As the U.S. hotel industry marks eight years of continued monthly revenue per available room growth, analysts are digging deeper into performance data to explain the trends behind these numbers and what hoteliers might expect moving forward.

Analysts shared data at last week’s Hunter Hotel Conference that underscores some of the big-picture trends behind ever-growing demand, the group vs. transient outlook and how economic policy factors in.

Demand continues to grow

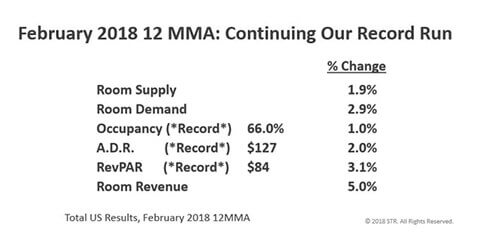

“The demand number has surprised everyone,” said Jan Freitag, SVP of lodging insights for HNN’s parent company, STR. “It gives us occupancy growth to a record level of 66%. We’re selling two out of three rooms every night.”

Freitag pointed out that demand related to Hurricane Harvey and Hurricane Irma in 2017 played a big role in overall U.S. demand numbers, and added that weather events like these might be part of a new normal, “and we as an industry need to be ready for this.”

Beyond that, Tourism Economics President Adam Sacks predicted a few additional factors contributing new demand on the U.S. hotel industry: international inbound travelers, group business, vacation-starved Americans and people aged 65 years or older spending more on travel.

“Despite some of the data you have seen, international travel to the U.S. was up last year,” Sacks said. “The dollar has eased, supporting further inbound gains. There are emerging middle class and new traveling households.”

He said underlying economic factors support continued demand growth from all groups.

“People are booking more hotel rooms per capita than ever before,” he said. “We expect it to continue to go up because of wealth and income increases. … People are taking fewer full-week trips and more partial-week trips, but both have begun to lift up. We see this as an important inflection point and opportunity for increased demand.”