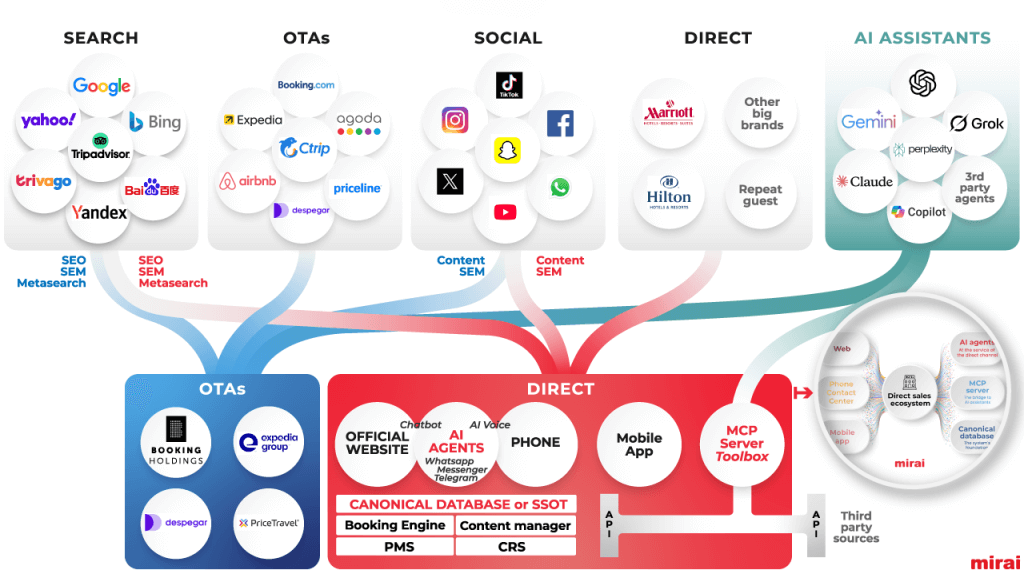

2015 witnessed heavy consolidation in the OTA space in China. So what needs to be done by hotels to balance out their distribution mix?

The pace with which OTAs have stepped up their accommodation reservation volume, coupled with consolidation featuring Ctrip, eLong and Qunar in this sector, it means the dynamics of distribution landscape is set to witness new action.

OTAs aren’t now expected to flood the market with aggressive promotional tactics. In fact, Ctrip’s co-president and COO, Jane Sun, has already indicated that competition based solely on pricing has proven to be “non-sustainable and disruptive” to the whole industry. OTAs believe that doing away with “irrational” competition, will contribute to the bottom-line and improve margins. Also, after sharing inventory with eLong “in the backend”, the plan is to capitalize on alliance with Qunar.

As for volume, the team at Ctrip managed to increase it accommodation reservation volume 50% y-o-y in Q3. For its part, Qunar asserts that momentum for hotel booking volume growth has been robust since the team started building its direct hotel network in Q1 last year. The team can handle a daily mobile volume of over 250,000 hotel room nights stayed on certain days. As we highlighted recently, Qunar’s “mobile plus hotel direct” focus remains a strong growth story. Qunar believes its growing mobile user base as well as the strengthening of its hotel content will pave way for further boost in the “commission rate” of its hotel business.

Impact of consolidation

Hotel companies, especially independent hotels and smaller chains, need to keep a vigil on how online traffic is being monetized by OTAs, and the possible repercussions on the commercial dealing between hotels and OTAs.

Around mid-2015 Qunar shared that it almost tripled volume it brings to each hotel.

So are hotels ready for a higher commission rate?

“OTA commission has not increased yet,” said Jun Miao, Senior VP of Operation and Sales, Homeinns.

However, Miao admits that from hotels’ perspective, the consolidation among OTAs will “partly increase pressure when negotiating price with OTAs.

Miao mentioned that the impact would be more profound on small/ medium-size hotels. “Due to the lack of self-owned channels, (these) hotels depend more on OTAs to supply customers. For them, the biggest possibility post OTA consolidation will be increase in commission.”

Overall, Miao expects OTAs to be more unified and their ability to bargain with hotels will also improve. “However, (the alliances) will reduce vicious competition among OTAs, thus stabilizing pricing, which, in fact, is good for Homeinns to protect the interests of members (loyalty program participants).” Guests can join Homeinns’ membership via app, web etc. and members receive exclusive offers from time to time. “We may offer OTAs equal treatment as our members. However, we will keep a baseline on members’ interests and reserve the best interests for our members,” added Miao, not explaining further.

For its part, for promotional activities, Homeinns group takes decisions according to the situation in dull and boom periods. “Generally, during dull periods, in consideration of flow volume, we loosen the control over rooms properly for OTAs for some activities to attract customer flow. However, in most cases, we protect the interests of (loyal) members and reduce the weight of OTA,” shared Miao.

Understanding each OTA’s strength

Each OTA is different and is positioned differently. “We use different OTA channels for sales when differentiating market and product positioning,” said Miao.

Miao explained Ctrip has advantage over others in the high-end, mid-end hotels users segments. “So our middle and high-end brands Homeinn Plus and Yitel show good sales results on Ctrip. Users of economy brands and second/ third-tier cities generally come from eLong and Qunar. For third and fourth-tier and even fifth tier cities, the package sales in Qunar and Meituan have better results.”

Read rest of the article at: China Travel News