Very often I’ve heard from the hoteliers legendary phrases as “We don’t work with groups” or even “We don’t accept groups”

NB: This is an article from Emanuele Mansueti of Hotelperformance

In many cases these choices can be correctly motivated, depending especially from the hotel size. To be able to accommodate groups an hotel needs minimum requirements for a good work-flow of the organization and to don’t risk to harm the guest experience of the other clients.

I am perplexed when this principle is detected by an hurried valuation and not supported by real data.

Each time we do a group quotation we have to evaluate the impact that contingent has into the date of the stay in the booking time, but also into the following selling of the reaming capacity and to the eventual preclusion to other market segments that might be more profitable.

We must also evaluate the impact for shoulder dates, the ones immediately previous and following the dates of the stay.

It might also happen that accepting a group we reach an occupancy forecast above the availability: in this case the quotation will have to consider revenues loss from other market segments that might have an higher contributory index. In this case we have to apply what is defined Group Displacement. What we must do is, indeed, a displacement of the forecast from a segment to another to don ‘t lose profit margins and the quotation will have to consider those margins that will loose from the other segments.

Not always PMSs offer accurate enough data to apply a pure displacement, or sometimes the Hotel needs don’t require to apply it. For these reasons I studied different Group Displacement models and in this article I would present you a simple one, that contemplate only the Sell Rate (BAR Rate) the Budget and the Business on the book.

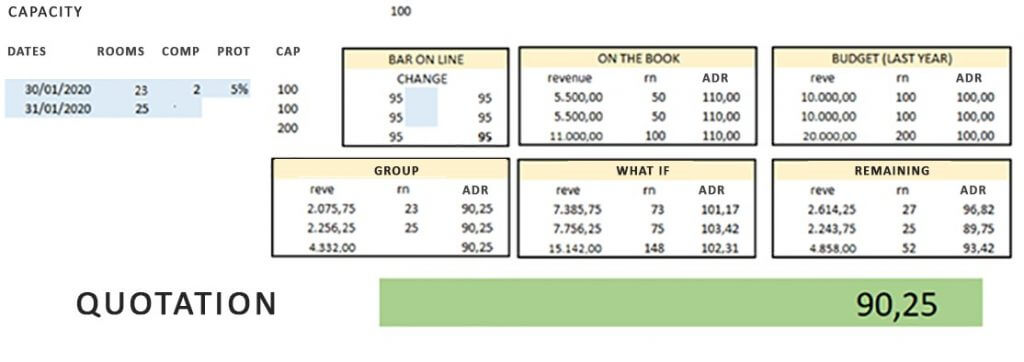

Figure 1.

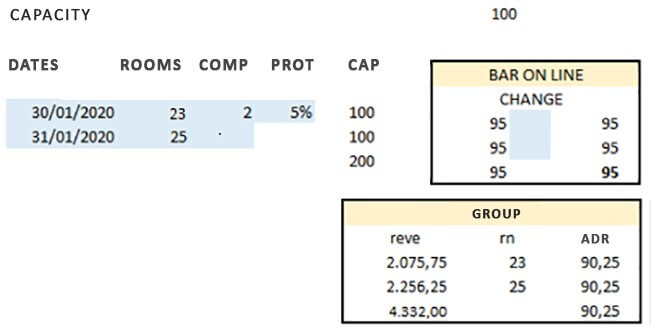

COMP: Complimentary rooms

PROT: Discount Percentage (Rate Protection) of the Bar Rate (sees point 4 of the following paragraph).

CAP: Total Capacity of the Hotel

To place an offer with this model we will need the following data:

- Online BAR Rates of the period requested

- ON THE BOOK: Revenue, Room Night e Average Room Rate

- BUDGET: Revenue, Room Night e Average Room Rate

- % Rate Protection and or Mark-up: a margin variance between the group quotation and the BAR Rate, partly determined by the degree of convenience that we want to grant the customer (Tariff Reprotection) and partly by any margin, an operator’s benefit is compensated to be retained if the rate was net of commission.

