According to the US Consumer Price Index, prices are set to increase an average of 7.5% in 2022. This marks the largest inflation jump since 1981.

NB: This is an article from Revenue Management Labs

Over the past 40 years, digitalization has created a highly aware, sophisticated buyer. Businesses stuck utilizing outdated pricing structures are struggling to withstand an evolving market. Inflation’s impact is traditionally offset by raising prices and passing costs onto consumers. This one-size-fits-all method isn’t effective as inflation dramatically increases a customer’s price sensitivity and willingness to pay versus the value offered.

Subscribe to our weekly newsletter and stay up to date

When the market changes, the consumer’s demands change. As the environment shifts around them so does a customer’s perceived value. The more an offering meets a consumer’s needs, the greater the probability of maximizing your revenue.

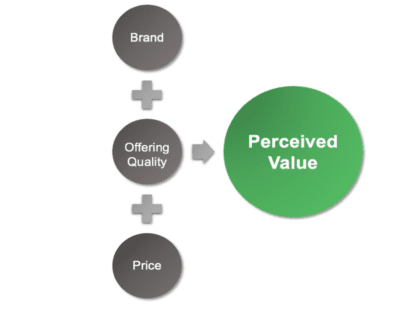

Customer needs, in most cases, are driven by perceived value. Perceived value is made up of 3 drivers- Price, Offering Quality / Service and Brand. In the face of massive environmental shifts, these drivers can be adjusted to better position your products & services to sell.

1. Brand Positioning

A strong brand positioning strategy is critical to captivating consumer attention and converting sales. Your brand is your connection to the customer. Successful branding affords visibility, relevance and loyalty – giving you a competitive advantage.

To adjust to inflation’s impact on your customers, consider whether repositioning your brand is needed.

A Brand Evolution may be required. By adapting your brand to fit the needs of different market segments or adjusting your marketing efforts to target a new audience, you can ensure your customers remain engaged and motivated to buy.

Think of a tennis brand primarily marketed through tennis facilities and sports clubs. During the prolonged pandemic, membership attendance structurally decreased by 30% thereby drastically impacting reach and visibility.

To maintain relevance, the brand must shift its strategy. This could look like refocusing advertising to public tennis courts (where players are now at), prioritizing community outreach, building courts, running outdoor camps, etc. All these tactics take you closer to where your customers have migrated.

By refocusing branding to match customer needs, businesses can improve willingness to pay and position themselves to sustain shifts resulting from inflation.

2. Offer Quality / Service

Inflation forces companies to evaluate the true value of their offerings. As prices rise, so does a buyer’s expectation for quality. So how do businesses take control of cost increases, without having unsatisfied customers?

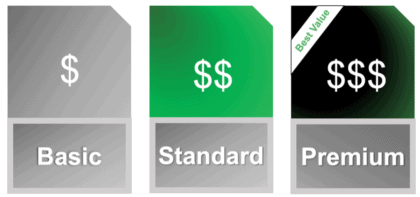

Take for example an outsourced IT services provider. They offer three service packages:

The Premium option was justified by 100 hours of available onsite support every month. In the past, the Premium option was extremely valued as it allowed for maximum uptime for organizations and drove employee satisfaction. However, with the drastic increase in remote work, the value associated with the Premium option has substantially deteriorated. It’s hard to justify charging a premium for onsite service when less than 50% of your employees are on site. This forces a fundamental rethinking on what services and tiers to create to more accurately match the needs of your customer base.

From another perspective, consider the medical mask market. In the past, it was seen as a relative commodity. If not mandated, customers were often open to switching brands/suppliers based on price. With the advent of the COVID pandemic, motivations to buy branched far beyond being a commodity.

Value Drivers:

- Safety

- Comfort

- Aesthetic

- Material

- Quality

- etc.

The renewed focus on quality allows companies to introduce offers anywhere from $0.05 to $75 / mask, differentiated based on some of the needs stated above. What was thought impossible 2 years ago is now a viable market opportunity.

