The global hotel industry is firmly positioned in an era of normalized growth levels. That means to achieve greater profits, hotel owners and operators need to explore every possible revenue stream while also working to manage expenses.

NB: This is an article from STR

Subscribe to our weekly newsletter and stay up to date

The starting point is a strategy built on a total performance picture – one that understands both the top and bottom lines as well as the circular relationship between the two. Fortunately, 35 years of historical profitability data presents obvious trends that inform hoteliers working to generate more financial gains.

Revenue and profit are closely linked

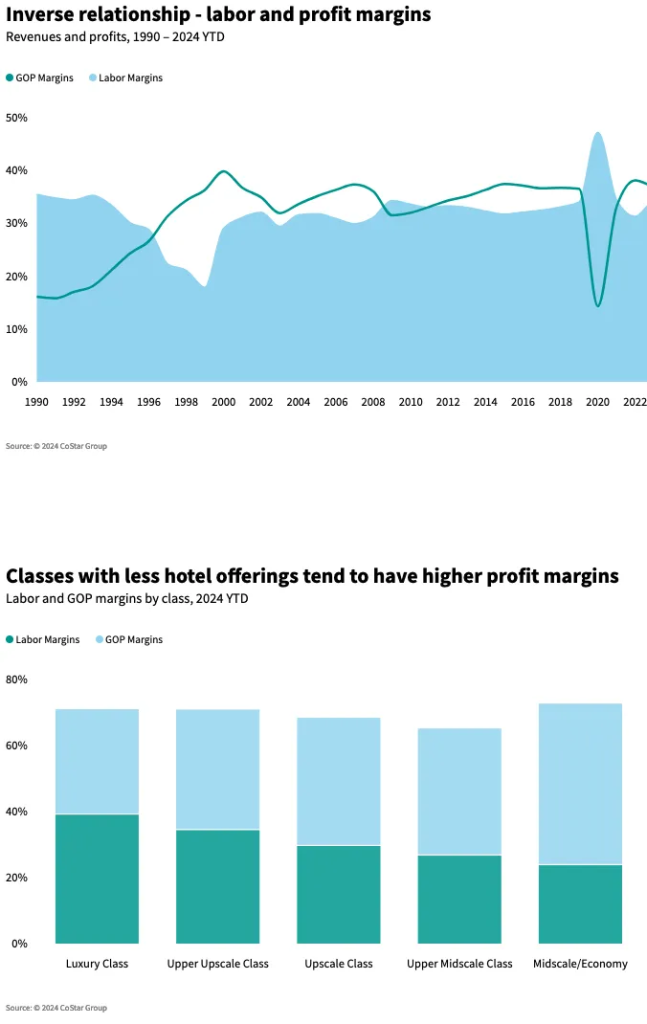

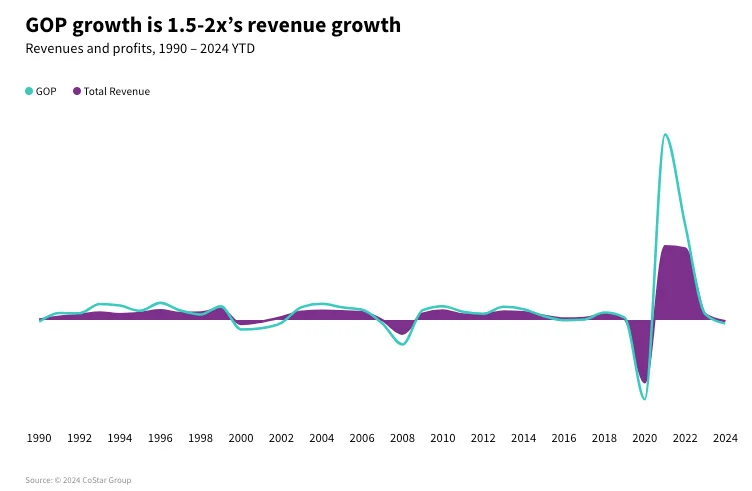

Understanding the relationship between revenue and profit is a great place to start. Using decades of data, we see with any growth or decline in revenue, gross operating profit tends to move 1.5 to 2.0 times more. That trend has played out consistently in the U.S. over the years. More recently in 2024, we also saw examples in Asia Pacific markets such as New Delhi, Bali, Kuala Lumpur and Bangkok. Those markets represented the trend through increases (12-month moving average), which aligns with a later pandemic recovery. Markets in other parts of the world—Dubai, Amsterdam, Beijing, Hong Kong, San Francisco—displayed the 1.5 to 2.0 times trend with decreases.

Labor and profit margins show an inverse relationship

It is no secret that labor costs place significant pressure on profit margins, especially in full-service properties where more staff is required to service more facilities and amenities. That is especially true when looking at resort and convention hotels.

On the other hand, classes of hotels with more select services tend to show higher profit margins.

On a global scale, the major markets—Los Angeles, New York City, Hong Kong, Berlin—show the greatest impact of labor on profit margins.

Hoteliers are getting more creative in deploying technology to help improve profit margins – robot room-service delivery, staffing systems, mobile check-in, food waste tracking, etc. Tech is going to continue to play a powerful role in maximizing profit margins considering the amount of pressure from labor and operating expenses in general.

Finding peak profitability

Because revenue per available room (RevPAR) is a product of occupancy and average daily rate (ADR), and because GOP is based off total revenues and expenses, all of these metrics are connected and demonstrate how the top line impacts the bottom line.

A long-held theory on flowthrough has been that when ADR growth compromises more than half of a RevPAR gain, flowthrough is improved, whereas GOP growth is assumed to be muted when occupancy is the main driver of RevPAR

Using several years of U.S. data, our analysis shows that as hotels increase occupancies, peak profitability efficiency is realized at a certain point: