As we begin a new year, let’s recap what has happened in our industry since January 2020 and move forward.

NB: This is an article from Beonprice, one of our Expert Partners

In the last 18 months we hoteliers have experienced something that never happened before, and this included the worldwide lockdown during 2020. We can find everywhere that COVID-19 has badly hit the hospitality sector, but how much exactly? Has it been the same for all the segments? What is coming?

Subscribe to our weekly newsletter and stay up to date

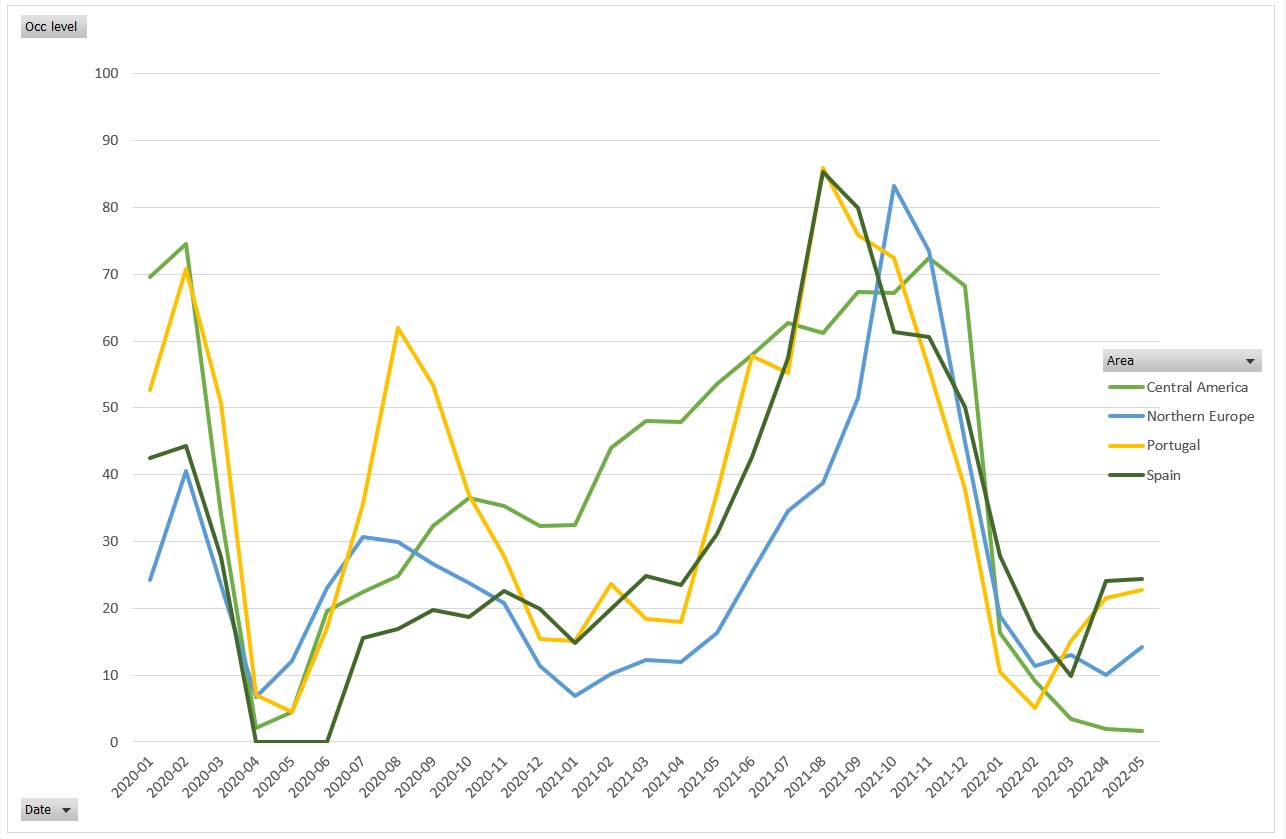

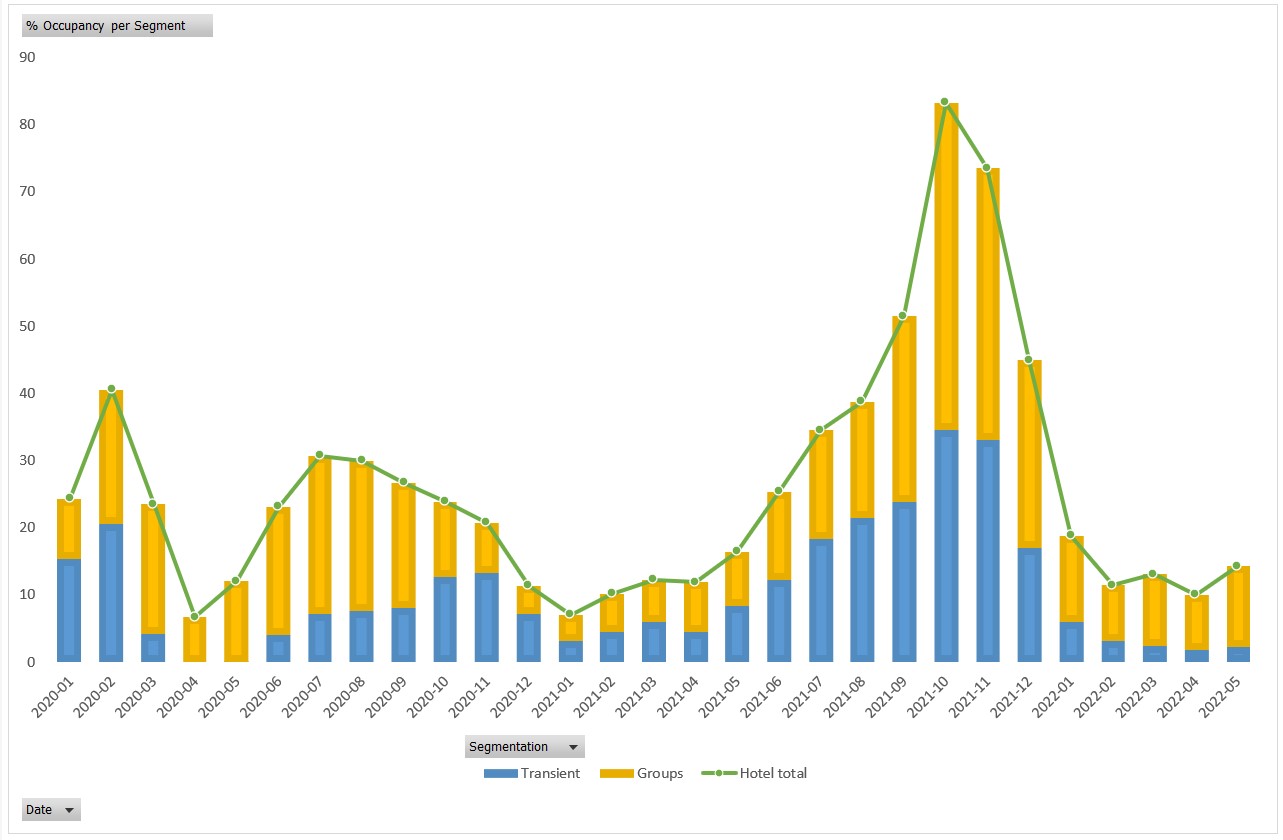

