For as long as I can remember, hoteliers have focused on measuring the conversion of most key distribution channels.

NB: This is an article from Kennedy Training Network

For example, digital marketing and revenue leaders look at website conversion metrics. In other words, how many website visitors actually make a booking. Depending on what data is available from their search engine, they may also look at the number of availabilities vs. bookings.

Subscribe to our weekly newsletter and stay up to date

Hotel call center managers look at call conversion by comparing reservations inquiries to confirmed bookings. Yet for most hotel sales operations, the main metric measured is usually “total revenue sold.”

Understandably, this may be because the data points may be harder to come by because hotel sales leads for groups, functions and corporate/business travel accounts come in through a diversity of channels and lead streams. These days, one lead may even come through multiple channels. However, we as an industry can and should make a more concerted effort to measure it hotel sales lead conversion as best we can.

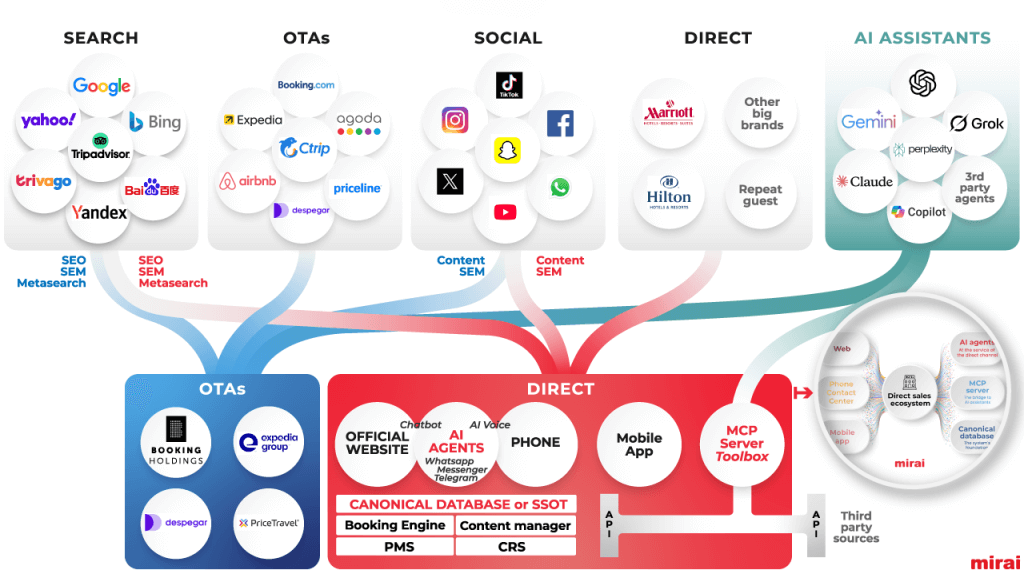

Why? First, establishing a benchmark number for hotel sales lead conversion, especially when evaluated by lead channel, can help sales leaders understand and react to the huge shift that has taken place in recent years due to the explosion of inbound RFPs. Whereas in the past, most sales leads came in by phone and then later by direct email, these days hotel salespeople are dealing with a flood of leads as online platforms like CVENT, Wedding Wire/The Knot, CVB Platforms, and brand distribution systems have proliferated.

As I’ve suggested numerous times in previous sales training columns for this publication, this industry is long overdue to update our processes for sorting, screening, and prioritizing leads. Doing so will enable our most senior sales talent to focus on the hottest opportunities, while those working in a “sales admin” type role can still sift through the sand to uncover the golden nuggets that might otherwise be overlooked.

Secondly, looking closer at sales conversion will provide a more empirical look at sales performance. When sales success is judged solely by total revenue, salespeople are sometimes incentivized and celebrated for what was simply the luck of being in an up market, where demand far exceeded forecast. Likewise, when demand is lower than expected, salespeople may be chastised for failing to meet sales goals when in fact they are converting leads at rates far higher than others. (Of course, whether demand is up or down, sales goals should always also focus on prospecting activities!)

Now, despite all the so-called advances in hotel sales software, when I conduct hotel sales audits, it is extremely rare to find anyone who is looking at overall hotel sales conversion. Or sure, some platforms will tell you how many leads from their specific channel are converting into bookings, but that number can be deceiving because it counts leads that a hotel may not even want to pursue due to the rate-ask being far too low, the dates requested being already sold, or having strong transient demand for the dates requested.

Another challenge, even for sales CRMs that do to track conversion, is that most hotel salespeople only enter leads they think they can win or that they have space/rates for, which then artificially inflates conversion.

So, what are we to do? Of course, the solution will vary greatly, and each hotel sales leadership team will therefore have to sort out solutions based on factors such as these:

- What are the primary sources of inbound leads and RFPs?

- What is our lead intake and tracking system? Do direct leads and platform notifications go straight to the designated salesperson or are they tracked at a single point of entry?

- Who decides if a lead is “qualified” and what is the basis for this decision? For example, if the lead says that dates are not flexible and we are sold out, do we go back and offer alternative dates and if so, is that considered a qualified lead or not? What if the source says they need rooms at rates somewhat lower than we could offer for their dates and they are not rate flexible; do we offer lower rates for alternative dates and if so, is that a qualified lead?

Obviously, when I consider the diversity of sales leaders who will read this article and imagine the range of lodging companies they are working at, I cannot provide guidelines in a single article. Instead, my objective is to encourage sales teams to discuss this issue and to at least get started trying to measure conversion. Get in the game now and tweak your processes as you go along.

Here’s one suggestion as a starting place.

- Start back at the main “entry point” for inbound leads. For larger hotels with a sales lead catcher role, such as a sales admin support staffer, look at the existing inbound lead tracking sheet. For smaller hotels with only one salesperson who receives all the leads directly by email (including email notifications that leads await in a platform), go back to their archived emails.

- Randomly pick a few different dates or weeks. (Depending on how many leads come in.) Try to grab as large of a sample size as reasonably possible, depending on how long you have to do this exercise. I would say at least 25, but 100 would be better.

- Sort the sample by lead source. (CVENT, direct email, brand source, CVB, Wedding Wire, etc.)

- Then search your sales & catering software and/or your PMS system to see if each lead went definite.

- Then divide the number of bookings by the number of leads. (Example: 15 bookings out of 100 qualified leads = 15% conversion.)

This exercise will at least get you in the game of measuring sales lead conversion, and by doing so you will gain insights into how to start a process to better measure conversion going forward. Ideally, you can use your sales and catering CRM but, if necessary, at least get started with a simple tracking form built in Excel.