3. Price

The kneejerk reaction to rising labor, commodity and freight costs is raising your prices, in theory, this allows businesses to pass cost adjustments to customers. While increasing prices is the fastest way to boost your revenue, it can also be the most expensive.

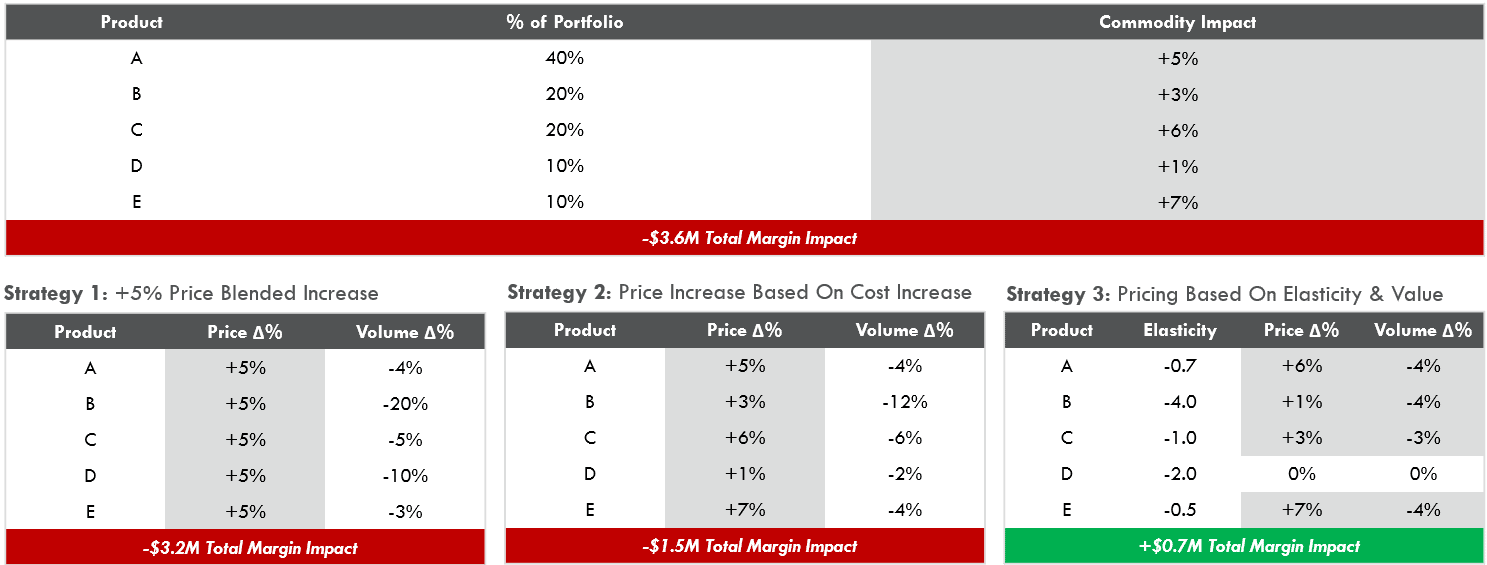

Take for example a scenario where commodity costs are increasing. If you understand your customer’s willingness to pay, you can realize drastically better results than if you were to take a cost-based approach:

The key to remember is value is comprised of 3 major drivers – Brand, Offering Quality / Service and Price. Often, we focus on price which is the easiest to pull but also the most expensive.

Final Thoughts

To combat inflation, industry leaders require strategic decision-making informed by customer insights and advanced data analytics. This insight into customer behavior, not only gives your business the opportunity to keep up with inflation but even expand profitability.

Our experts have been increasing profits in evolving markets for over 20 years. We have the experience needed to create sustainable revenue growth that outlasts inflationary times. Call us today to readjust your offerings and win over your customers.