Lately, I have spoken to several revenue managers who have told me how much their cost is to take a room—to make that last sale of the day.

NB: This is an article by David Lund, founder of The Hotel Financial Coach

What I heard concerns me because it tells me some people do not understand the fixed vs. variable components of payroll and expenses in their hotels.

Quite simply put, one revenue manager told me his cost to take a room in his hotel in NYC was $290.

“What?” I exclaimed over the telephone.

“Yes, that’s the cost.”

To which I replied, “That’s the total cost of all your expenses, both fixed and variable?”

Silence ensued for a moment and I said, “Let’s slow things down and look at the scenario.”

It is noon and you have 10 rooms left to sell today, the demand for today has been strong but in the last week we have been up and down around the +10 mark. My question is, “Exactly what does it cost you in variable expenses to take those last 10 rooms and how should they be priced?”

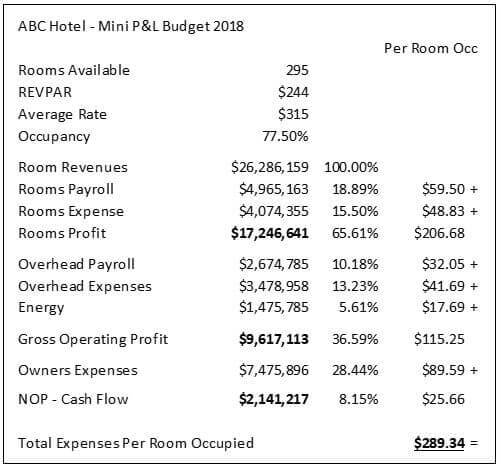

This is a very different question than: “What are costs per room occupied?” Let’s look at this question first because I think it will help clean up some confusion. Here are the facts of this “rooms only” operation in New York City.

In the above-simplified budget for this 295 room hotel, we can see all the expenses on an annualized basis is just north of $24 million. This number is achieved by adding the rooms pay, rooms expense, overhead pay and expense, and finally the owner’s expense. We only need to divide this number by the total rooms available—which is 83,488 on an annual basis. This gives us a good measure to understand what our pricing should be to generate an annualized profit using the current cost structure.

However, it does not tell us the real variable cost to take those last few rooms. Let’s look at the major components of the cost to take those last few rooms. What items will we need to utilize to take those last 10 rooms that are purely variable? To determine this we must first understand the nature of the fixed expenses.

The fixed expenses in this hotel at this point are many. We are already running a house count of 285 rooms and occupancy of 96.6 percent. All the costs for the following under this scenario are fixed. In other words—and this is the pivot point—it will cost no additional dollars on any of the following items to take those last 10 rooms:

- Front desk, guest services, reservations payroll

- Cable television

- Contract services

- Linen and uniform purchases

- Equipment purchase

- Decorations

- All overhead expenses and payroll

- All owner expenses

The truly purely variable expenses:

- Room attendant payroll and benefits

- Linen cleaning

- Guest supplies

- Papers

- Cleaning supplies

- Travel agent commissions

- Reservation fees

- Credit card commissions

- Brand fees

- Energy (some variable)

That’s it for our costs to take the last 10 rooms.

Let’s look at the chart below for a summary:

The chart clearly shows the individual costs for the variable items and the incremental profit from the sale of each room. For an annual picture let’s look at the impact on profits if the hotel was able to sell these 10 rooms half the days of the year:

(180 days x 10 rooms x $117) = $210,600 in additional profit that goes straight to the bottom line

This boosts the NOP closer to 10 percent. The real impact is an additional profit of the $210K, which adds an additional $2.6 million in asset value using a very modest capitalization rate of 8:

(8/100 = 12.5), therefore 12.5 x 210,600 = $2,632,500

When you think about your current selling policy as it relates to last-minute inventory, make sure you have a good handle on the real variable costs to sell those last-minute rooms. Don’t be confused by the big fixed cost per room stickers.

Know there is a balance between building the base, yielding the inventory in the largest demand period, and selling those last rooms more often.

Author Bio

David Lund is The Hotel Financial Coach, an international hospitality financial leadership pioneer. He has held positions as a Regional Controller, Corporate Director and Hotel Manager with an international brand for over 30 years.

He authored an award-winning workshop on financial leadership and has delivered it to hundreds of hotel managers. David coach’s hospitality executives and delivers his Financial Leadership Training, helping hotels increase profits and build financially engaged management teams. David helps aspiring hotel leaders overcome their uncertainty with the financials in a safe and productive environment. The coach also consults on hotel financial statement and system design, financial policy and asset management.

He speaks at hospitality associations and company events and he has had many articles published in hotel trade magazines. David is the author of the book, Seven Secrets to Create a Financially Engaged Leadership Team in Your Hotel.

David is a CHAE through HFTP and a Certified Professional Coach

This is how you can contact David

Website: www.hotelfinancial.com

Email: david@hotelfinancialcoach.com

Phone: +1 415 696 9593