Across the globe, domestic travel is expected to be the first category to recover from COVID-19.

NB: This is an article from Koddi

While consumer expectations and confidence will be a big driver of mid-to-late recovery trends, the first signals leading to initial demand growth will be policy changes. One of the biggest questions remaining for travel marketers is, “How will consumer behavior change throughout the rest of 2020 once domestic travel demand normalizes?” To understand where the pockets of opportunity exist today, our team analyzed the hotel search trends we’re seeing in the U.S.

Demand Growth in the United States

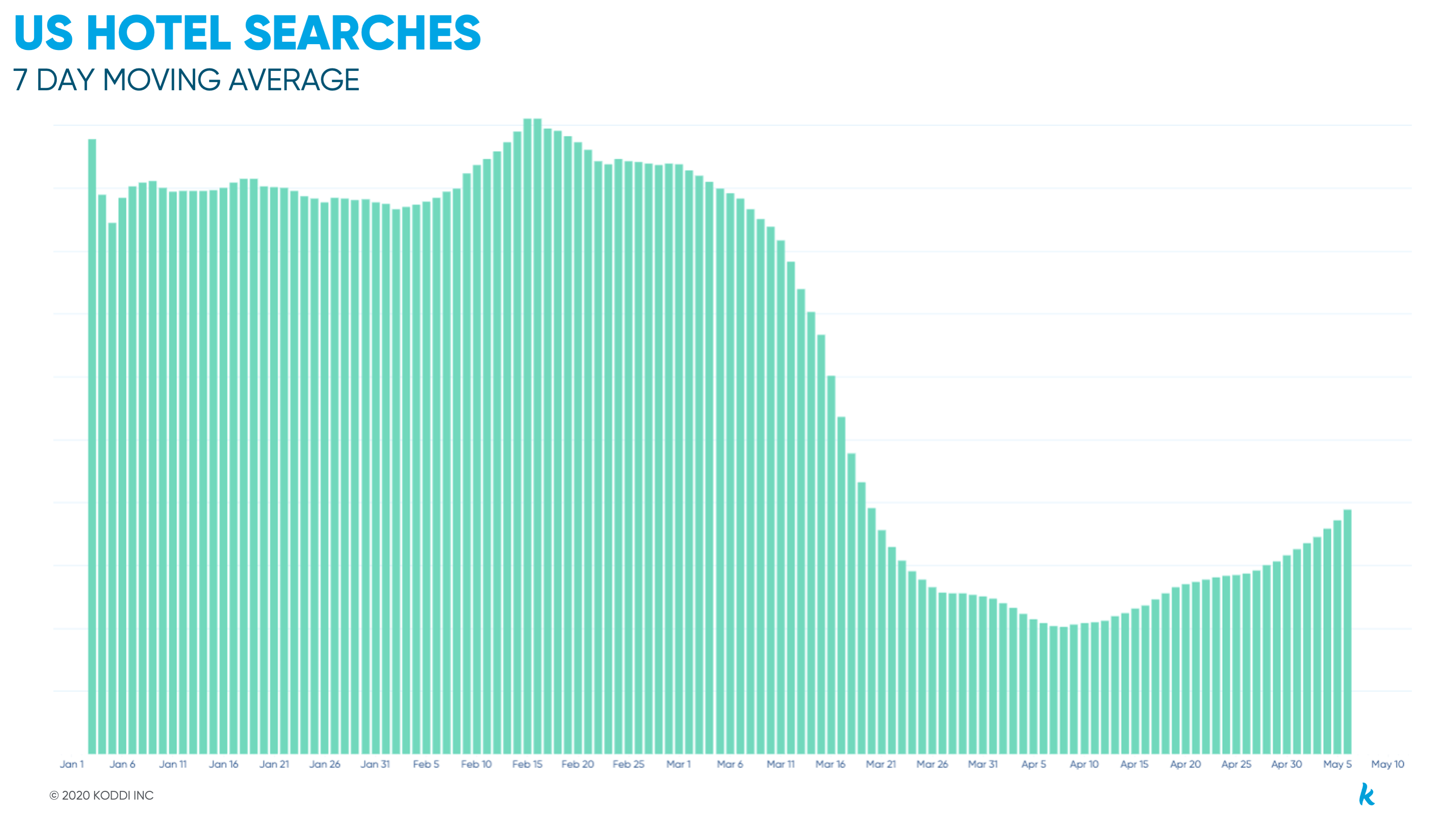

Moving into the first week of May, hotel demand continues to improve and is up 20% week over week. Much of this growth is likely due to the states that have lifted their stay at home orders, allowing residents to go to restaurants, beaches, health care centers, and retail stores at limited capacity and while still practicing social distancing. Consumer confidence is also improving slowly as these states are expected to open more of the economy in phase two efforts mid-to-late May.