Given it is the beginning of a new year, let’s recap what has happened in our industry since January 2020 and work towards it. Analysing the occupancy levels by geographic areas we can see that hotels are now at similar levels as they finished in January-February 2020, but the demand is being conservative in January 2022.

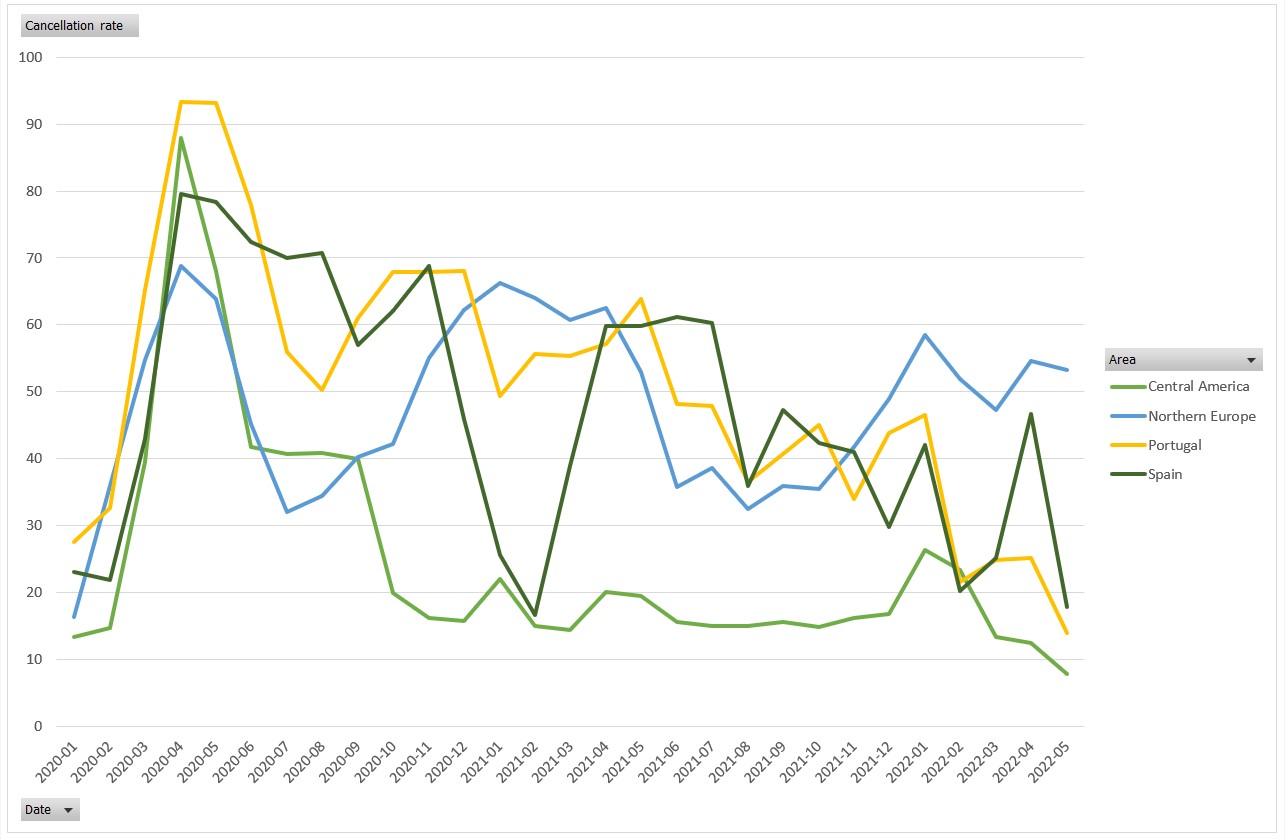

On the other hand, when we check the cancellations rate, we can see that it depends on the area:

- In Northern Europe, it has increased in the last months, reaching February’20 levels. This is due to the continuous travelling restrictions

- Central America and Portugal show a negative trend, and it continues until May’22.

- In Spain, we can see a concerning pick in April 2022, reaching November’21 levels.

