If the U.S. lodging industry is going to achieve pre-COVID-19 demand and revenue levels, it is critical that large hotels in the top 25 markets recover.

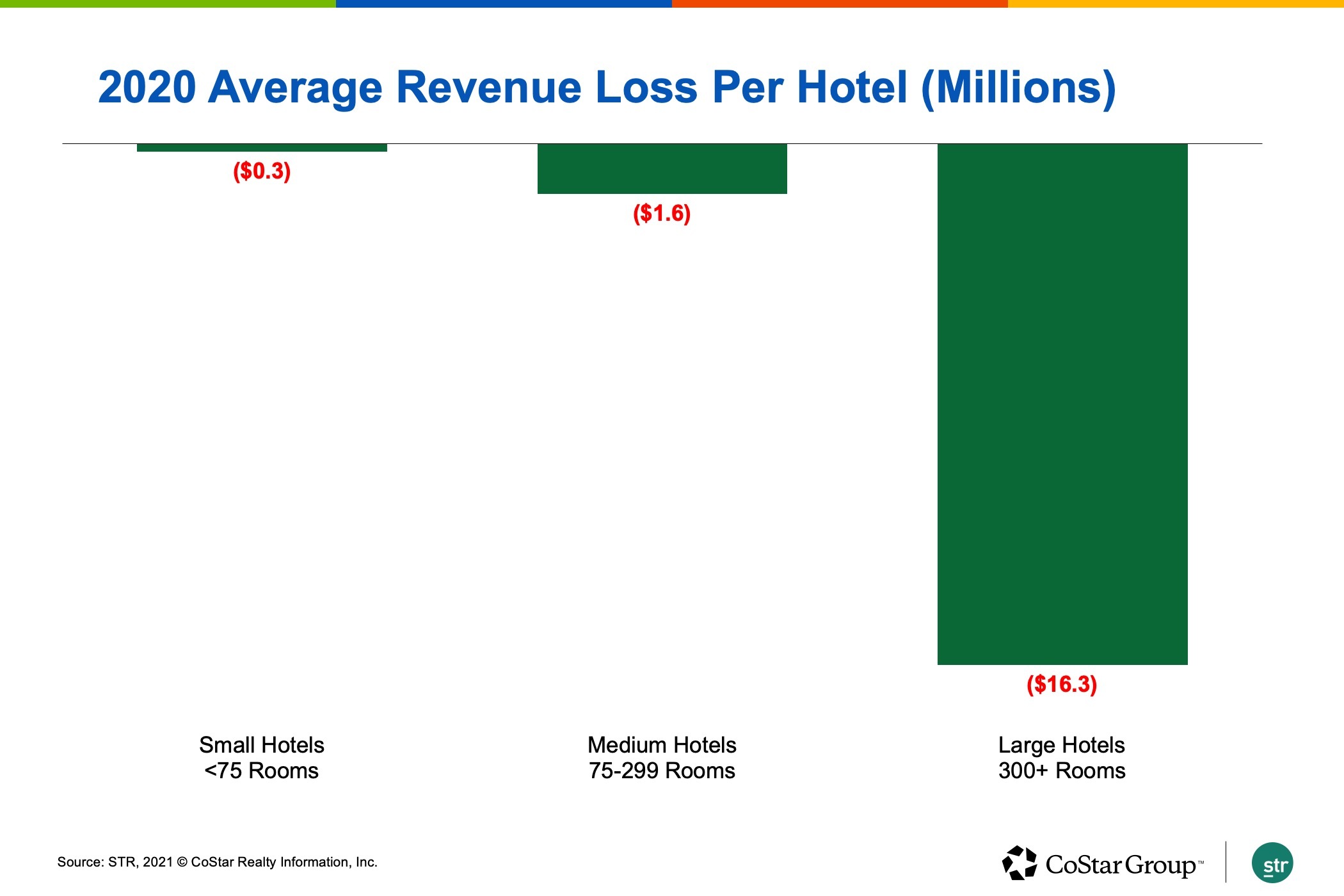

In 2020, the average U.S. hotel lost $1.4 million in rooms revenue via a drop of 7,400 room nights. Data from the U.S. Bureau of Labor Statistics estimates that at year end, hotels experienced a 34% drop in employment, among the largest decline of any sector. All, however, are not created equal, and the losses in revenues, demand, and employment have been centered in large hotels, those with 300-plus rooms.

Subscribe to our weekly newsletter and stay up to date

In 2019, large hotels accounted for just 3% of all hotels and 17% of all U.S. rooms but contributed 24% of the industry’s rooms revenues and an estimated 29% of hotel employment. The largest concentration of these is in urban and resort locations within the U.S. top 25 markets as defined by STR, CoStar’s hospitality analytics firm.

Their impact to the industry and general economy is easy to see: In 2020, the average large hotel lost $16.3 million in rooms revenue and demand dropped by 80,300 rooms. Small hotels with fewer than 75 rooms and medium with between 75 and 299 rooms experienced less of a decline, with rooms revenue falling by about $1 million, and demand dropping by 5,000 rooms per hotel on average during the year. The decline in revenue and demand by large hotels resulted in many of them temporarily closing; 38% of which closed at some point in 2020. With their temporary closings and limited demand, many shed thousands of jobs in the process. We estimate 45% of all jobs lost in the U.S. industry were by large hotels.

In January and February 2020, large properties accounted for one-third of industry room revenue and nearly two points of occupancy. In the 10 months ending December 2020 — in other words the COVID-19 period — these lost $32 million in rooms revenue, representing 38% of the industry’s total rooms revenue decrease. Additionally, they knocked off 2.4 points of industry occupancy. Over the COVID-19 period, large hotels only materialized 23% of their 2019 room revenues, whereas hotels in the other two size categories combined achieved more than 50% of 2019 room revenues. From July through October, the peak 2020 COVID-19 demand months, small- and medium-sized hotels realized nearly 60% of their 2019 room revenue whereas large remained very weak, with just 27% of their 2019 revenue.