Bookassist continues to study the changing market for over 1000 of its hotel clients across Europe. The impact on hotels’ business remains stark, and shows many local variations.

NB: This is an article from Bookassist

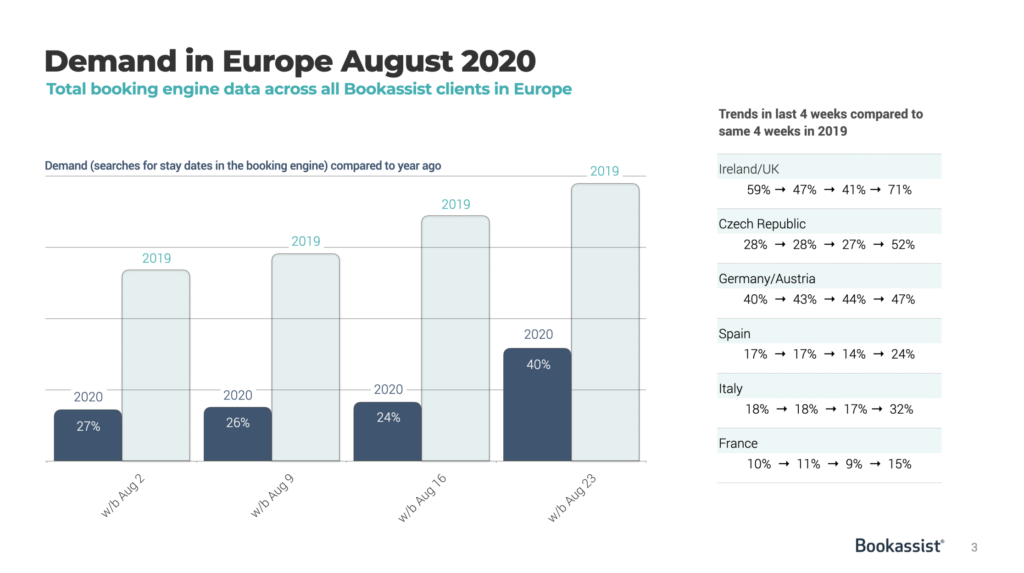

A clear common indicator is demand for hotels (i.e. searches being made for stay dates on the hotels’ booking engines), and August figures showed that recovery remains slow.

During August, across all segments and countries in the Bookassist portfolio in Europe, searches for hotels rooms (for any future date) stood at about a quarter of last year’s volume in the first three weeks of August. Volume noticeably rose to about 40% of last year’s value in the last week of August.

Individual countries fared quite differently, with Ireland/UK showing the best comparison with last year (reaching 71% of last year’s figure in the last week of August) while France, Spain and Italy were all sharply down despite late rallies in the last week of the month.