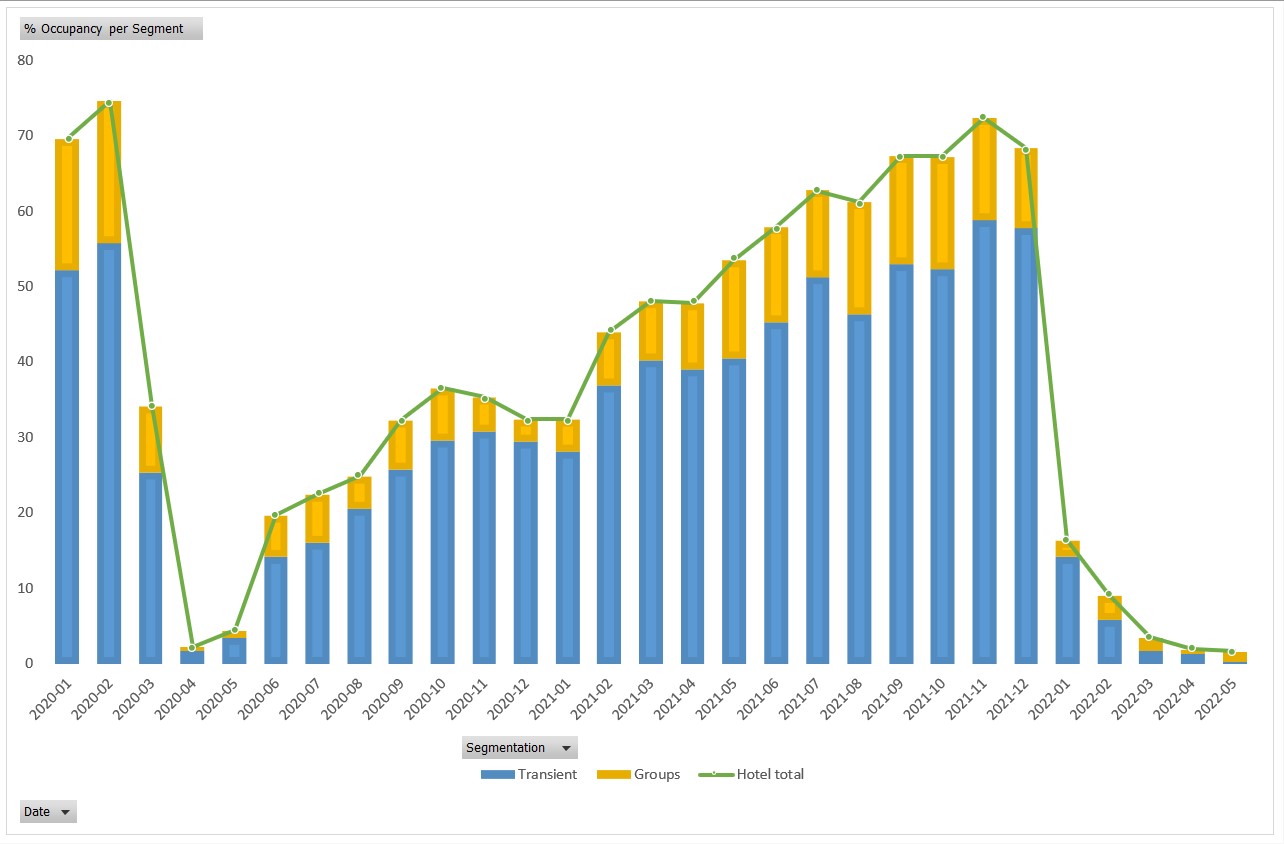

Once we have analysed the Occupancy and cancellations level, we need to question how our reservations are behaving, are we attracting the right Business Mix?