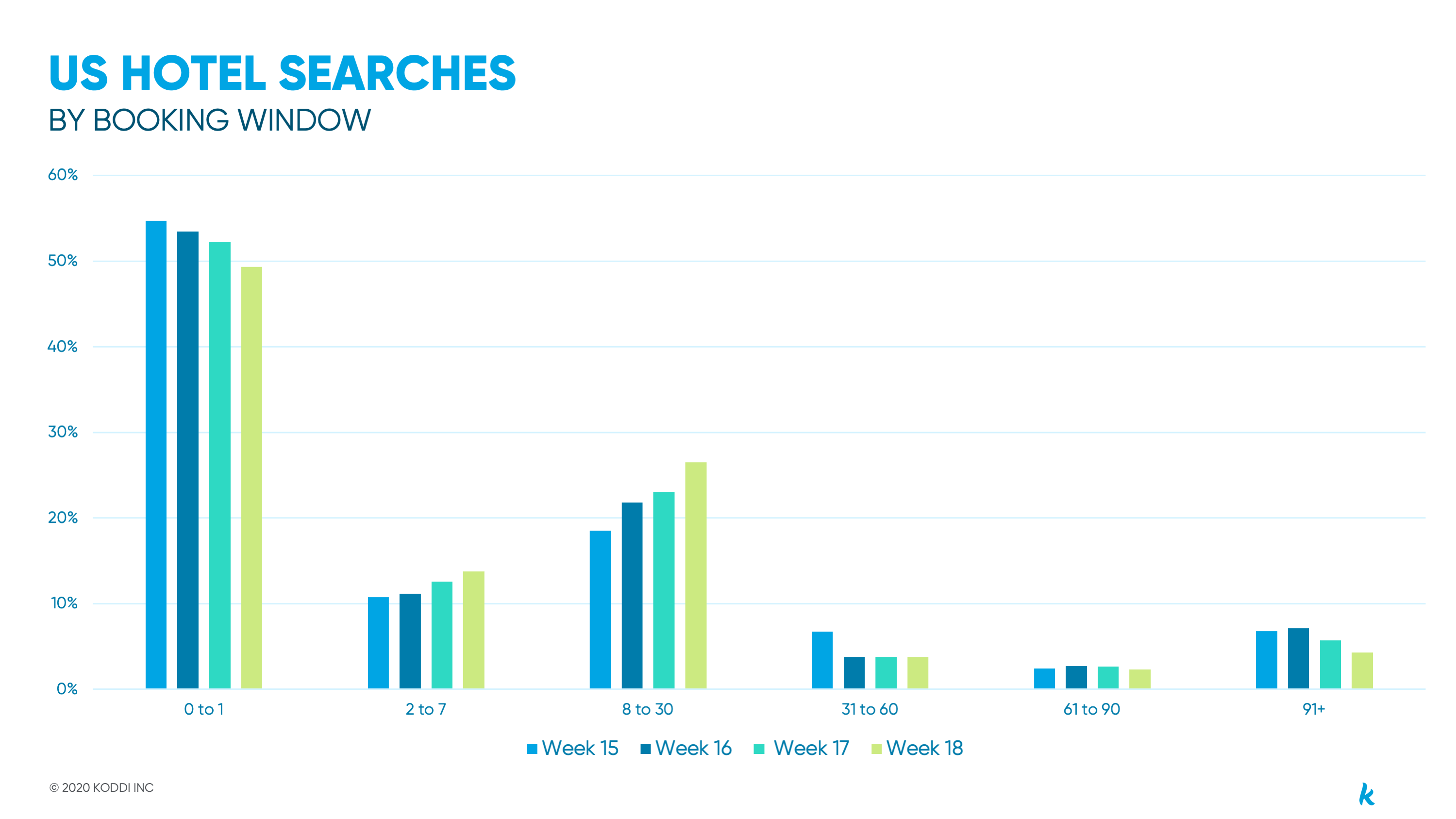

Additionally, looking at the searches by booking window, while same-day and next-day still make up over 50% of the searches, we are starting to see some improvements for the 2-7 and 8-30 booking window buckets. As a frame of reference, in Jan 2020, same-day and next-day searches made up only 20% of all searches compared to the 50% we’re seeing now.

