The hospitality industry is in an unprecedented period of growth. However, this growth has not been driven by group.

NB: This is an article from Rainmaker

In the past decade, transient growth has outpaced group growth in a dramatic way. Transient business has increased 53.7 percent vs. only 7.5 percent for group business. As a measure of mix, group business has gone from just shy of 40 percent contribution to less than 32 percent. However, the news is not all doom and gloom. From an ADR perspective, group rates are growing at a slightly higher pace than transient rates (13.9% increase in group ADR vs. 12.1% for transient ADR).

These trends are creating angst in both sales and revenue teams. And all of it is leading to an overwhelming feeling of FOMO, or the fear of missing out. FOMO is also exacerbating the sometime adversarial relationship between sales and revenue management.

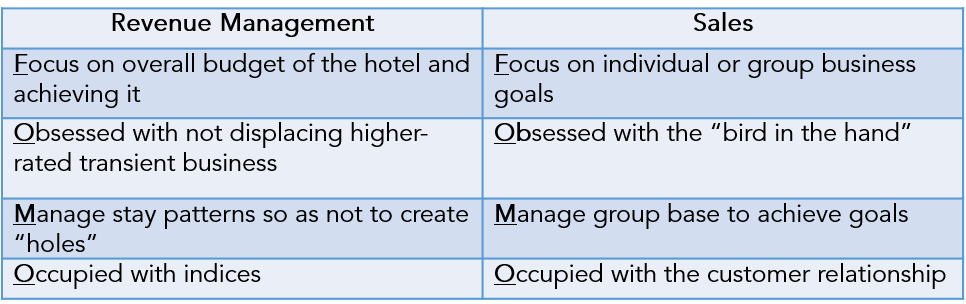

To better understand the ongoing battle, it is necessary to see the issue from both sides of the fence.

Given these contradictory goals and frameworks, how can these two teams work together to overcome FOMO and win the best business, transient or group, for their property?

How Sales and Revenue Teams can Overcome FOMO to Win Group Business

What methods can we employ to overcome FOMO? Each team will need to make some concessions and adjustments to create buy-in from the other team.

- Data must lead the way to making all strategic decisions. But first, the revenue team must be able to show the accuracy of the data. This means not only sharing the forward-looking data but also lifting the hood on the historical forecast and how the hotel performed relative to it. This practice will create trust in the certainty of the forecast. Trust will build confidence.

- The forecast must go beyond a total number for the month. To allay the fear of FOMO it is necessary to deepen the level of forecasting. It’s not enough to forecast by month and segment into transient and group. The forecast should break out by day and down to sub-segments within each of those categories. This way every member of the team can truly understand what would be displaced.

- Separate and definitely not equal goals must go away. The two teams should have comparable incentive plans and they must all be tied to profit

- The sales team needs to employ alternate date pricing for all groups. They should be prepared to price for the initial set of dates and at least two alternates dates. Ideally, at least one set of dates should be a need period for the hotel. If the sales team is effectively using the daily forecast, they should be able to determine those dates with minimal guidance.

- Both teams need to understand and agree on how displacement is calculated. And both teams need to agree upon what the acceptable level of displacement is.

- Acquisition costs need to be considered when making decisions on both sides of the business equation. All business is not created equally and profit should be considered when determining the true value of the business.

- Profit across all spend is the final component. Too often we skew to group business because of the ancillary spend. However, if you understand the ancillary spend of your transient guests it might be they are spending an equal amount daily plus bringing in a higher daily room rate.

Forecasting: Say No to FOMO

Forecasting is about more than what you will do. It is also what you can do (unconstrained). Understanding demand at a granular level will help you better manage the flow of business.

Most revenue managers have a strong feel for what transient demand will be. Where the sales team can be of help is by providing them the tools to understand group demand. Often sales teams don’t enter all leads into their sales and catering platforms. They stick with entering the hotel leads they feel certain will convert. This doesn’t provide a true understanding of the demand for group. By entering all leads, hot or not, into your system, revenue managers can begin to understand the demand for group which will lead to more accurate forecasts and better rate recommendations for groups.

Lead time is another important metric. Since groups typically book much further out, knowing the true demand will help both teams make better decisions on when to take a chance on groups and when to take a pass.

Monitoring pace and pickup as two separate metrics for both group and transient business will provide both teams with an understanding of how transient business is building as well as how groups are performing. Additionally, by tracking the pickup of groups, both teams can work together to reduce blocks earlier thus giving inventory back to the transient side while there is more than enough time to sell those rooms.

Two final notes: first, forecasts are not static items to be set and forget. They need to be updated regularly (at least weekly). Second, they need to be communicated to all key stakeholders. This keeps everyone on the same page and equally accountable.

By adopting these practices, the sales and revenue teams will be unstoppable. With these two functions in alignment, and the right data metrics in place, you will capture the best business, group or transient, to ultimately increase your profits.