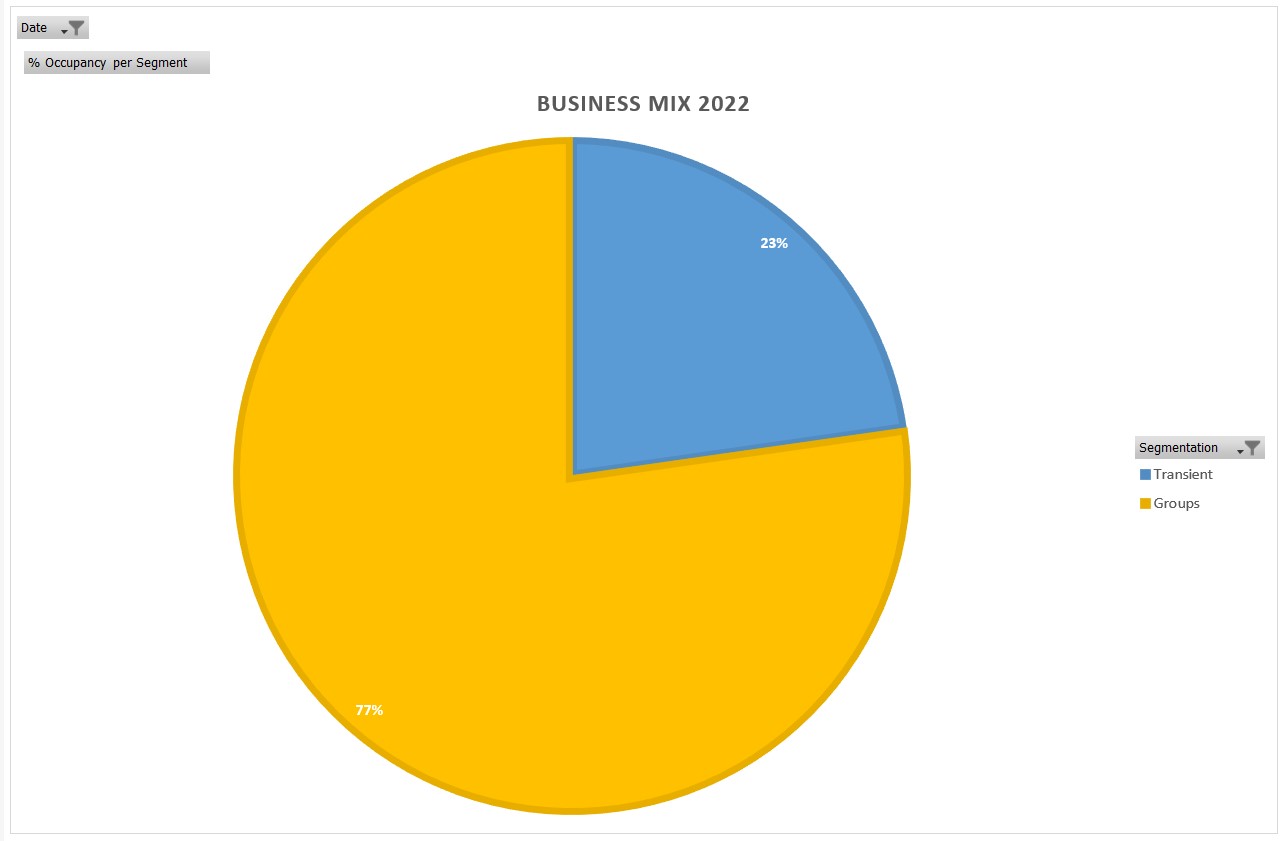

Central America

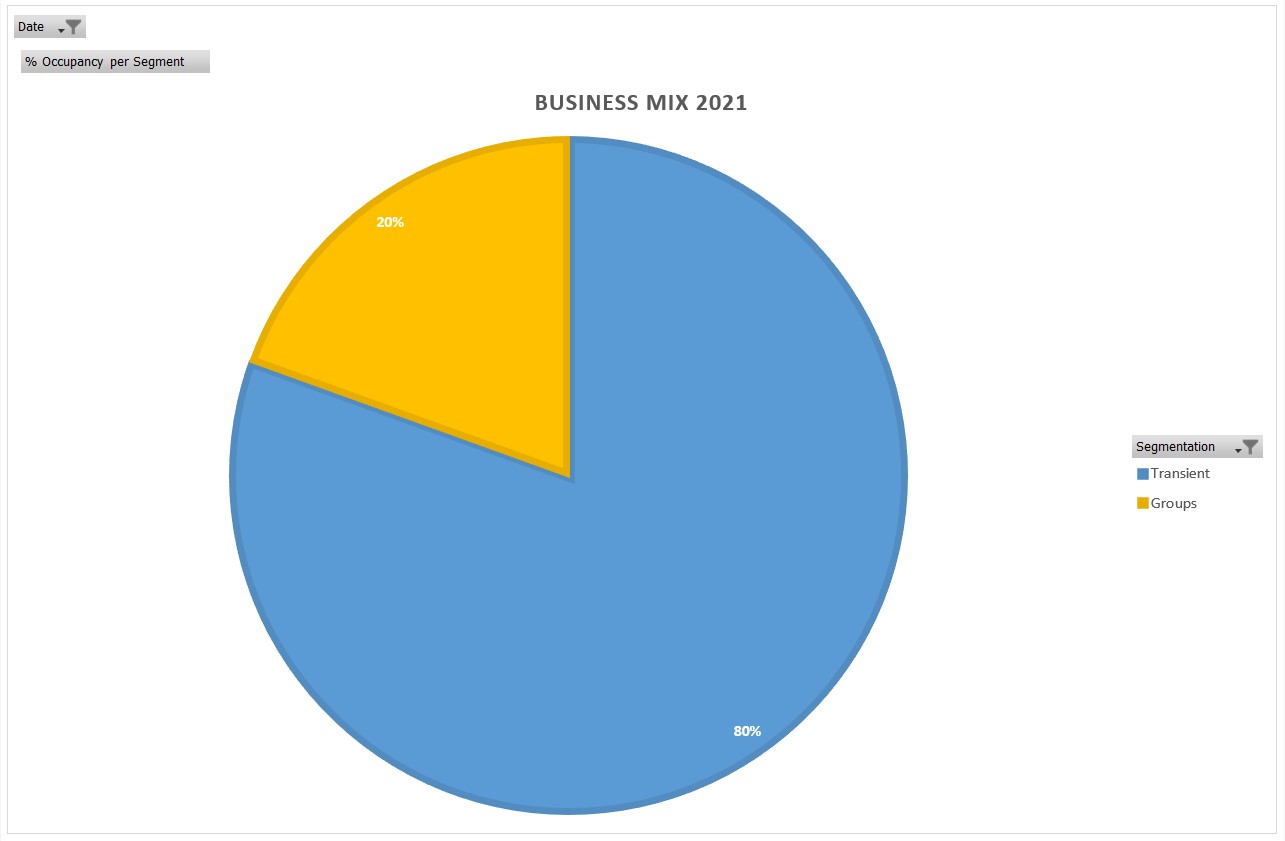

As we analyse the business Mix for hotels in Central America we can see that during 2021 the business mix has been distributed as:

- 80% of the total has been transient.

- 20% of the total has been Groups.

However, as we step into 2022, our OTB show that the willingly to travel of the Segments groups is slightly higher than the previous year:

