How important is it to list on the GDS? And how well does the GDS perform compared to other distribution channels?

NB: This is an article from D-Edge

Subscribe to our weekly newsletter and stay up to date

To better understand the opportunities hotels are missing, we conducted an analysis of booking data from independent hotels and small to medium-sized hotel groups across Europe and Asia Pacific. We also interviewed hoteliers about their experiences with the GDS. Some of our findings may surprise you – they certainly surprised us!

As leisure travel rebound has reached its peak in most parts of the world, hoteliers are turning their attention to the corporate segment to meet revenue objectives and drive growth.

And the timing couldn’t be better. After a lagging recovery following the pandemic, the business travel segment is gaining momentum. This year, global spend is expected to increase by 11.1% over 2023 and to grow at a compound annual growth rate (CAGR) of 7.0% from 2025 to 2028. By 2028, the business segment is forecasted to reach over US $2.0 trillion in value, according to the Global Business Travel Association (GBTA).

For hotels, a key source of business travel is the GDS (Global Distribution System). In fact, about 80% of GDS bookings are corporate, whereas 20% are leisure. And business travellers are about twice as valuable to travel suppliers as leisure travellers, according to Amex GBT.

A large share of corporate travel is managed by travel management companies (TMCs) like CWT, Amex GBT, BCD, and ABC Global Services. TMCs book hotels almost exclusively through the GDS, either through their travel agents or, more frequently these days, via self-booking tools used by employees of their corporate clients. Travel consortia like Internova Leaders Network and Signature Travel Network also book accommodations primarily through the GDS.

As part of their services, TMCs source and negotiate a list of preferred vendors on behalf of their clients, sending out annual requests for proposals (RFPs) to hotels. Being listed on the GDS is the first step of the strategy to bid for this business.

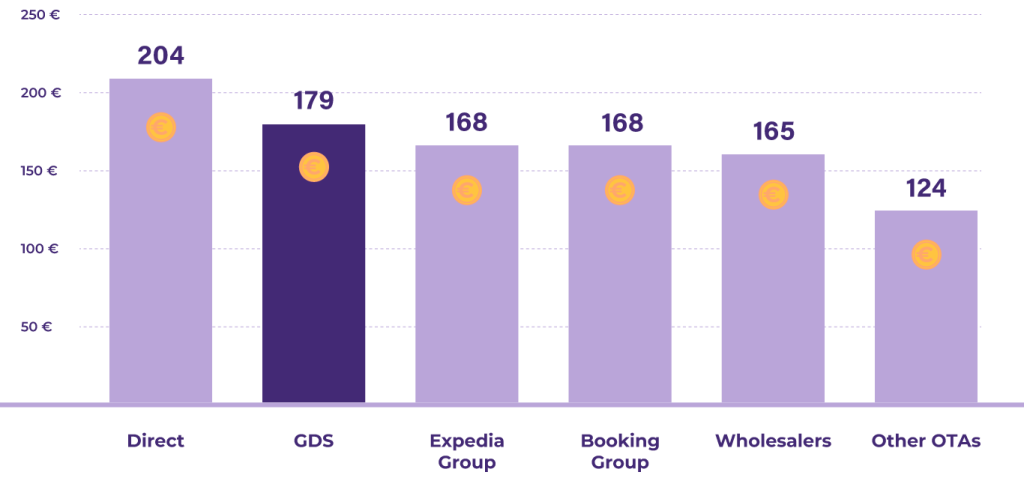

GDS Bookings have one of the highest ADR

At €179, GDS bookings generated the second highest average daily rate (ADR) during the January to May period, exceeded only by direct bookings at €204, and well ahead of OTA rates, which ranged from €124 to €168.

This is particularly significant because the majority of sales via the GDS are entry-level room types, whereas other channels sell all room categories, including premium rooms and suites.

At Platzl Hotel in Munich, a strong ADR is a primary motivation for listing on the GDS.

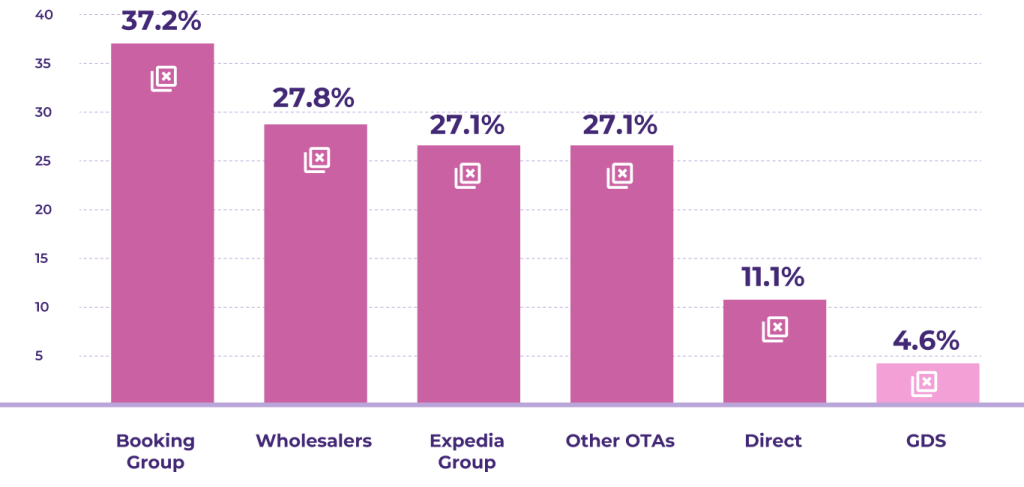

The GDS Has by Far the Lowest Cancellation Rate

High cancellation rates are a bane of the hotelier’s existence, making it difficult to forecast performance accurately and optimise occupancy. At only 4.6%, GDS cancellation rates make revenue strategy far more manageable. By comparison, the average cancellation rate for Booking Holdings was a daunting 37.2%, and for wholesalers it was 27.8%.

“For us, the cancellation rate on the GDS is definitely lower than on other distribution channels, but it depends on the guest,” said Julia of Platzl Hotels. “Our business travellers tend to book short term, so they’re less likely to cancel. And leisure travellers who go into a travel agency to plan a trip have much higher intention than on an OTA, where it’s easy to book and cancel.”

At the Evergreen Laurel Hotel, in addition to low cancellation rates, Magali likes the fact that GDS reservations are guaranteed in the event of no-shows.