When measuring hotel profitability, two key metrics stand out: flow through and flex. Flow through measures the percentage of additional profit from each extra dollar of revenue, while flex gauges the ability to save profit during revenue shortfalls.

NB: This is an article from Hotstats

Subscribe to our weekly newsletter and stay up to date

These metrics provide crucial insights into financial performance, offering a comprehensive framework for operational analysis.

“Understanding flow through and flex is essential for any hotel aiming to optimize profitability and navigate economic fluctuations effectively,” says Lisa Martin, Regional Director for Hotel Finance, at Davidson Hospitality.

Integrating these metrics into your analysis toolkit can unlock the secrets to maximizing profitability.

Simplifying the Calculations

Don’t be intimidated by the calculations – determining flow through and flex is straightforward. All you need are the total revenue and gross operating profit (GOP) figures for two distinct time periods.

The Flow Through Formula

The sign of the Flow Through percentage tells us whether GOP changed in the same direction as revenue, and the number or absolute value measures the magnitude of the change in GOP in relation to the change in revenue.

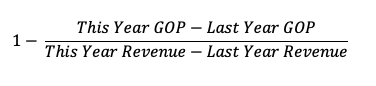

The Flex Formula

Flex is 1-Flow Through because we are not interested in how much of the loss in revenue was translated into a loss of profitability, but rather how much we were able to keep in our profits despite the fall in revenue.

Flex can be thought of as one minus flow through because, in this scenario, we are not interested in how much of the loss in revenue turned into a profit decrease, but rather how much we were able to save despite the fall in top line.

Decoding Flow Through

Flow through primarily revolves around revenue increases. To decipher the results effectively, two key components demand attention: the sign and absolute value.

The sign of the flow through percentage reveals whether the GOP changed in the same direction as revenue. A positive sign indicates an increase in GOP, while a negative sign signifies a decrease.

The absolute value of the flow-through percentage gauges the magnitude of the change in GOP relative to the change in revenue. If the absolute value exceeds 100 percent, it suggests that the GOP overreacted, with profit changes surpassing revenue changes. Conversely, if the absolute value falls below 100 percent, it implies that the GOP underreacted, with profit changes trailing behind revenue changes.