Knowing the relationship between revenue and expenses is the key element to understand the hotel business’s profitability.

NB: This is an article from Catala Consulting

Whether when considering extending a business, to reopen a hotel or to manage daily hotel room rates, understanding how much does each room cost is crucial to determine a profitable selling price. Similarly, managers may wonder how many rooms do they need to sell to achieve their target profit, or to what extent the sale’s volume fluctuation may impact their profit level.

Subscribe to our weekly newsletter and stay up to date

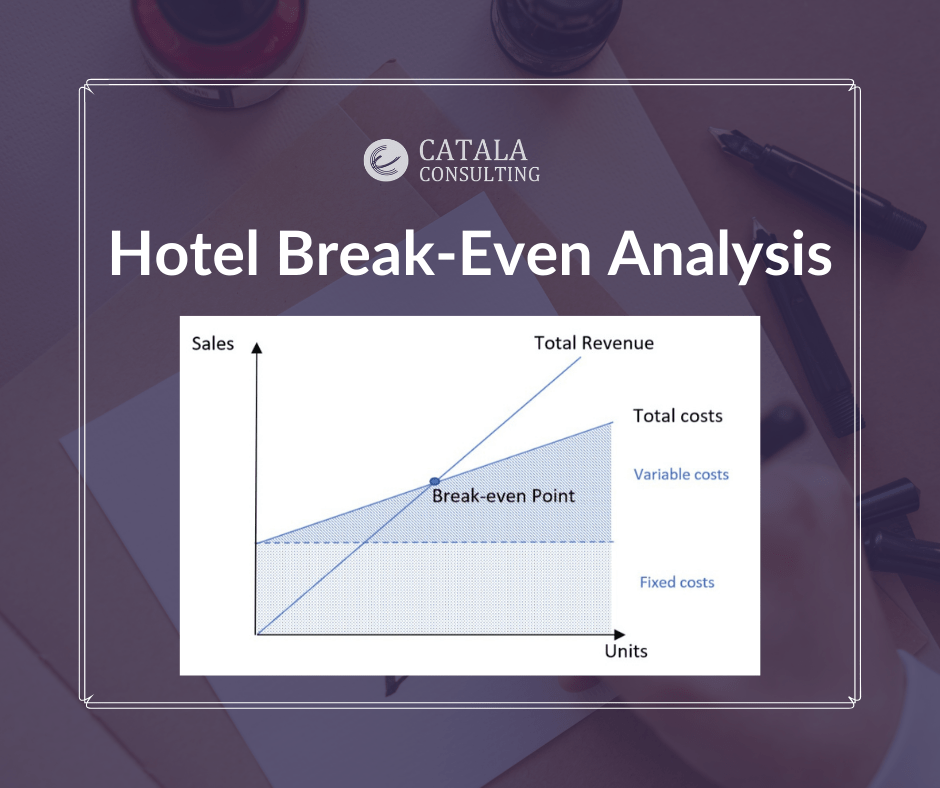

Adopting a “cost-volume-profit” approach, called as well the break-even analysis, can provide answers to those questions. The objective of this hotel break-even analysis is to identify the number of sales, in unit or monetary value, for which the total costs equal the total revenue. In other words, how many rooms does a hotel need to sell to cover its total costs? The break-even point (BEP) refers to the point from which all future sales contribute to generating profit.

BEP in rooms = Fixed costs / (Selling price per room – Variable cost per room)

The BEP can be calculated in sales by simply multiplying the BEP in-room per the average daily rate, or in occupancy percentage.

Type of costs categorization

In everyday hotel affairs, different terms refer to cost classification. Costs can be classified according to their nature, related-department, identifiability or variability. The variability approach is used to realize a hotel break-even analysis with the break-even point referring to the threshold where the property operates at neither a loss nor gain. There are two types of cost: fixed and variable.

- The fixed costs do not alter with changed levels of sales activity, such as rents, mortgages, payroll, insurances, taxes, building, advertising costs, subscriptions, utilities costs, equipment etc. They can be further classified into committed fixed costs, which are unavoidable in the short term; or into discretionary fixed costs, which are set at a fixed amount for a specific period, such as market research expenses or development costs.

- The variable costs tend to vary with the volume of activity, such as the commission fees, income taxes but as well food supplies, guest room amenities etc. An increase in production results in higher variable costs and vice versa.

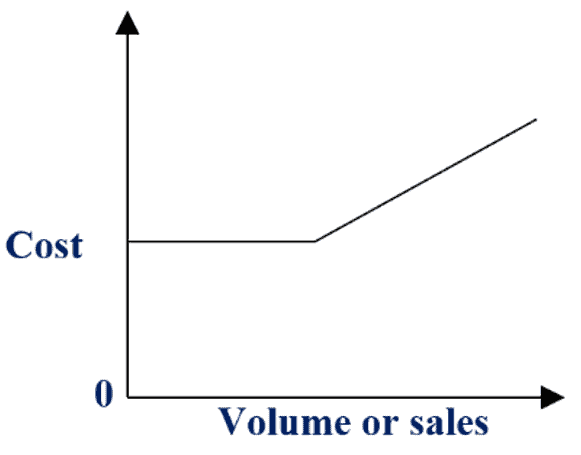

- Semi-variable costs have a structure of both fixed and variable costs. Therefore, until a certain level of activity the costs remain fixed, but when exceeded they become variable. This is the case of telephone charges, electricity bills, bonus-based salaries etc.

How to identify your fixed and variable costs?

Determining the proportion of each type of expenses is crucial to realize a hotel break-even analysis and identify future strategies. A cost structure primarily made of variable costs may have more stable costs per unit, and therefore stable sales. Whereas a cost structure mainly composed of fixed costs may more easily take advantages of the economy of scale and lower per-room costs. There are different methods to differentiate the fixed costs from the variable:

– High-low method: involves taking the highest sales of activity and the lowest, and comparing the level of their respective costs. The first step is to calculate the Variable Cost per room, and then proportionally apply it to the sold unit’s level to determine the variable and fixed costs.