Subscribe to our weekly newsletter and stay up to date

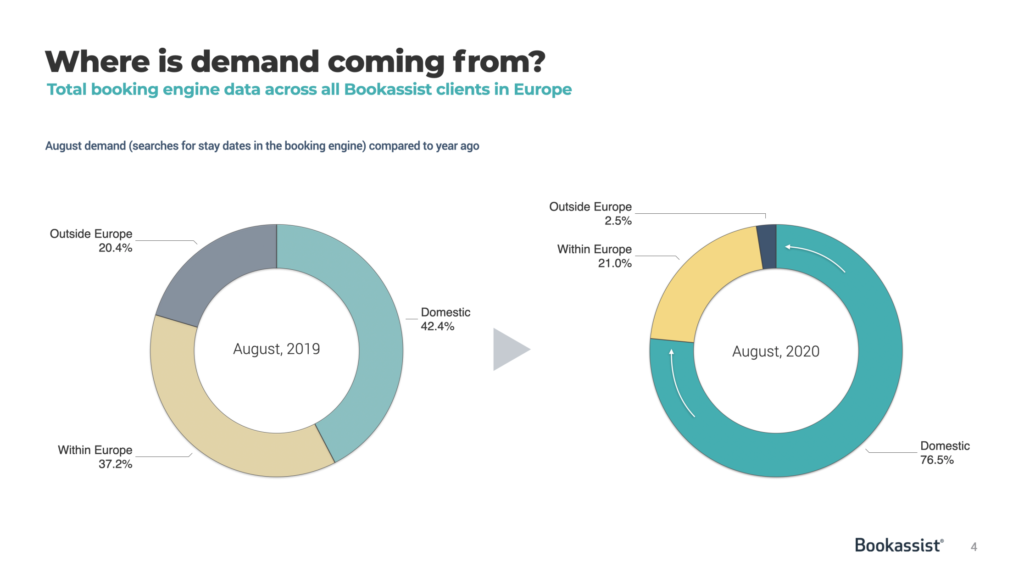

The change in demand origin is even more stark with a huge swing towards domestic searchers and the collapse of intercontinental searchers by almost a factor of 8 compared to last year. Domestic is largely leisure, while business travel is at a trickle in many cases.

This really shows that hotels need to continue to strongly target the domestic leisure market while the demand is there, and adapt their messaging and product to be ever-more local. Concurrent with this, direct sales through hotel websites has increased strongly as a proportion of internet business, showing that the domestic market right now currently prefers booking on hotel websites versus online travel agents (OTAs). This is likely to be correlated to more detailed information being sought out by travellers on hotel websites as they seek extra assurance about their travel and conditions at their destination.

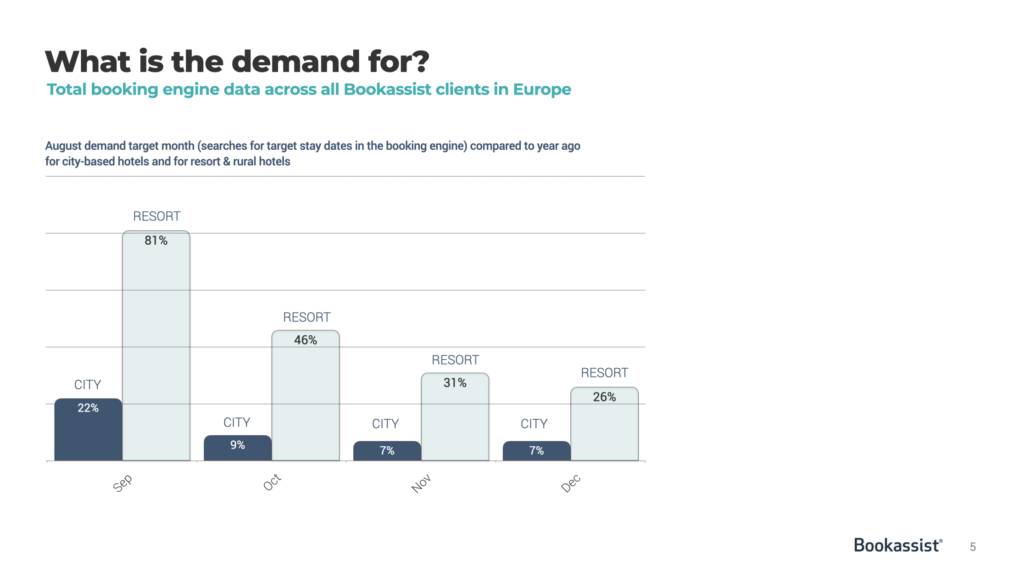

The target of demand across future months shows that customers continue to be cautious. City hotels continue to see strongly-reduced demand compared to last year, and on-the-books values are very low across the board. By the end of August, demand for September dates in city hotels was just a quarter of what it was at the same time a year ago.

Resort and rural hotels are faring far better in relative demand terms, but still see future demand deflated versus year ago. At the end of August, demand for September dates in these hotels were about 80% of last year’s value, which is not bad in the current climate. But the typical high demand values for future months in such properties was not in evidence, with demand for December, for example, at just a quarter of last year’s level.

The pattern of future demand for September through to December 2020 shows that consumers are taking quite short-term decisions about travel and are not planning in advance in appreciable numbers. This wait-and-see approach is also coupled with continuing high levels of cancellations, making business planning for hotels extremely difficult.