In our previous post, we examined the impact of coronavirus disease (COVID-19) on metasearch traffic across APAC, witnessing a sharp decline beginning in mid-January, before ultimately tumbling into a freefall by the end of February, when decreases were as high as 80% year-over-year.

NB: This is an article from Koddi

We noted that over the January to February time period, North America had remained relatively insulated from these trends. However, for those of us in the United States, the past 48 hours have been a whirlwind of activity related to COVID-19. Virtually all major sporting events have been canceled or postponed indefinitely, and conferences, concerts, and other large gatherings have followed suit.

With that in mind, and knowing that many of our clients are already experiencing elevated domestic cancellation rates, we took a closer look at recent metasearch traffic across the United States as a whole. Moreover, to help contextualize this travel-specific data, we sought to understand the relationship between travel searches and confirmed cases of COVID-19 in the United States. By leveraging the datasets compiled by researchers at Johns Hopkins’ Whiting School of Engineering, which aggregate reports across multiple global federal and state health authorities, we were able to demonstrate precisely how COVID-19 outbreaks impact travel searches, down to individual states within the US.

Tracing the Impacts of COVID-19 Across US Travel Search Patterns

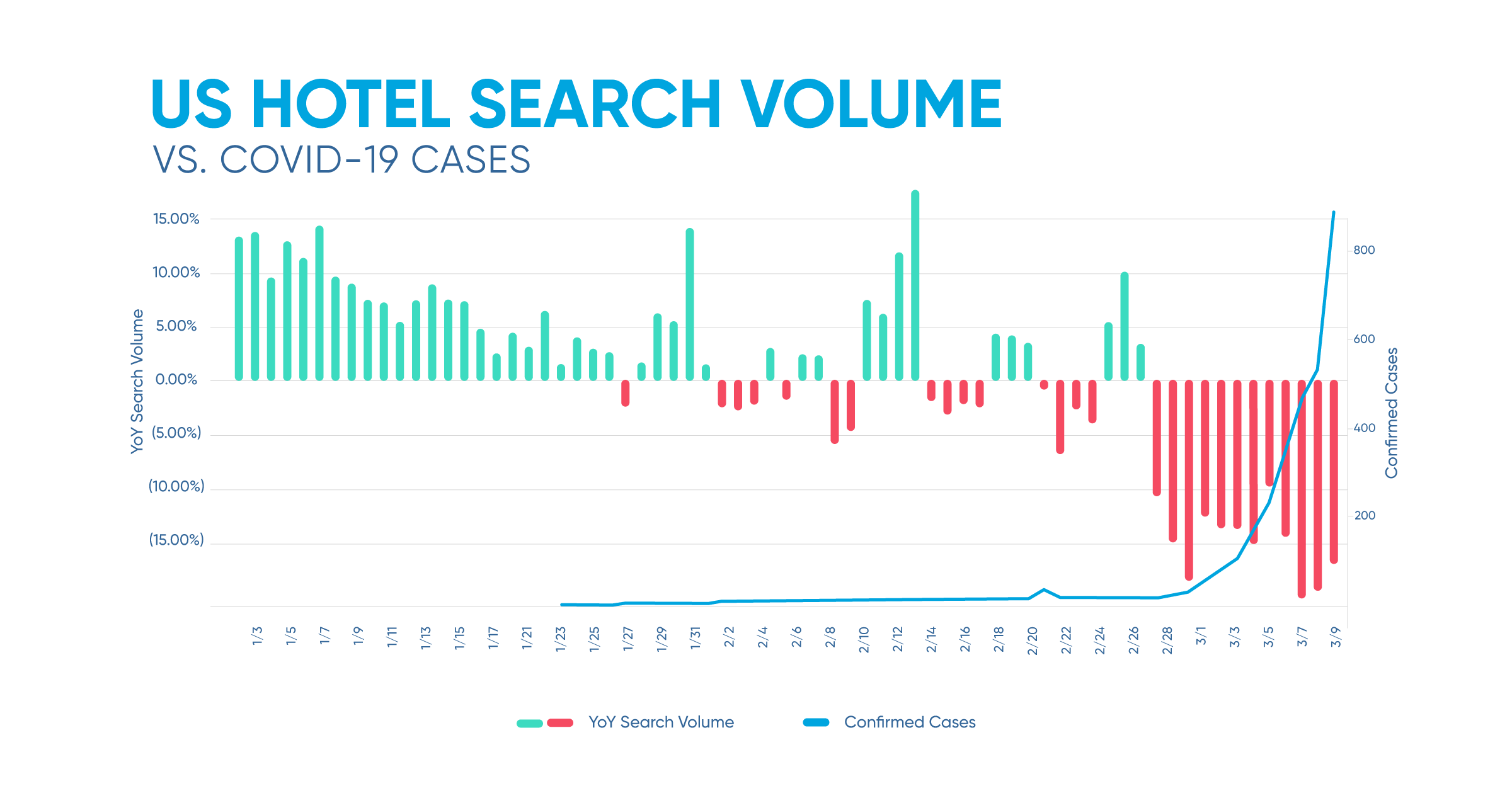

When looking at the US as a whole, a clear positive search traffic trend exists across the early portion of January, prior to confirmed cases existing within the United States. We do see a softening of that trend, however, as January closed and global cases began to escalate.

While there are strong days within the month of February, these were largely isolated occurrences. Within the US travel market, the tailwinds experienced at the beginning of January were effectively neutralized as global cases continued to rise. Most days had relatively flat traffic patterns year-over-year, and some negative comparisons were realized.

All of that changed, however, on February 28 when the World Health Organization raised its risk assessment of COVID-19 to “Very High,” the highest designation short of declaring a global pandemic – a milestone that has subsequently been reached. Consequently, US travel searches dropped 10% year-over-year, nearly doubling the largest single-day drop to date. Interestingly, confirmed COVID-19 cases in the US had not spiked at this point, remaining in double digits overall. This indicates that at a national level, decreased demand preceded the rampant spread of the virus itself. From that point on, no doubt exacerbated by the first reported death from COVID-19 on February 29th, travel search demand continued its fall across the US, sustaining daily losses greater than 10% and peaking at nearly a 20% decline year-over-year.

