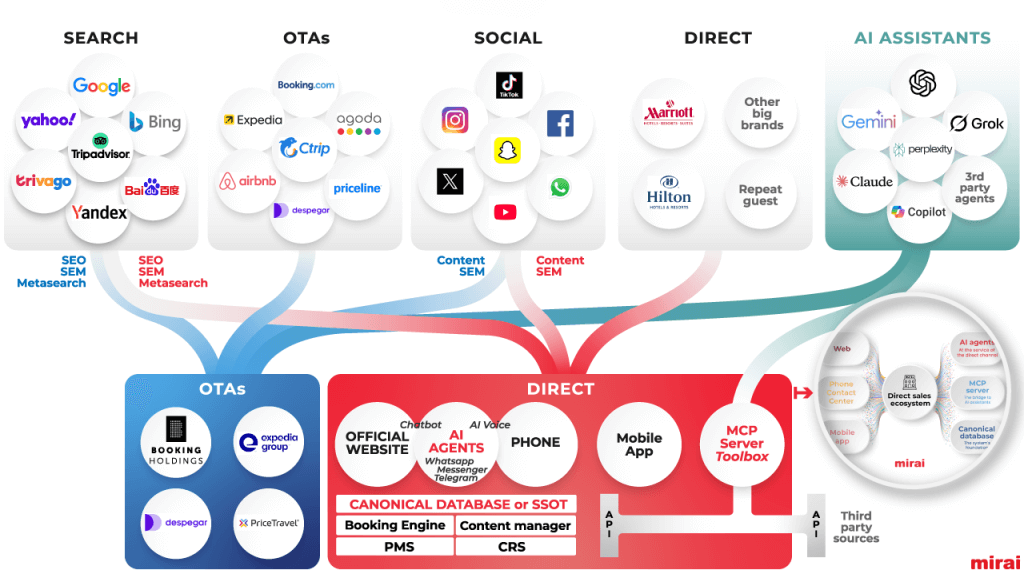

At the largest online travel conference last week, industry executive Steve Hafner was asked an unusual question: What’s the first word that comes to mind when you think about Google? “Annoying,” said Hafner, chief executive officer of Priceline Group Inc.’s Kayak business.

Hafner captured the mood well. Despite more than $15 billion in annual revenue and hefty profits, online travel agents like Priceline and Expedia Inc. are increasingly wary of Google’s encroachment on their turf. That’s lifting tension with a sector that’s one of Google’s biggest advertisers.

The two camps once lived in harmony. The travel giants appeared on top of Google’s travel search results, either by buying ads or tweaking their websites to suit Google’s algorithm. But in recent years, Google remade its search engine to show its own flight and hotel information above links to Priceline and Expedia. It launched a trip-planning app in September and sometimes lets travelers book hotels and flights. Some industry players expect more direct competition like this.

“Google has a bigger vision than just purely how much they’re making on ad revenue,” said Kayak co-Founder Paul English, who left in late 2013 and is now building a travel-concierge service called Lola.

Google’s travel executive Oliver Heckmann has the tricky job of keeping online travel agents happy while building increasingly competitive services for consumers. These advertisers need them as much as the Alphabet Inc. unit needs them, but he’s always mending fences.

“If I look at the industry, everybody is sort of collaborating and competing with each other,” he said, while dismissing concern about a larger threat. “I want to get a margarita every time I have to clarify that misunderstanding.”

Read rest of the article at Bloomberg