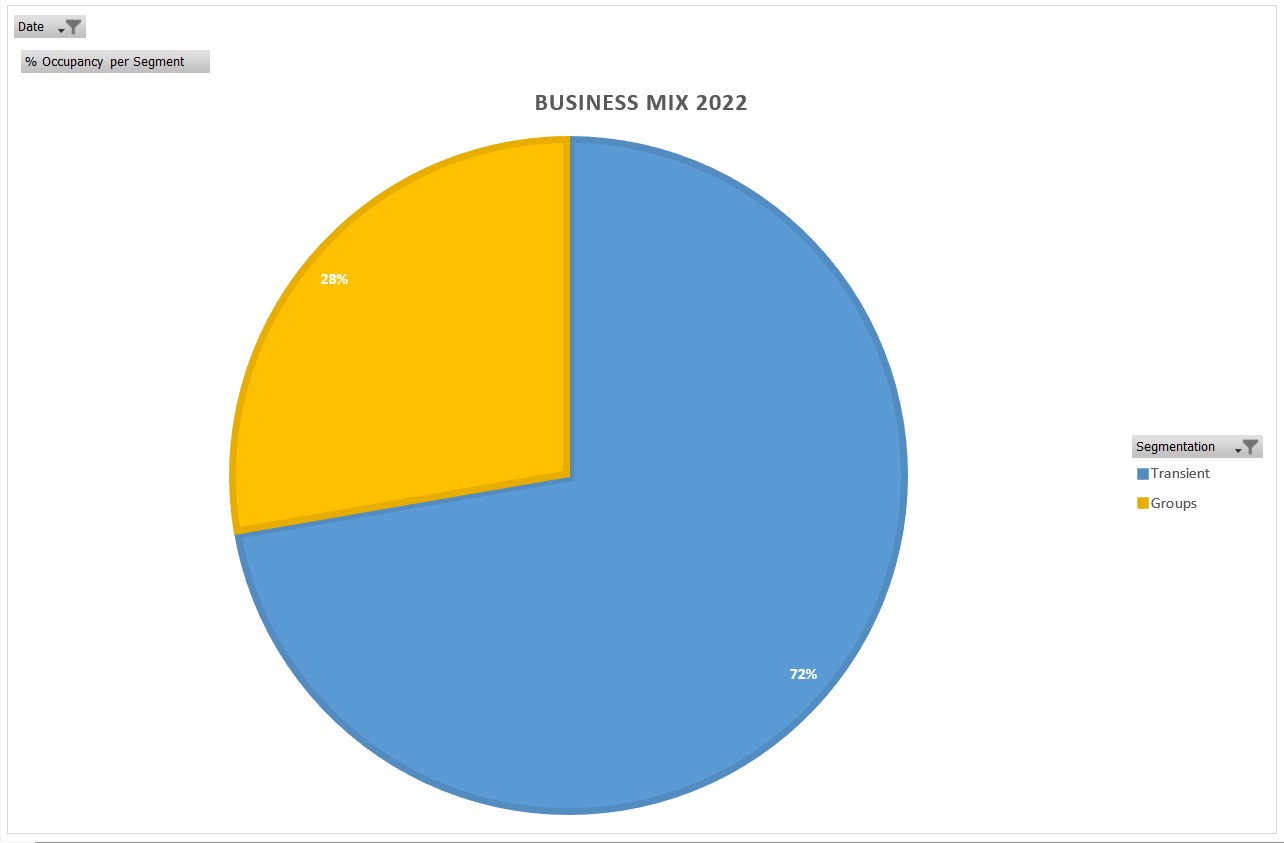

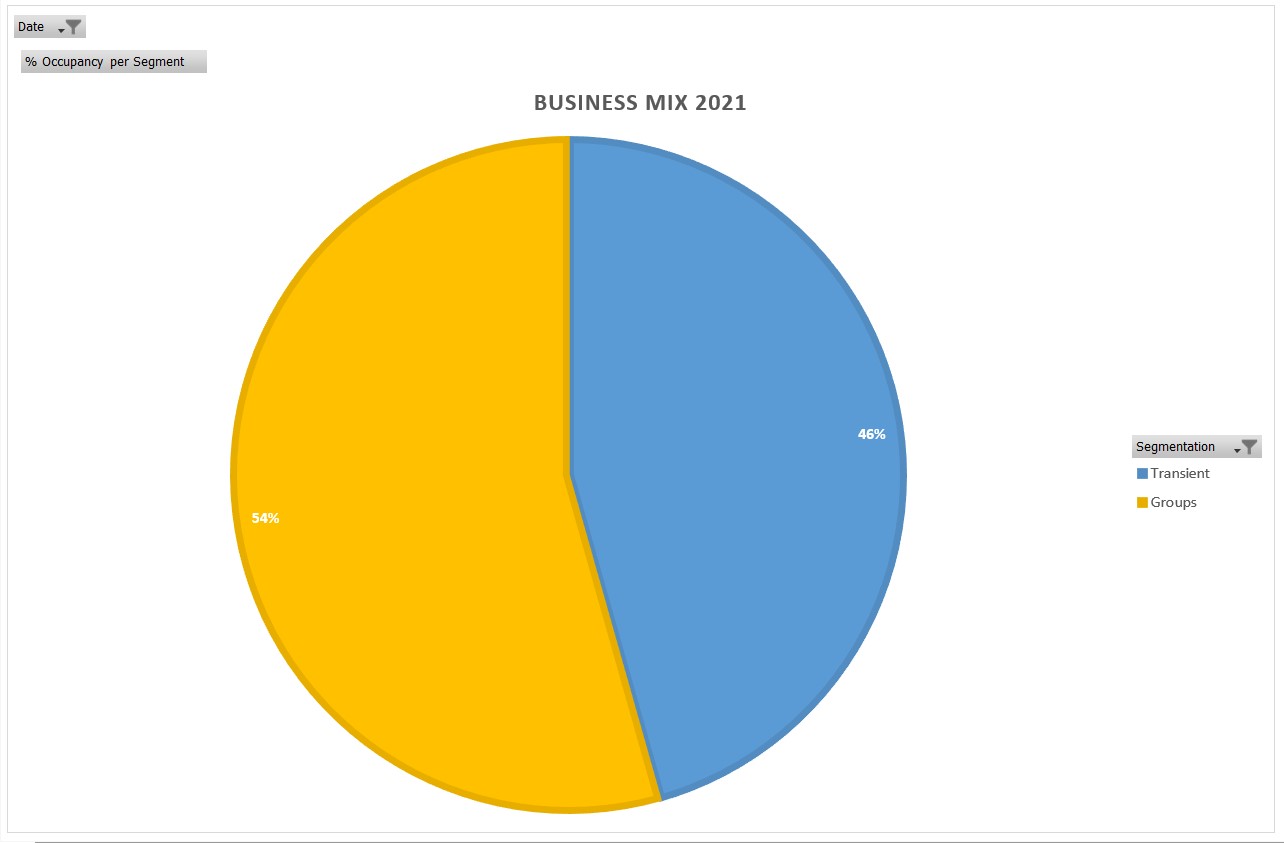

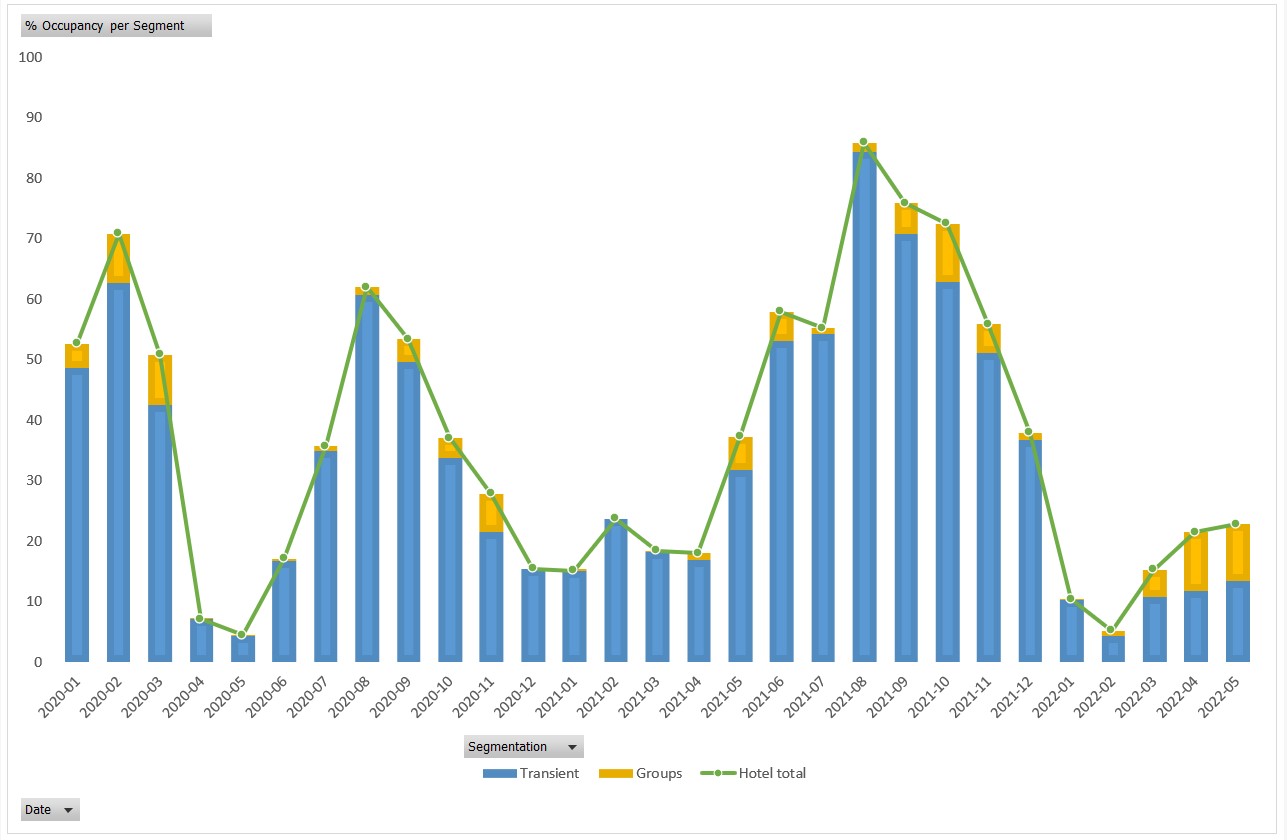

Northern Europe

Business Mix in hotels in Northern Europe show a constant increase in Groups since Mid 2021. Thus, the business mix during 2021 was:

- 54% of the total was transient

- 46% of the total was Groups

This trend seems to continue in 2022, even though it is too early to conclude.

