Hotel benchmarking is essential to every hotel brand’s growth strategy.

NB: This is an article from The Hotels Network, one of our Expert Partners

From five-star luxury properties to serviced apartments and everything in between. Benchmarking allows you not only to understand your hotel’s performance compared to the market but to pinpoint areas for improvement.

Subscribe to our weekly newsletter and stay up to date

Traditional hotel benchmarking, however, generally focuses on comparing rates and occupancy, providing little understanding as to how those results came to be. That is why, at THN we launched BenchDirect, the first benchmarking platform for your hotel’s direct channel. Taking a completely new approach, BenchDirect provides real-time insights so you can break down the entire booking funnel and understand your hotel’s performance compared to the market and competition.

With multiple dynamic competitive sets and covering more than 30 key metrics, BenchDirect provides you with invaluable insights to help you unravel the building blocks of your direct channel strategy. In addition to looking at overall data for these metrics from Conversion rates and LOS to Disparities and Average Booking Value, you can easily drill down on the data using filters by source, travel party, country and more!

But knowing how to analyze this data, how to determine areas for improvement, where opportunities lie and what actions to take can be baffling for even the most seasoned hoteliers. In our handy new guide, you will find real use case examples showing how hotels are breaking down the analytics and taking full advantage of everything BenchDirect has to offer.

Fancy taking a sneak peek? Let’s delve into this real example of the analysis of a hotel’s benchmarking data…

The Scene

In this use case, we are cross-filtering three key metrics of the property’s direct booking channel (website visits by visitor country rank, total conversion rate and overall revenue) and comparing them to similar hotels in the same destination. With these metrics, we will be able to identify the main source markets for the hotel’s website traffic, if these lookers are being effectively turned into bookers, and how much they spend on average.

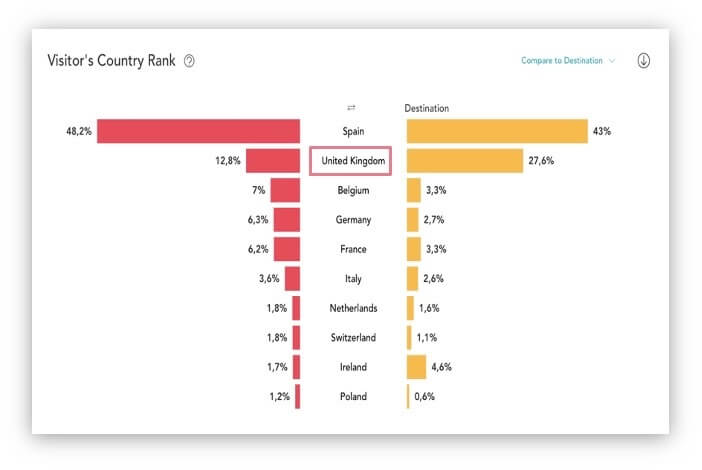

Firstly, we take a look at the visitor country rank to see the origin of those guests who are searching for a stay on the hotel’s website. Comparing the hotel’s distribution of visitors by country to that of the destination compset, we see that the UK is the second biggest source market in both cases.

Visitor Country Rank for Website Visits

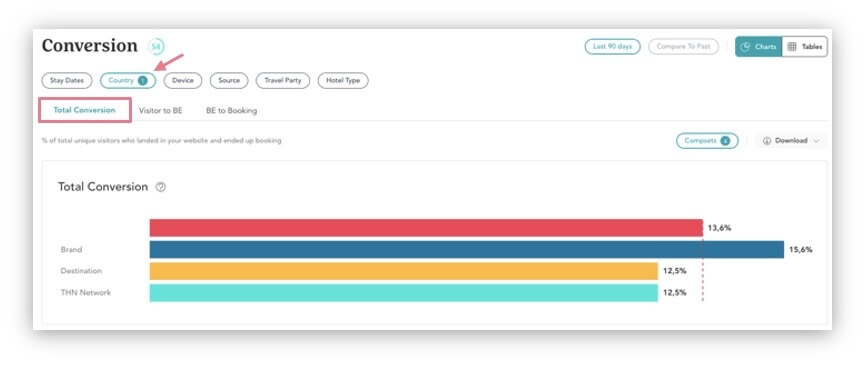

To understand more about how traffic from the UK is behaving, we take a look at the Total Website Conversion rate, filtering the information specifically for the UK market. From the dotted red line in the below graph, we can see that the hotel has a slightly higher website conversion rate than the Destination. This means that the hotel is able to convert more UK website visits into actual stays compared to other similar hotels in their destination.

