On April 20, 2022, Kristi White presented to the industry a deep dive into its quarterly Meetings Recovery Forecast.

NB: This is an article from Knowland

While there is a lot of data to digest, the good news is that the industry is recovering, some markets faster than others. Those who are most productive, and taking advantage of technology to ensure their sales teams have the proper tools, are definitely seeing an uptick in capturing new group business.

Subscribe to our weekly newsletter and stay up to date

Let’s start at the beginning of 2022

The beginning of the year started off a bit rocky. January realized a dip down from December of 2021, which is unusual under normal seasonality patterns. Typically, we see around an 11% increase from December to January.

However, this year we realized a 17.8% decrease. This is related to Omicron and we saw an immediate correction in February with a 43% increase over the prior month. The average before the pandemic was 4.5%.

March was an even bigger increase as the month-over-month increase moved to 57% compared to a normal increase of only 13%. The long and short of these numbers is the increases for February and March were robust and recovered, for most markets, enough to wipe out any losses incurred in January.

Looking at it from a capture perspective, March achieved 64.7% of 2019 volumes which is the highest we have seen a single month since the world went sideways. For the full year, recovery is sitting at 49.4% which is up from the full year of 2021 at 39.3% recovery. Another long story short, recovery is moving ahead and it’s accelerating over the past two months.

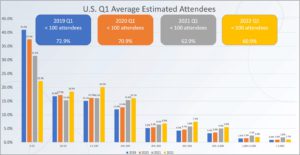

Looking at the Size of Meetings

As we look at the size of group meetings, for the most part, the metrics are mostly recovered. One category where there is a gap is in the under-25 category. In 2019, the numbers were dramatically higher than in 2022. These tend to shift across quarters.

However, this shift is good because the meetings shifted into the slightly larger categories. This is another sign of recovery because it shows people are getting more comfortable meeting in larger group numbers.

Another reason this doesn’t concern us is because at the end of last year, these numbers were frighteningly similar. However, across the year, we expect there will be some fluctuations as companies return to meeting and perhaps go slightly bigger than we saw in 2021 but they return to normal meeting cadences.