- Group Consistency

- Complimentary granted

If the hotel does not have a proper daily budget, it can take the last year result but considering some factors as Day of the week and the presence of an event or a festivity

Let’s start so to define some formulas:

We deduct the Percentage of Rate Protection to the Sell rate, to obtain a first-rate hypothesis; we multiplicate it for the number of the daily room of the group and we deduct the complimentary rooms. On this way we get the revenue generated from the group, still in first hypothesis.

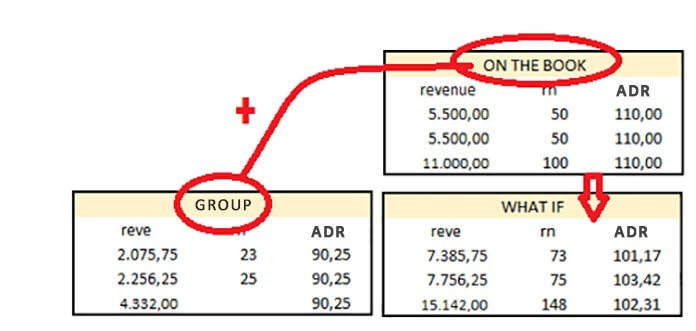

Afterword we sum the revenue and room nights generated by the group request with the On the book revenue and room nights: this gives us first scenario, so-called what-if, that shows the total result we will get accepting that group at the defined rate as first hypothesis.

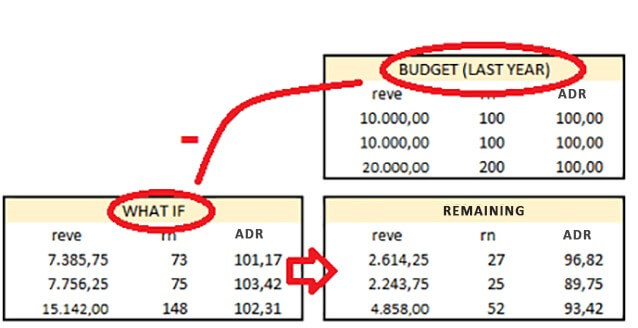

The difference between Budget and What If calculation tell us how much we miss to reach the Budget.

At this point the Revenue Manager will be called to make a series of assessments:

- Does the group price negatively affect in the average room revenue, so as to affect the result? In the example above it doesn’t, as the What If indicates an ADR of 102.31 euros, therefore above the ADR of the budget

- Do we have any extra occupancy margins compared to the budget? We therefore evaluate the hypothesis of selling more rooms even with a lower average revenue; in the specific case we will have no margin as the budget provides for 100% occupancy

- Do we have an advantageous occupancy rate or will have a displacement? Not having a forecast or an historical analysis – the Same Point Last Year (SPLY) or Same Point in Time (SPIT) – it’s not possible to answer with certainty and the evaluation is therefore discretionary, based to the lead time and the Revenue Manager Experience. In any case, from the results we can say that there are margins to decrease the Average Room Rate towards the increase of occupancy.

- Is the residual ADR sustainable for sale? It is necessary to establish whether the ADR is sustainable to achieve the Budget in terms of the market. In our hypothesis being this of 93.42 compared to the 100.00 euro of the budget ADR and the 110.00 euro of the On The Book ADR, we consider it more than affordable.

If, on the other hand, the data indicated do not match the requirements, we will have some levers to intervene on, for instance, by raising the BAR Rate on which the quotation is calculated, or by decreasing the re-protection margin or by not accepting the group.

There are obviously cases where no “plausible” quotation allows us to obtain the budget; In that case, we will have to review the budget unless we know we have other sources of alternative business.

Paradoxically – but not too much – some values must be interpreted inversely way. For example, if the Residual Turnover is negative, it means that with the acquisition of the group, under the conditions proposed by the displacement, we exceed the budget and therefore the result is obviously positive.

It is also necessary to understand that with an equal deviation of the room night from the budget, the less it is lacking in terms of Revenue and the lower the ADR required to obtain it; this actually generally means that there are more favorable conditions for a higher quote.

As you can see, this model is easily obtainable with Excel: an extractor from the PMS and a couple of macros can also allow you to make the system constantly updated but, in the absence of these, the data to be reported in the scheme are simple to obtain.

In the next articles, I will instead show you more elaborate and punctual models, based on different segmentations.