Total Conversion Rate for website visits from the UK

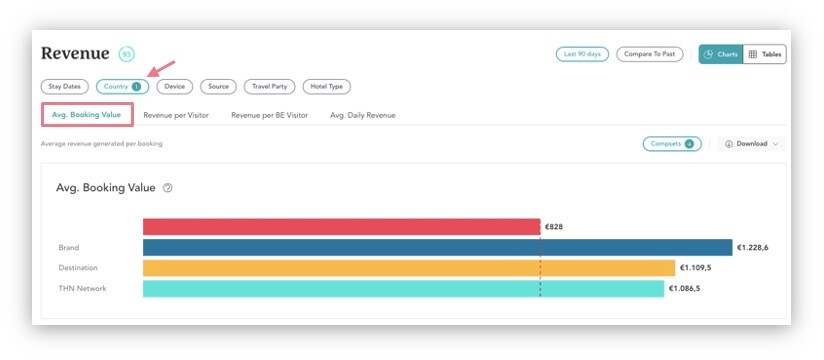

However, when looking at the Revenue tab filtered by country, we see in the graph below that the hotel’s average booking value for UK visitors is significantly lower than all 3 compsets. In other words, despite the hotel’s website being quite effective at converting UK visitors, it is underperforming in terms of the average booking value of those conversions.

Average Booking Value for website visits from the UK

The Opportunity

While the hotel is performing well when converting UK visitors into bookings, the data indicates that visitors from the UK are potentially willing to spend more on hotel bookings. There is therefore an opportunity for the hotel to adopt new tactics specifically aimed at boosting the average booking value of these UK conversions on their website.

Best Practices

Based on this valuable opportunity identified from the analysis, the hotel should look for ways to increase the average booking value of the reservations coming from the UK.

An effective way to achieve this is by tailoring the website experience for the UK market. With today’s personalization technology, it’s possible to create relevant website messages and offers exclusively for the UK market and use targeting rules to only show them to UK users. For instance, Hotel H could push UK visitors to upgrade to a higher value room type such as rooms with a sea view or suites. Alternatively the hotel could entice visitors to book additional services such as late check-out or breakfast.

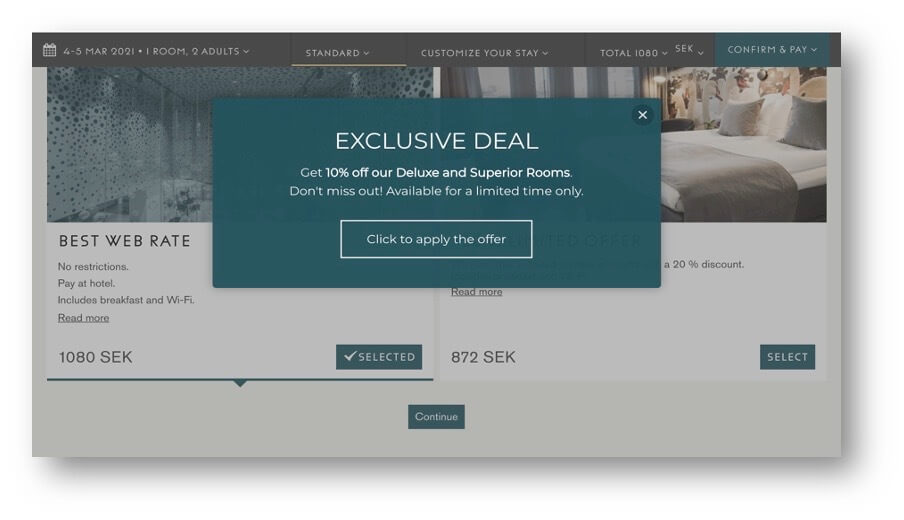

There are any number of website campaigns a hotel could do to encourage visitors to spend a little extra on their reservation, but we’re showing the example below as it has proven to be highly successful. As you can see in the image, the hotel is displaying a Layer promoting an exclusive offer for higher value room types. Shown on the booking engine and targeted towards visitors who are searching from the UK, the message format includes a 1-click promocode. This means that the offer is only applied to those visitors who click directly on the CTA (call-to-action), limiting the diffusion of the discount.

By promoting this attractive upselling deal to UK visitors, who we know have the potential to be high-value guests, the hotel can expect to be able to tempt them to spend a little more, helping to boost direct revenue.

Layer with a 1-click promo code for UK visitors

This example is just one of the eight use cases that our guide explores. By going through the different metrics, drilling down on the data, explaining how to interpret the results and sharing best practices around taking action, this guide is the perfect starting point as you embark on your hotel benchmarking journey to grow your direct bookings.

Ready to sign up your hotel to BenchDirect, for free? Be sure to join our waiting list and become part of our global network of 10,000+ hotels who are already happily benchdirecting.