As the hotel industry battles to rise out of the pandemic, it has been interesting to watch upselling’s role in revenue recovery.

NB: This is an article from Roomdex, one of our Expert Partners

We have compiled upselling trends data across its customer base over the last 6 months (2021). In this time, we can all agree rates and occupancy have been slowly climbing up. The question is: what can we learn about consumer behavior from upselling performance in the recovery?

Subscribe to our weekly newsletter and stay up to date

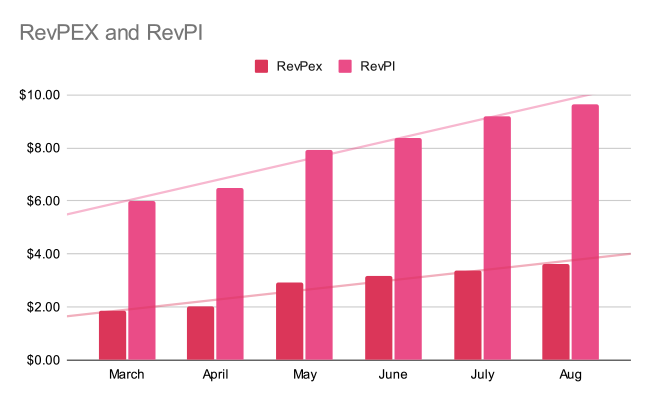

Observation 1: RexPEX and Rev PI

We have introduced some new industry KPIs to help us all understand upselling performance on a granular basis. Let’s first talk about RevPEX and RevPI. These metrics show upsell email marketing effectiveness.

- Revenue Per Exposed Reservation (RevPEX)

Formula: Hotel upsell revenue / no. of upselling emails sent

With ROOMDEX, not every reservation will receive an upsell offer because it is dependent on persona, timing, and room availability. A higher trending RevPEX number tells you that more of your offers are being opened and converted into sales. - Revenue Per Offered Viewed (RevPI)

Formula: Total upsell revenue / number of offer views

RevPI is a conversion performance indicator. The email has been opened – is your offer content persuasive enough to convert?

If you can get the guest to open the offer email, you will, obviously, have a better chance of converting a sale. A faster trending RevPI line can indicate a couple of things. As occupancy rises, ADR rises, and thus initial reservations will be for less expensive rooms. That provides more opportunities to successfully upsell. However, we know that occupancy dipped in August, yet conversion still rose. That could indicate the lagging impact of the booking window (we’ll have to see when we get September’s numbers). But it could also reflect a growing cultural acceptance of self-service stay enhancements. Remember that these numbers include stay extensions as well as room upgrades. In other words, there is a growing trend in upselling conversion despite occupancy changes.

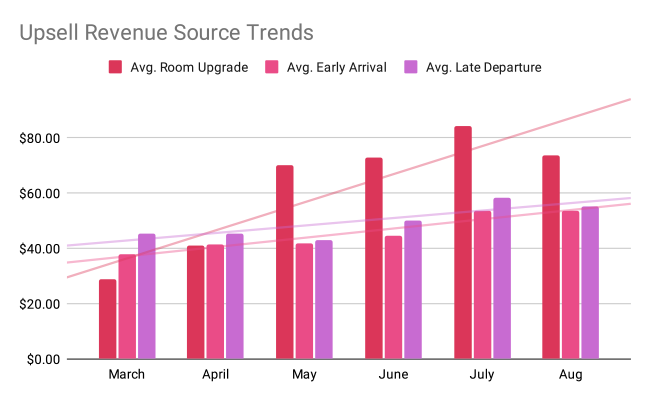

Observation 2: Upselling Revenue Source Trends

When we look at where room-based upsell revenue is coming from, we see an interesting comparison between upgrades and stay extensions (early check-in and late check-out monetization).