Beach Destinations Leading the Recovery Trend

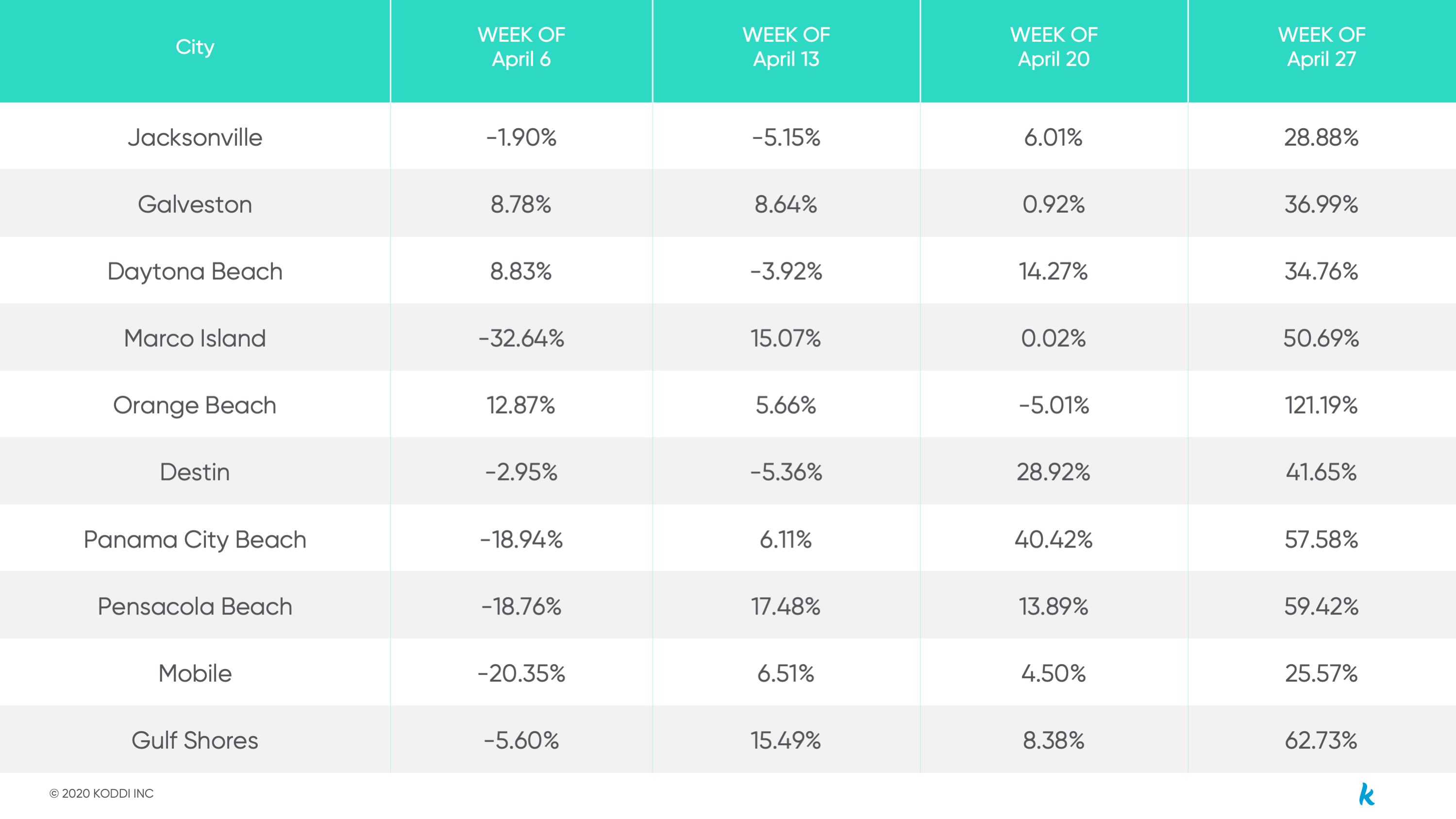

The U.S. recovery will be fragmented, at the state and even down to the city level. Moreover, many policy decisions are being made at county levels which makes the demand trends extremely dynamic. Looking at the top U.S. destinations by search volume that have at least a 25% WoW growth, beach destinations are leading the rebound as local restrictions are being relaxed or lifted.

Beach destinations in Texas, Alabama, and Northwest Florida saw the strongest uptick week-over-week corresponding with the reopening of beaches and loosening of restrictions. Other beach destinations that didn’t make the list above (including Myrtle Beach, Fort Lauderdale, and Miami) also saw 10-20% increases in search volume week-over-week.

Destination Shifts

As the U.S. slowly reopens piece by piece, consumers may choose to travel in different patterns than we’d typically anticipate. Initial U.S. demand is expected to be mostly leisure travelers who are looking to salvage any opportunity for summer vacations. With airlines operating with limited service for essential travel only, many American travelers will likely take to the road in their personal vehicles.

Consumers may turn to less densely populated and closer destinations such as nearby state and national parks, smaller cities, beaches, and general sightseeing road trips. This will funnel traffic towards a larger set of destinations in and around a two to six-hour driving range of some of these harder hit metro areas.

With many major companies extending their work-from-home policies and virtual meetings becoming the norm, business travel will be slower to recover than leisure in high-volume metro areas, especially as corporate travel and entertainment budgets shrink.