2025

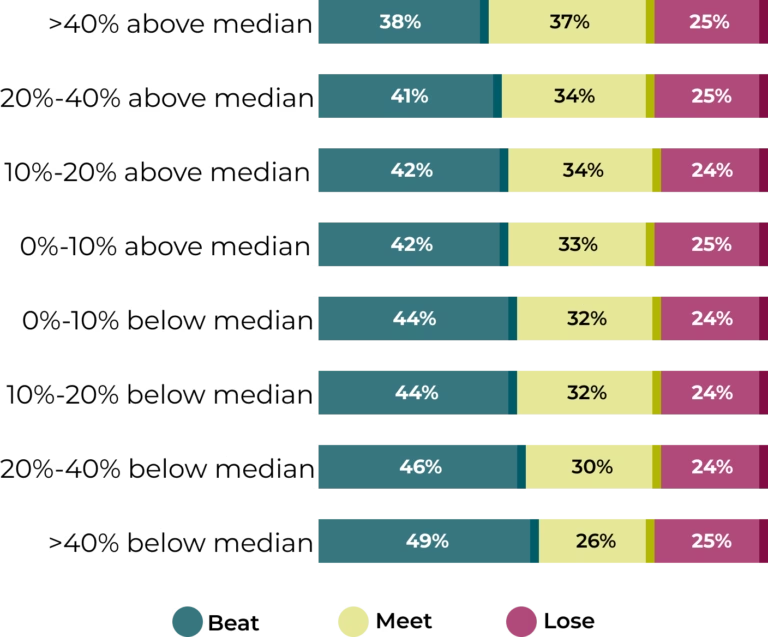

Non-major OTAs, however, show a different pattern: their lose rate increases notably when hotel prices exceed the market average (Graph 5).

Graph 5. BML by Price Segment: Other OTAs

Source: World Parity Report | April 2025