Whereas both numbers are impacted by occupancy changes, room upgrades seem to be surging. This trend may simply be the result of higher ADR and ROOMDEX’s yielding algorithm. Likewise, upgrading your room for a small fee is more appealing if, especially for leisure transient business, initial ADR is rising, and you initially selected a room more by price. We see a small dip in August as occupancy may have been impacted by the rise of the Delta variant.

Stay extension improvement is probably a reflection of pricing optimization by the ROOMDEX system. Many hoteliers are “reluctant” to price stay extension aggressively given that they had no pricing precedent to rely on. However, across the ROOMEX portfolio, we have seen tremendous guest acceptance and purchase of early arrivals and late departures, and this success has emboldened hoteliers in allowing ROOMDEX more fair market yielding parameters.

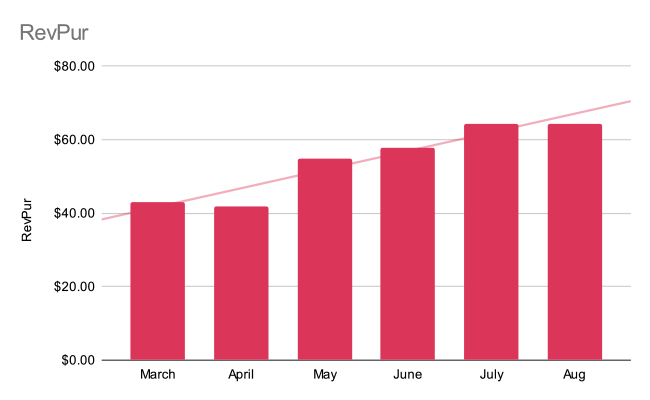

Observation 3: RevPUR or Overall Room-based Upselling Revenue

Overall revenue for upselling does reflect Occupancy (more reservations to sell to) and ADR (because ROOMDEX yields upsell pricing). Few hotels have reached maximum occupancy for any substantial amount of time, so there is almost always a wide array of inventory to upsell. But even as the industry recovers and occupancy starts to max out in some markets, we expect ROOMDEX upselling to perform well. Why? Dynamic pricing. Flat upsell rates and manual pricing simply can’t keep up with optimized, dynamic pricing that reflects demand and adjust accordingly.

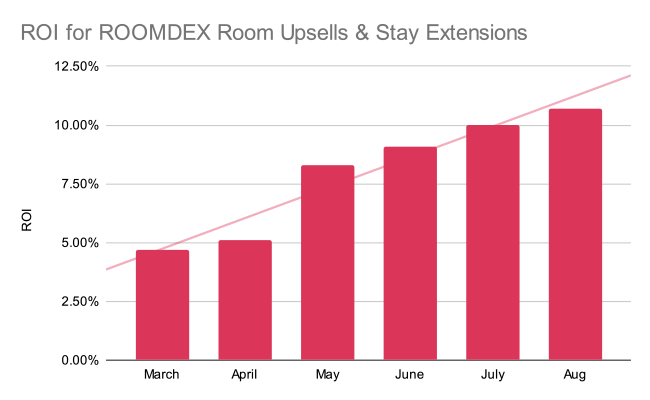

Observation 4: ROOMDEX ROI (room-based revenue only)

Hotels that have activated ROOMDEX are seeing a return on investment that is growing consistently (and mostly within 48 hours from activation). Whereas this trend does reflect RevPUR to a degree, there is some trend differences based on yield settings and offer content differences across the portfolio.

Conclusion

The good news is that across high AND low occupancy months, automated upselling is providing new and easy revenue (and ROI) for ROOMDEX hotels. In fact, in low occupancy, we are seeing new revenue to the hotels within hours of activation and a full ROI in 3 to 7 days. In mid/high occupancy times, the ROI commonly being reached within as little as 24 hours.

So automated upselling works well, and our hotels are seeing an estimated overall revenue lift per of 0.75% to 1.5% per month (at zero effort and commission). That is a great story to tell your owner, brand rep or asset manager!