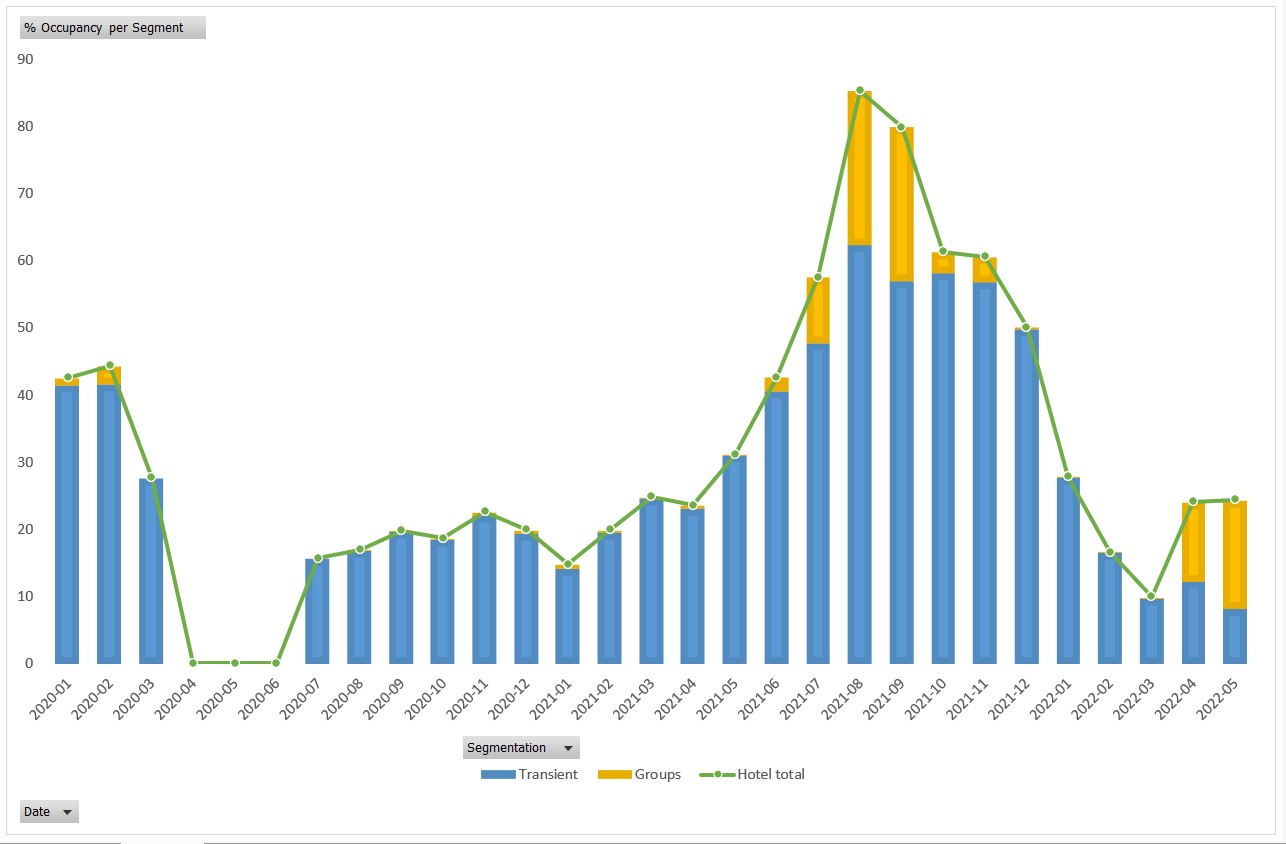

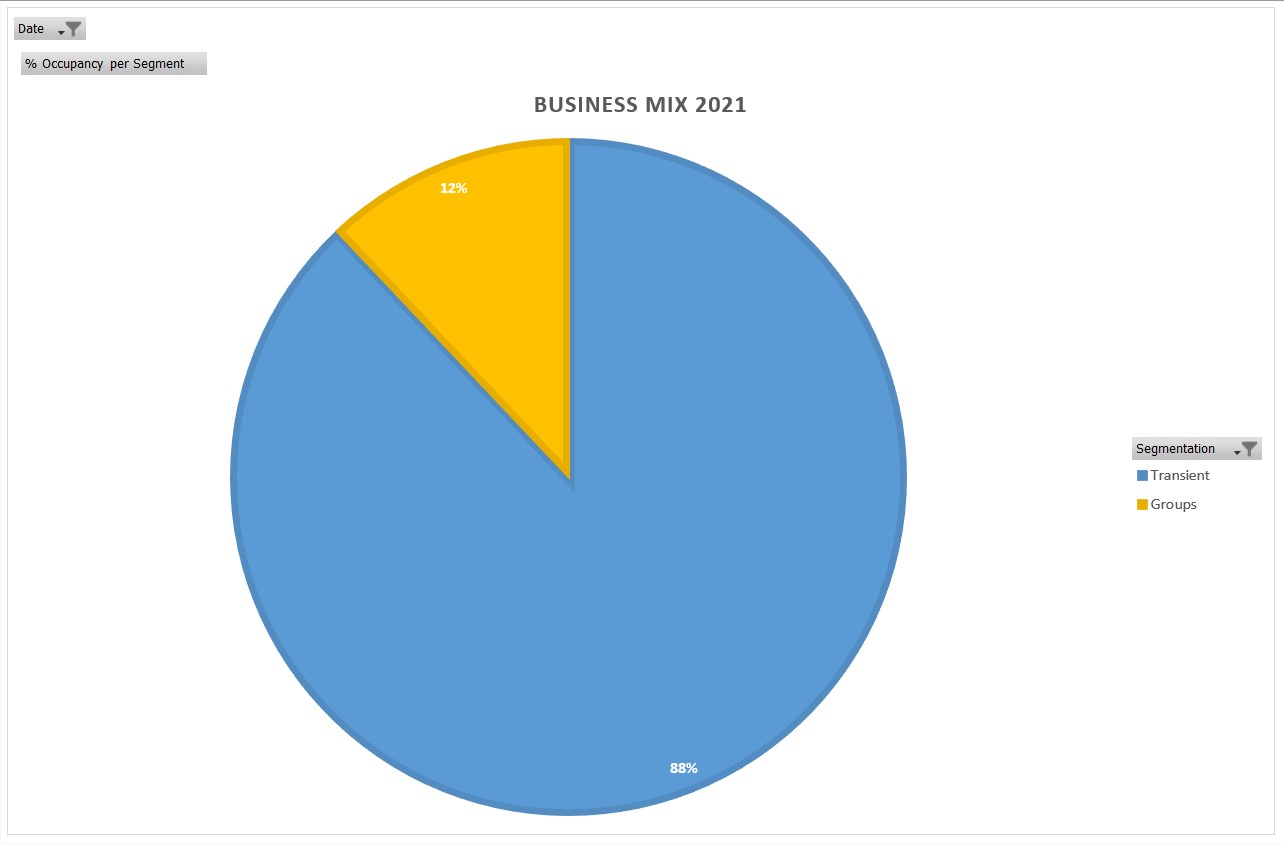

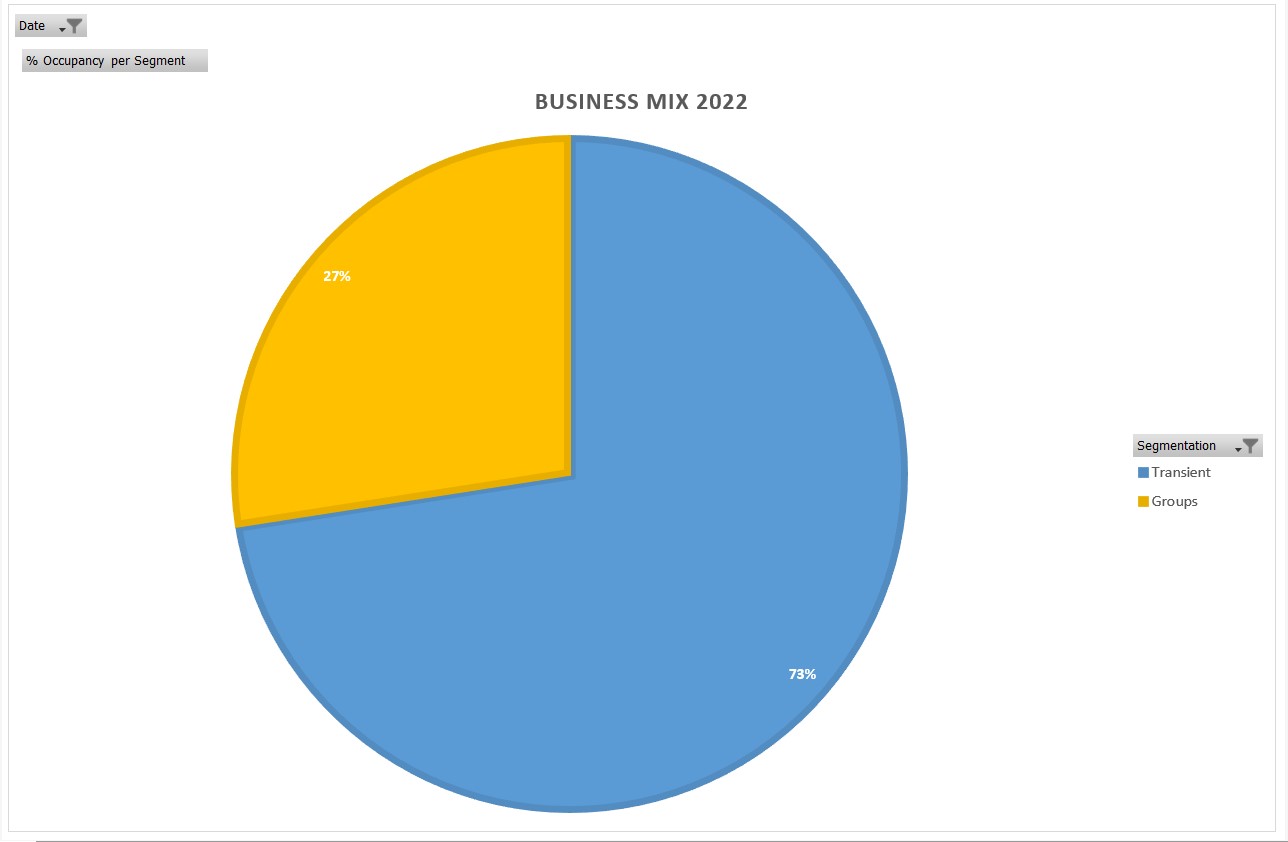

Spain

As we can see, the Spanish market is predominantly covered by transient business, however, Groups seem keen in April and May. As of the Transient segment, we can see that January has already beaten January 2021.

As a summary, business Mix in 2021 was as follows:

- 12% of total was Groups

- 88% of total was Transient

While 2022 is showing an increase demand on Groups, it is too early to conclude:

Portugal

Last but not least, let’s analyse the Portuguese market.