More Substantial Impacts Seen in States with High Amounts of COVID-19 Cases

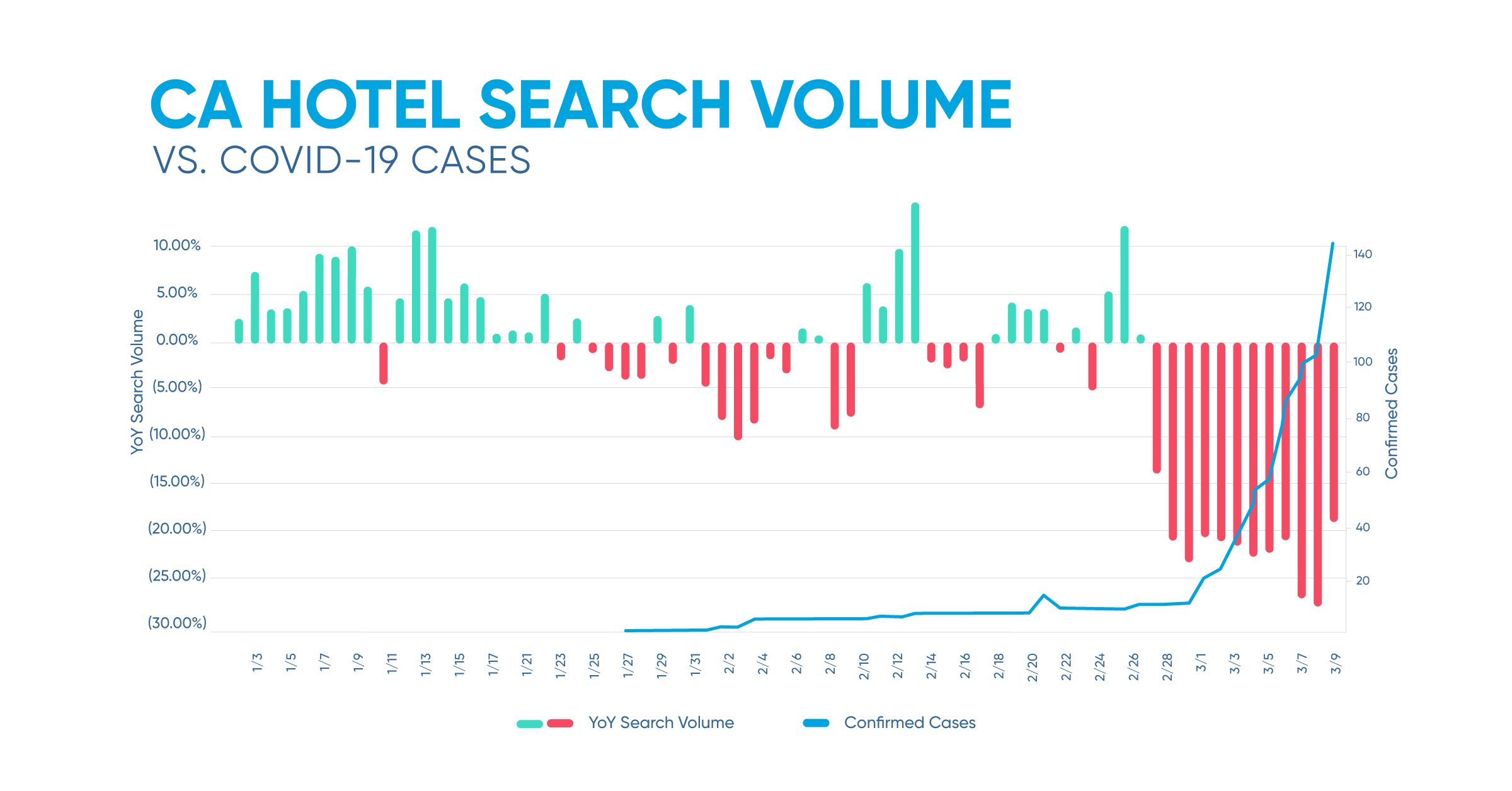

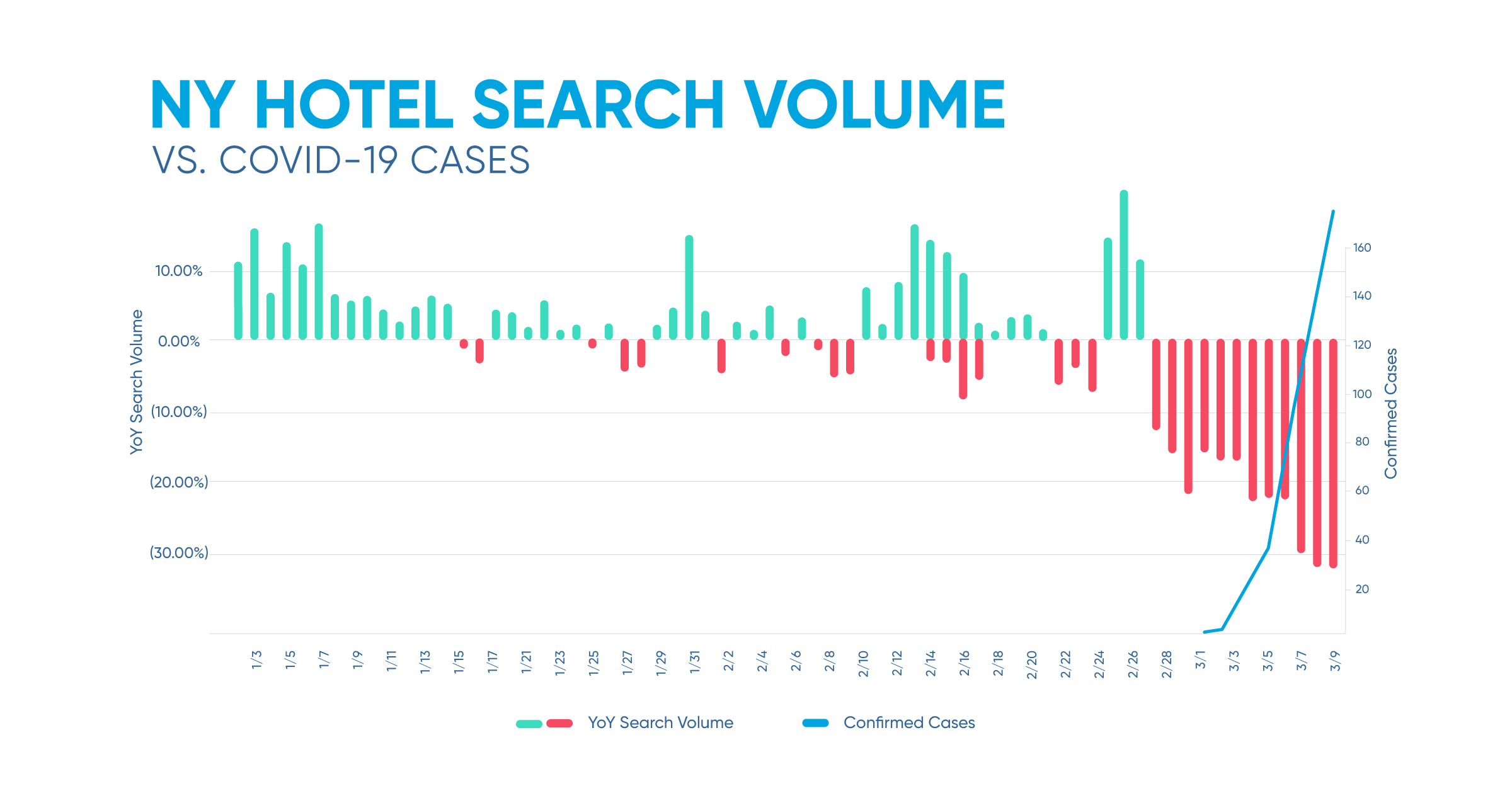

While the effects of COVID-19 on aggregate US travel searches may not reach the staggering drops we’ve reported previously in APAC, there’s still a marked downward trend that goes against the curve we would normally expect. With that said, we do know that hotbeds of COVID-19 activity have become prevalent in several key states – New York, Washington, and California. By examining these states independently, we are better able to predict the impact to travel demand across the nation should confirmed cases of the virus continue to grow at similar rates in other states across the US.

