Known for pairing candour with data-driven clarity, the HotStats CEO recently unpacked the latest profitability trends shaping the UK and European markets – and the results were anything but comforting.

“It’s not that sweet at the moment,” he began with a wry smile.

Subscribe to our weekly newsletter and stay up to date

Across much of Europe, the story is increasingly uneven – and in the UK, the numbers paint a sobering picture. In the UK, flat revenues and rising labour costs are squeezing margins to their thinnest levels in years. Drawing from HotStats’ proprietary P&L data gathered from nearly a thousand hotels in the UK, Grove offered a sharp, factual look at where the pressure points lie – and what operators can still control.

Europe’s Two-Speed Recovery

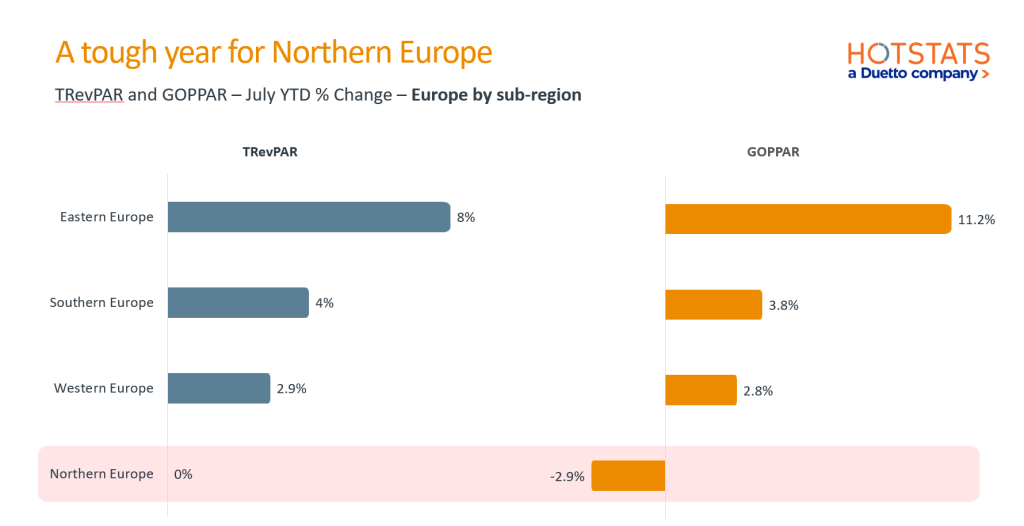

At the continental level, Grove’s charts revealed a striking divide between regions.

“Eastern Europe has seen further success this year – an 11% increase in GOPPAR,” he noted “Southern Europe is up 4%, Western Europe 3%. But Northern Europe – which for us is mainly the UK and Ireland – is 3% down.”

The UK now sits third from the bottom among European markets for profitability. Revenue remains mostly flat – down just 0.5% – but profitability has dropped by 4%, underscoring how rising costs are eroding even stable income streams.

Figure 1: Across Europe, profitability trends are diverging – and the UK remains one of the few regions still in decline.

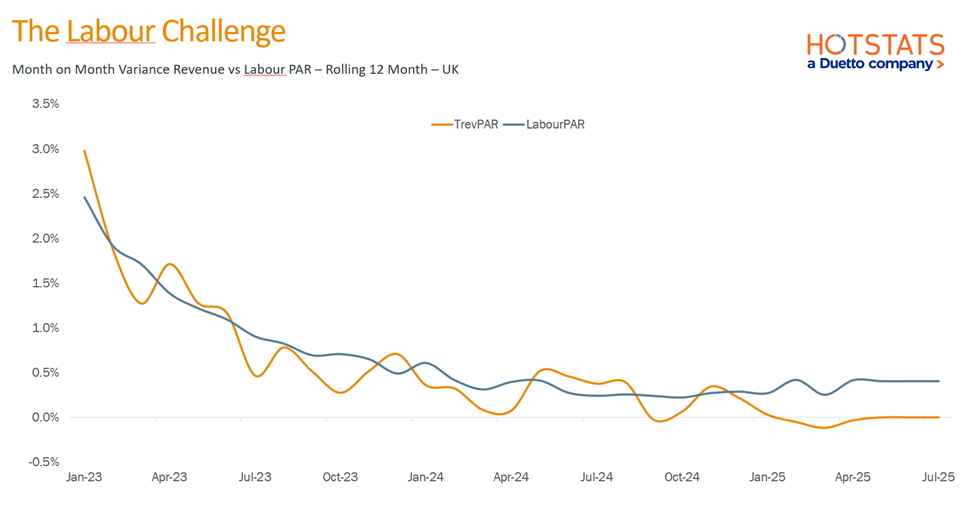

The Labour Cost Crunch

The central culprit, according to Grove, is labor.

Since the April 2025 changes to National Living Wage and National Insurance, payroll costs have risen 4% to 4.3%, effectively wiping out any gains in revenue.

“Revenues are flat, and labour costs have increased by that amount,” Grove explained. “That’s almost entirely why profitability is down 4.2% year-to-date.”

By July, a strong summer gave temporary relief – August even posted +0.5% TrevPAR growth – but the uptick barely dented the annual trend.

Figure 2 : Flat revenues, steadily rising labour costs, and the resulting squeeze on profit margins.

Cardiff on Top, London Still Leads

Zooming into city-level data, Grove highlighted Cardiff as one of the year’s rare bright spots.