Imagine that you’re reviewing your RMS’s recommended prices before the system automatically deploys them, and something seems off.

NB: This is an article from Duetto

Your best rooms have been selling out quickly, leaving little room for last-minute transient business that could boost profits. You’ve also noticed that business travel seems to be returning in spurts, forcing you to think about whether your pandemic-revamped segments would benefit from a reboot.

Subscribe to our weekly newsletter and stay up to date

You mention your concerns during a team Zoom with sales and marketing. Revenue numbers look amazing compared to the heart of the pandemic and comparable to years past, so you get a lot of blank stares. You recently noticed that your reviews have been gradually trending lower since you re-opened, and resources have been an issue – with 100% of your rooms open to welcome back guests, you’ve struggled to hire and retain customer-facing staff. Your two college-age kids helped out during the summer, but they’re back in school.

Even with the incredible boost that intelligent, automated RMS tools can provide, you can’t ignore potentially business-deflating trends that could remain (or be created) when you turn on system automation. ADR looks good, but your Total Revenue Per Occupied Room (TrevPOR) is trending downward, which could be the result of several factors – perhaps your three-star onsite restaurant hasn’t re-opened, for example, or you’ve made some safety-based decisions to reduce the number of rooftop bar and pool guests at any given time.

Your RMS should be tracking all of this and making appropriate adjustments to help you survive. Still, you’re worried about stagnant room type and segment definitions and contemplating overriding your RMS’s suggestions for premium room types until you can get a handle on how to adjust to shifting demand and uncertain staff availability.

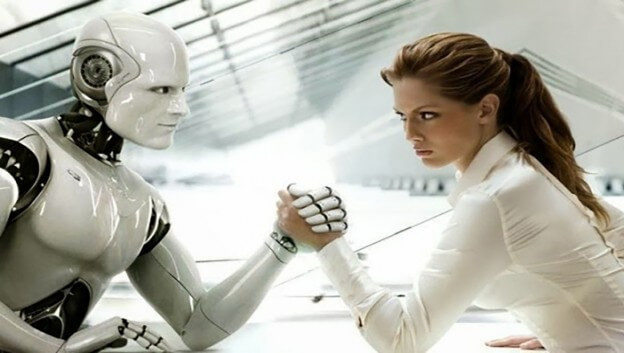

Human vs. machine: collaboration or conflict?

The “intelligent revenue management application” concept is founded on the premise that analytics – more specifically, AI and machine learning – can help hoteliers fill rooms at optimal prices, all of the time, even in unpredictable conditions. Meanwhile, RMS vendors selling the promise of increasingly-intelligent analytics and optimization, are unwilling (or unable) to show what’s inside their algorithms. Somehow they serve hotels of all shapes and sizes on automated, black box virtual brains that can out-think revenue management experts.

Nothing could be further from the truth.

From a Gartner blog: “Through 2022, only 20% of analytic insights will deliver business outcomes.” The hotel industry can relate – clearly, RMS systems typically fall short in several areas if left to their own devices:

- No two hotels or brands are created equally. While RMS vendors increasingly tout the number of data sources within their algorithms, some of these data points (e.g., competitor pricing) may not be relevant to your specific business. If you have the #1 or #2 ADR rank in your comp set, your algorithm doesn’t necessarily need to look at what everyone else is doing publicly – clearly; you’re already doing it better.

- Most algorithms are still built around fixed price points by LOS and discounts. Unless your algorithms independently yield each segment, channel, and room type according to changes in demand, they’re not providing you the best possible price, every time, based on unconstrained demand and your business requirements. When your supply is fixed, demand shifts should raise or lower your prices. If and when you desire to flex your business (reducing occupancy to account for workforce constraints, for example), your RMS should adjust accordingly to account for the impact on your pricing distribution strategies, segmentation, room types, etc.

- Overrides can backfire – but not overriding can also backfire. All automated RMSs provide an “exit” if any of the pricing that the system generates doesn’t jibe with your strategy (or seems completely off the rails). Most pricing algorithms are naturally safeguarded to an extent, but this doesn’t mean they’ll give you the prices that will always help you more profitably fill your available rooms. In some systems, overriding will terminate the automation, which can lead to partial or full abandonment of the RMS entirely by frustrated DORMs. Seek out an RMS that learns from user overrides (effectively, machine learning), so it is more likely to price in alignment with your experience and strategy.

Is it possible, per the Gartner quote above, that RMS analytics aren’t solving the true business problem at hand? The most modern systems are tuned to deliver intelligent automated pricing based on a multitude of data points, but business strategy – and its ultimate impact on room (and other outlets) pricing – is often veering in so many different directions that analytics, left without supervision, can’t readily track.

So if analytics are making the best decisions they can, based on available data, there has to be some way to train and watch them so they (a) don’t make the wrong decisions, particularly when running in automation mode, and (b) they account for the strategies and guardrails that your business needs to not only be profitable but also to grow and differentiate your brand.