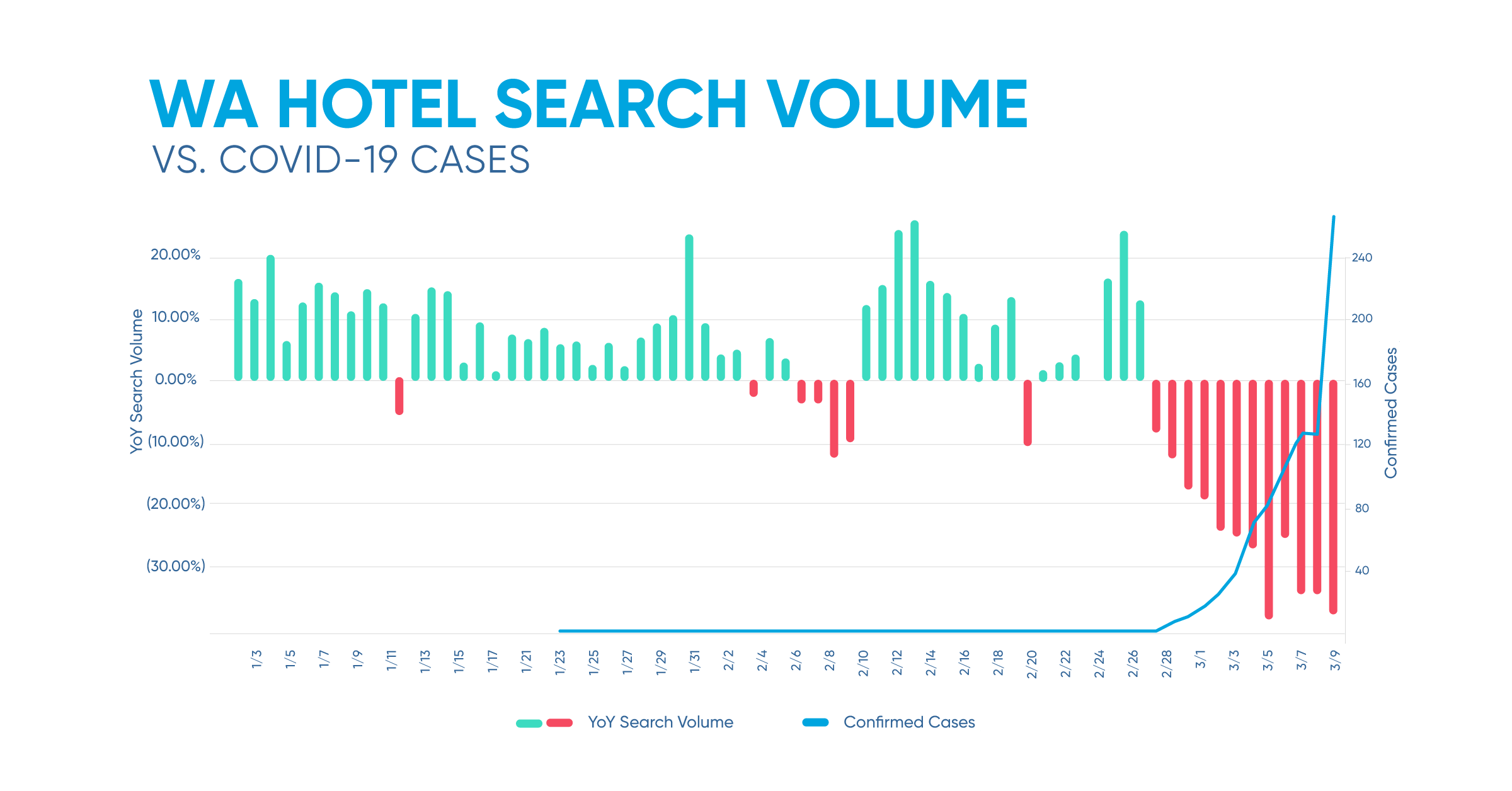

The first state to confirm COVID-19 cases in the US, Washington, has seen a widespread increase in confirmed cases – nearing 300 in total by March 10th. An interesting trend in the search data for Washington is that despite the presence of confirmed cases in Washington, search traffic was largely positive year-over-year for the majority of February, and outpaced the US as a whole. However, beginning in March, there was an abrupt change in that behavior. Year-over-year searches for Washington declined dramatically and indeed outpaced the US as a whole. Rapid drops in demand occurred in early March, peaking at a nearly 40% decrease, while confirmed cases continued to grow exponentially.

Similar trends exist for both New York and California, the other two US states leading the number of confirmed cases. Although the drops in search traffic are not as significant as those seen in Washington, they both outpace the US market as a whole by a wide margin. New York has seen sustained drops of greater than 30% for the past several days, and California is nearing the 30% mark as well.

Looking Ahead

In our previous blog post, we urged caution when making sweeping changes to marketing investment as a result of COVID-19, and we stand by that assertion today. While the overall declines in search behavior and the rise of cancelations present headwinds for all travel marketers, pockets of opportunity still exist. By leveraging advanced targeting capabilities around particular geographical markets, source markets, and stay dates, marketers can mitigate losses while maintaining efficiency throughout.