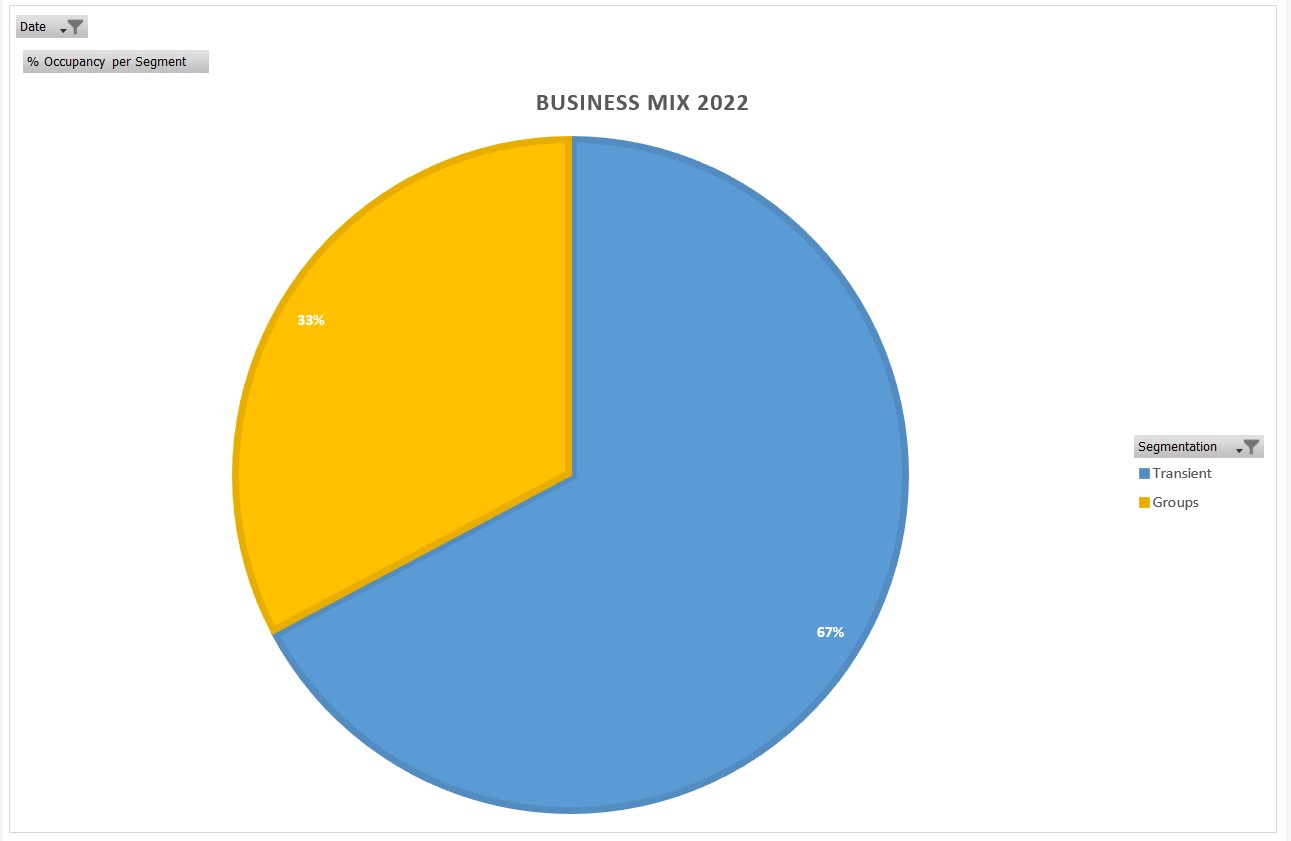

We can easily observe that January and February 2022 show a weaker trend than Last Year, however, the Segment Groups seems to be getting stronger this year.

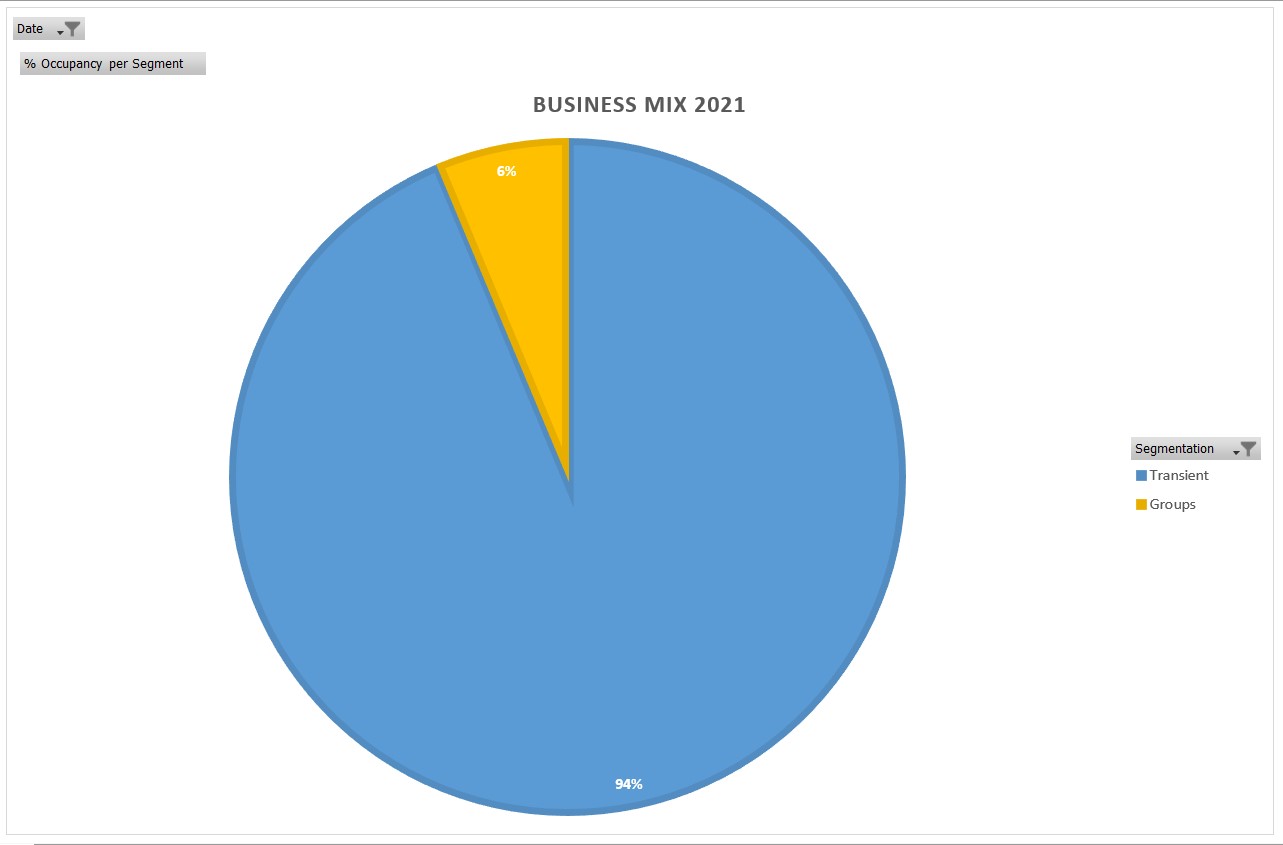

Clearly, during 2021 Transient was the dominant segment in Portugal, reaching a 94% of total of confirmed reservations.

For the next 5 months, we can see that Transient is coming slower than Groups, as Groups is as of today the 33% of the business mix.

Conclusion

As it is to expect, each market will show a different and unique business mix, but that is exactly the challenge we like to get up every morning, isn’t it? Now, with this information in hand, I wonder if your hotel(s)’s Business Mix is in line with the market demand.